The financial intake generated by Turkish Aerospace Industries (TAI) through its various activities, including the design, development, manufacturing, and support of aerospace systems, constitutes a key metric for evaluating the company’s performance and its contribution to the national economy. This financial figure encompasses revenue streams derived from both domestic and international sales, service contracts, and research and development projects.

The magnitude of TAI’s financial gains reflects its competitiveness in the global aerospace market and its role in advancing Turkey’s aerospace capabilities. Historically, increases in these financial returns have been correlated with significant milestones in the development and deployment of domestically designed platforms, enhanced export opportunities, and strategic partnerships with international aerospace firms, leading to increased investments in technological advancements and expansion of operational capacity.

The following discussion will delve into the factors influencing the financial performance of the company, examining specific projects, market dynamics, and strategic initiatives that contribute to its overall financial standing within the broader context of the aerospace sector.

Strategies for Analyzing Turkish Aerospace Industries Financial Performance

The accurate assessment of Turkish Aerospace Industries (TAI)’s financial performance is crucial for stakeholders, including investors, policymakers, and industry analysts. These strategic recommendations aim to provide a structured approach for interpreting the financial health and future prospects of the organization.

Tip 1: Evaluate Revenue Diversification. Analyze the distribution of revenue across different product lines and services. A balanced portfolio reduces reliance on single projects and mitigates risk associated with market fluctuations specific to any one area.

Tip 2: Monitor Export Performance. Track the proportion of financial returns derived from international sales. Successful export activities indicate competitiveness in the global market and access to broader revenue streams.

Tip 3: Assess R&D Investment Efficiency. Evaluate the relationship between research and development expenditure and subsequent financial gains. This reveals the company’s ability to translate innovation into commercially viable products and services.

Tip 4: Analyze Contractual Obligations. Scrutinize the terms and conditions of significant contracts, particularly long-term agreements, to identify potential risks or opportunities impacting future financial streams. Delays or changes in major contracts can substantially affect revenue projections.

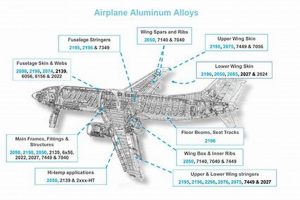

Tip 5: Track Material and Supply Chain Costs. Closely monitor fluctuations in raw material prices and supply chain efficiencies, as these factors directly impact production costs and profitability. Identifying and mitigating potential disruptions is critical for maintaining stable financial returns.

Tip 6: Benchmark Against Competitors. Compare TAI’s financial metrics with those of its competitors in the aerospace industry, both domestically and internationally. This provides valuable insights into its relative performance and areas for improvement.

The effective application of these strategies will enable a comprehensive understanding of TAI’s financial standing, informing sound decision-making and fostering sustainable growth within the evolving landscape of the aerospace sector.

The insights gained from these analyses lay the foundation for future investigations into specific areas of the company’s operations, promoting a more in-depth understanding of its contributions to the aerospace industry.

1. Sales Growth

Sales growth represents a fundamental driver of financial success for Turkish Aerospace Industries (TAI). Sustained increases in the volume and value of aerospace products and services sold directly contribute to the overall financial gains. This relationship is critical for evaluating the company’s performance and its ability to compete effectively in the global market.

- New Product Introduction

The introduction of new aerospace platforms, such as the Hrjet advanced trainer and light combat aircraft, significantly influences sales growth. Successful development and deployment of these innovative products attracts both domestic and international orders, contributing directly to the increase in financial volume. Timely project delivery and demonstrable performance are key to securing consistent sales.

- Expansion into International Markets

Penetrating new international markets is vital for sustained sales momentum. Securing contracts with foreign governments or commercial entities for aircraft, components, or maintenance services diversifies financial influx and reduces reliance on domestic demand. Successful bidding processes and competitive pricing are crucial for capitalizing on international opportunities.

- Increased Production Capacity

Expanding production capacity to meet rising demand directly supports sales growth. Increased manufacturing output enables the fulfillment of existing orders and facilitates the acceptance of new contracts. Strategic investments in infrastructure and workforce development are essential for optimizing production capacity and enhancing sales potential.

