The entity under discussion is a major Israeli aerospace and defense company. It develops and produces a wide array of technologies and systems for both military and civilian applications. These include aircraft, missiles, satellites, unmanned aerial vehicles (UAVs), and a variety of electronic systems.

This organization’s significance lies in its contribution to Israel’s defense capabilities and its substantial role in the global aerospace market. Its innovations have enhanced national security while generating significant export revenue. Historically, this entity has been at the forefront of technological advancements, adapting to evolving security threats and market demands. Its research and development efforts have consistently yielded cutting-edge solutions, positioning it as a key player in the international defense industry.

Having established the foundational understanding of this influential organization, subsequent discussions will explore its specific product lines, technological advancements, global partnerships, and its impact on the broader geopolitical landscape. These discussions will elaborate on the breadth and depth of its contributions to the aerospace and defense sectors.

Operational Insights from a Leading Aerospace and Defense Firm

The following insights are derived from observing the operational practices of a prominent entity in the aerospace and defense sector. These tips highlight key principles for success in technologically advanced and strategically vital industries.

Tip 1: Prioritize Research and Development Investment: Continuous innovation is crucial. A significant portion of resources should be allocated to R&D to maintain a competitive edge and develop advanced technologies, such as unmanned systems or missile defense systems.

Tip 2: Foster Strategic Partnerships: Collaboration with international partners can expand market reach and access specialized expertise. Joint ventures or collaborative projects can leverage complementary strengths, leading to synergistic outcomes in areas like satellite technology or aircraft manufacturing.

Tip 3: Adapt to Evolving Geopolitical Landscapes: The ability to adapt to changing security threats and geopolitical dynamics is essential. This includes anticipating emerging needs, developing counter-measures, and tailoring solutions to specific regional challenges. For example, the development of advanced radar systems to counter aerial threats.

Tip 4: Emphasize Quality Control and Reliability: Rigorous quality control measures are paramount in ensuring the reliability and performance of aerospace and defense products. Comprehensive testing, adherence to industry standards, and meticulous attention to detail are crucial.

Tip 5: Cultivate a Highly Skilled Workforce: Investing in the training and development of a skilled workforce is vital for technological innovation and operational efficiency. This includes providing ongoing education, fostering expertise in specialized fields, and promoting a culture of continuous learning.

Tip 6: Maintain Robust Cybersecurity Measures: Protecting sensitive data and critical infrastructure from cyber threats is crucial. Implementing robust cybersecurity protocols, conducting regular vulnerability assessments, and investing in cyber defense technologies are essential.

The effective implementation of these principles can contribute to enhanced technological capabilities, increased market competitiveness, and strengthened security posture.

In conclusion, these operational insights derived from observing this leading aerospace and defense organization, offer valuable guidelines for success in a dynamic and strategically important sector. Subsequent sections will further explore the application of these principles in specific contexts.

1. Defense Systems Innovation

Defense Systems Innovation forms a cornerstone of the entity under examination. The organization’s continued success in developing and deploying advanced defense technologies is paramount to its global standing and its contribution to national security.

- Missile Defense Systems

Development and deployment of advanced missile defense systems, such as the Iron Dome, Arrow, and David’s Sling, demonstrate a commitment to protecting civilian populations and strategic assets from aerial threats. These systems incorporate advanced radar technology, interceptor missiles, and command-and-control systems to detect, track, and neutralize incoming projectiles.

- Intelligence, Surveillance, and Reconnaissance (ISR) Systems

The provision of comprehensive ISR capabilities provides critical situational awareness for military and security forces. These systems encompass advanced sensors, UAVs, and data analytics platforms, enabling real-time monitoring of potential threats and enhancing operational effectiveness. Examples include advanced radar systems and unmanned aerial vehicles equipped with high-resolution cameras and signal intelligence capabilities.

- Electronic Warfare (EW) Systems

The development of EW systems disrupts enemy communications and radar capabilities. These systems include jammers, decoys, and electronic countermeasures designed to degrade the effectiveness of opposing forces. Technological innovations in EW are crucial for maintaining a competitive advantage in modern warfare.

- Cybersecurity Solutions

Addressing the escalating threat of cyber warfare through development of robust cybersecurity solutions. These solutions encompass threat detection, vulnerability assessments, and incident response capabilities, designed to protect critical infrastructure and sensitive data from cyber attacks. The integration of artificial intelligence and machine learning technologies enhances the effectiveness of cybersecurity defenses.

These innovations reflect a dedication to technological advancement and a proactive approach to addressing evolving security threats. The continued development and deployment of these systems are crucial for maintaining a robust defense posture and contributing to regional stability. The organization’s success in these domains underscores its pivotal role in the global defense industry.

2. Global Partnerships

International collaborations constitute a crucial component of its operational model. These alliances are not merely transactional; they represent strategic imperatives that extend its reach, enhance its technological capabilities, and mitigate risks associated with operating in a technologically advanced and geopolitically sensitive sector. Forming partnerships is a deliberate strategy designed to share development costs, gain access to diverse expertise, and penetrate new markets that would otherwise be inaccessible. Consequently, participation in multinational projects becomes feasible, allowing the undertaking of large-scale endeavors that would be beyond the scope of individual efforts.

Specific examples illustrate the tangible benefits of this partnership-centric approach. Cooperative programs with defense contractors in the United States facilitate technology transfer and joint development of missile defense systems. Collaboration with European firms enables participation in consortia developing advanced aerospace technologies. These arrangements not only broaden its product portfolio but also enhance its reputation as a reliable and innovative partner in the global defense community. Successful partnerships also enhance resilience against economic fluctuations and geopolitical uncertainties. The ability to leverage diverse supply chains and access multiple markets reduces dependence on any single region or customer.

In conclusion, the integration of global partnerships is a fundamental element of its business strategy, yielding benefits that extend across technological innovation, market expansion, and risk mitigation. While challenges exist in managing diverse interests and navigating complex regulatory environments, the strategic advantages derived from these alliances are demonstrably significant. These collaborations contribute not only to the entity’s success but also foster international cooperation in defense and aerospace sectors.

3. Aerospace Technology

Aerospace technology constitutes a core component of the entity under consideration. The organization’s identity is intrinsically linked to its capability to innovate and produce cutting-edge aerospace systems. This dependency is not merely theoretical; it is manifested in the design, development, and deployment of a wide array of aircraft, satellites, and related technologies. The impact of advanced aerospace technology on its capabilities is demonstrable. For instance, its development of advanced radar systems directly enhances the performance of its air defense solutions. Similarly, its expertise in satellite technology has enabled it to provide critical communication and surveillance services. These examples illustrate how aerospace technology acts as a catalyst for its growth and competitiveness in the global market.

The integration of aerospace technology into its operations extends beyond mere product development. It also encompasses research and development activities aimed at pushing the boundaries of what is possible. Investments in areas such as advanced materials, propulsion systems, and autonomous flight control are crucial for maintaining a technological edge. The practical application of this understanding lies in the development of more efficient, reliable, and capable aerospace systems. For example, its expertise in unmanned aerial vehicle (UAV) technology has