- Service and Maintenance Agreements

Recurring revenue from service and maintenance agreements associated with existing aerospace platforms contributes significantly to stable sales performance. Providing comprehensive support and maintenance services strengthens customer relationships and generates long-term financial streams. Effective contract management and responsive service delivery are paramount for maximizing revenue from these agreements.

The interplay of new product introduction, international market expansion, production capacity optimization, and service agreement sustainment directly influences the trajectory of TAI’s financial performance. By strategically managing these factors, the company can achieve sustainable sales growth and solidify its position as a major player in the aerospace industry.

2. Export Markets

The establishment and cultivation of export markets are fundamentally linked to the generation of financial returns at Turkish Aerospace Industries (TAI). Accessing international markets expands the potential customer base, diversifies financial streams, and mitigates reliance on domestic procurement, directly influencing financial standing.

- Diversification of Financial Influx

Export markets provide a critical avenue for diversifying financial influx beyond domestic sales. This is particularly important in scenarios where domestic demand fluctuates or is subject to budgetary constraints. Successful penetration of international markets ensures a more stable and resilient financial base.

- Enhanced Production Capacity Utilization

Securing export contracts allows TAI to optimize its production capacity. The increased demand from international customers justifies investments in expanding manufacturing facilities, streamlining production processes, and improving overall operational efficiency, leading to enhanced profitability.

- Technology Transfer and International Collaborations

Export agreements often facilitate technology transfer and collaborative projects with international partners. These collaborations not only enhance TAI’s technological capabilities but also open doors to new market segments and financial opportunities through joint ventures and shared development programs.

- Geopolitical Influence and Strategic Partnerships

Aerospace exports often carry significant geopolitical implications. Establishing relationships with foreign governments through the sale of defense-related products can foster strategic partnerships and strengthen diplomatic ties, potentially leading to preferential treatment and increased market access.

The effective cultivation of export markets through strategic partnerships, competitive pricing, and technological innovation directly contributes to the enhancement of financial returns at Turkish Aerospace Industries. The long-term success of the company is intrinsically linked to its ability to secure and maintain a strong presence in the global aerospace arena.

3. Contract Values

The financial gains of Turkish Aerospace Industries (TAI) are fundamentally tethered to the monetary worth of its contractual agreements. These agreements, encompassing a spectrum of aerospace-related endeavors, serve as the primary mechanism for securing revenue and sustaining operational viability.

- Scope and Complexity

The breadth and intricacy of a contract directly influence its monetary value. Agreements involving the design, development, and production of complete aerospace platforms, such as aircraft or satellites, command significantly higher values compared to contracts focused solely on component manufacturing or maintenance services. The level of technological sophistication and the extent of customization required contribute to the overall contract price.

- Contract Duration and Payment Terms

The length of a contract and the agreed-upon payment schedule are critical determinants of financial impact. Long-term contracts, spanning multiple years, provide a predictable and consistent revenue flow. Payment terms, including upfront payments, milestone-based disbursements, and final settlement upon project completion, dictate the timing and magnitude of revenue recognition, affecting short-term and long-term financial planning.

- Risk Allocation and Liability Clauses

Contractual clauses pertaining to risk allocation and liability assignment can substantially affect the financial outcome for TAI. Agreements that clearly delineate responsibility for potential cost overruns, delays, or performance failures protect TAI’s financial interests and mitigate exposure to unforeseen expenses. Conversely, contracts with ambiguous or unfavorable terms may jeopardize profitability and increase financial risk.

- Negotiation Power and Market Dynamics

TAI’s negotiation leverage and the prevailing market conditions influence the final contract value. Strong bargaining power, stemming from technological leadership, unique product offerings, or limited competition, enables TAI to secure more favorable terms. Conversely, intense competition or customer dominance may necessitate compromises, potentially reducing the contract’s overall financial benefit.

In essence, contract values are not merely numerical figures; they represent the culmination of strategic negotiations, technological capabilities, and market dynamics. The careful management of contractual agreements is paramount for ensuring the financial health and sustained success of TAI within the competitive aerospace landscape.

4. R&D Returns

Research and development (R&D) returns directly influence financial gains for Turkish Aerospace Industries (TAI). Investment in R&D leads to the creation of new technologies, improved products, and innovative services, all of which can be commercialized to generate revenue. The effectiveness of R&D spending is measured by its ability to produce marketable assets that increase sales, secure new contracts, and enhance the company’s competitive position. For instance, the development of indigenous unmanned aerial vehicle (UAV) technology has resulted in significant sales both domestically and internationally, directly boosting revenue streams. Furthermore, R&D efforts focused on improving existing aircraft performance or developing advanced avionics systems can lead to higher-value contracts and increased customer satisfaction, contributing to long-term financial growth.

A crucial aspect of R&D returns lies in securing intellectual property rights through patents and licenses. These protections provide a competitive edge and enable TAI to command premium prices for its products. The commercialization of patented technologies not only generates direct revenue but also attracts strategic partnerships and collaborations with other aerospace firms, further expanding market reach and financial capacity. For example, TAI’s R&D investments in composite materials have resulted in proprietary technologies that are now integrated into various aircraft components, enhancing performance and reducing weight, thereby increasing the value proposition for customers.

In summary, R&D returns serve as a fundamental driver of financial prosperity for TAI. Strategic investment in R&D, coupled with effective commercialization and intellectual property protection, enables the company to innovate, compete, and secure financial success in the global aerospace market. The challenge lies in balancing short-term financial pressures with the long-term benefits of R&D, ensuring that investments are targeted towards projects with the highest potential for commercial success and strategic alignment with the company’s overall objectives.

5. Production Efficiency

The level of production efficiency at Turkish Aerospace Industries (TAI) exerts a direct and substantial influence on its financial gains. Enhanced production processes, streamlined workflows, and optimized resource allocation translate into reduced manufacturing costs and increased output, directly impacting financial performance. Improvements in production efficiency allow TAI to deliver products more rapidly and at lower costs, thus enhancing its competitiveness in the global aerospace market. This increased competitiveness can lead to higher sales volumes, larger contract values, and greater overall financial returns. For example, implementing lean manufacturing principles in the production of aircraft components can significantly reduce waste, shorten lead times, and lower production costs, leading to higher profit margins for TAI.

The impact of improved production efficiency extends beyond cost reduction. Efficient production allows TAI to meet delivery schedules more consistently, enhancing its reputation for reliability. A reputation for on-time delivery is a crucial factor in securing new contracts and maintaining customer loyalty, further contributing to revenue stability and growth. Moreover, investments in automation and advanced manufacturing technologies can increase production capacity, enabling TAI to fulfill larger orders and respond more effectively to market demands. This scalability is essential for achieving sustained financial success in the rapidly evolving aerospace industry. Furthermore, efficient production translates to higher quality products with fewer defects, reducing warranty claims and improving customer satisfaction, thereby enhancing TAI’s brand image and long-term revenue potential.

In conclusion, production efficiency constitutes a critical component of TAI’s financial strategy. By continuously optimizing its production processes, investing in advanced technologies, and ensuring efficient resource utilization, TAI can drive down costs, enhance competitiveness, and secure its long-term financial prosperity. While challenges such as supply chain disruptions and workforce skill gaps may hinder efficiency gains, a relentless focus on improving production processes remains essential for maximizing financial returns and ensuring TAI’s continued success in the global aerospace market.

6. Global Partnerships

Global partnerships represent a strategic imperative for Turkish Aerospace Industries (TAI), influencing its ability to generate financial streams and expand its presence within the international aerospace sector. These collaborations, often involving technology transfer, joint development programs, and market access agreements, are critical for enhancing TAI’s capabilities and competitiveness, ultimately impacting its financial performance.

- Technology Transfer and Knowledge Acquisition

Global partnerships facilitate the transfer of advanced technologies and specialized knowledge to TAI, allowing the company to enhance its design, manufacturing, and testing capabilities. This infusion of expertise reduces reliance on foreign technology and accelerates the development of indigenous aerospace platforms. Successful integration of acquired technologies leads to improved product offerings, increased sales, and higher financial returns.

- Joint Development and Production Programs

Collaborative ventures involving joint development and production of aerospace systems enable TAI to share development costs, mitigate technical risks, and access larger markets. These partnerships often entail the co-production of aircraft components or the joint development of new aerospace technologies, contributing to increased production volumes and enhanced revenue streams for all participating entities.

- Market Access and Distribution Networks

Strategic alliances with established international aerospace firms provide TAI with access to established distribution networks and broader market reach. Leveraging partner’s existing sales channels and customer relationships facilitates the penetration of new markets and the expansion of export opportunities, leading to increased sales and financial growth.

- Risk Mitigation and Financial Stability

Global partnerships help to mitigate financial risks associated with large-scale aerospace projects. Sharing development costs, production responsibilities, and market risks with international partners reduces the financial burden on TAI and enhances its long-term financial stability. This collaborative approach allows TAI to undertake more ambitious projects and pursue opportunities that would otherwise be beyond its financial capacity.

The synergistic effects of technology transfer, joint development programs, expanded market access, and mitigated financial risks underscore the critical role of global partnerships in shaping TAI’s financial trajectory. By strategically fostering these collaborative relationships, TAI enhances its competitiveness, expands its market presence, and secures its long-term financial prosperity within the dynamic global aerospace landscape.

Frequently Asked Questions

This section addresses common inquiries regarding the financial performance and revenue generation strategies of Turkish Aerospace Industries (TAI), providing objective and factual responses.

Question 1: What are the primary sources of financial inflow for Turkish Aerospace Industries?

The principal sources of financial influx include revenue from domestic and international sales of aerospace products (aircraft, satellites, components), income from maintenance, repair, and overhaul (MRO) services, and funding received for research and development projects, both from government and private sector sources.

Question 2: How does export performance impact the overall revenue stream?

Export activities are critical for diversifying financial influx and reducing reliance on the domestic market. Increased export sales typically lead to a stronger financial position, improved profitability, and enhanced competitiveness in the global aerospace sector.

Question 3: What role does government funding play in supporting revenue generation?

Government funding, including research grants, development contracts, and procurement agreements, provides a significant source of financial support, particularly for long-term projects and technological advancements. These funds are often instrumental in enabling TAI to undertake strategic initiatives and develop cutting-edge aerospace solutions.

Question 4: How does investment in research and development translate into increased financial intake?

R&D investment can generate increased financial intake through the creation of new products and technologies that command higher market value. Successful R&D efforts can also lead to the securing of patents and intellectual property rights, enabling TAI to generate revenue through licensing agreements and exclusive product sales.

Question 5: What factors influence the fluctuation of financial gains from year to year?

Year-to-year fluctuations in financial returns can be influenced by a variety of factors, including changes in global market demand, geopolitical events, fluctuations in currency exchange rates, the timing of major contract awards, and unforeseen disruptions to supply chains or production processes.

Question 6: How does competition within the aerospace industry affect Turkish Aerospace Industries’ earning power?

Competition within the aerospace industry directly affects earning power by influencing pricing strategies, market share, and the ability to secure contracts. Intense competition may necessitate lower profit margins or increased investment in marketing and sales efforts to maintain competitiveness and secure revenue streams.

In summary, the financial performance of Turkish Aerospace Industries is influenced by a complex interplay of domestic and international factors, strategic investments, and market dynamics. A comprehensive understanding of these factors is essential for evaluating the company’s financial health and future prospects.

The following section provides a concluding summary, reiterating the key takeaways.

Conclusion

The preceding analysis has presented a multifaceted examination of the financial generation capabilities of Turkish Aerospace Industries. The scope of this examination has encompassed various determinants including sales growth, export market performance, contract values, returns on research and development investments, production efficiencies, and strategic global partnerships. It has been shown that a convergence of these factors shapes the financial posture of the organization.

Ultimately, the sustainable maximization of Turkish Aerospace Industries’ financial intake depends on consistent innovation, strategic market positioning, and effective navigation of the complex global aerospace ecosystem. Continued diligence in these areas is essential for securing long-term financial health and reinforcing the company’s contribution to the national economy.

![Aerospace Jobs: India's Growing Industry [Hiring!] Innovating the Future of Flight with Reliable Aviation Solutions Aerospace Jobs: India's Growing Industry [Hiring!] | Innovating the Future of Flight with Reliable Aviation Solutions](https://mixaerospace.com/wp-content/uploads/2026/03/th-153-300x200.jpg)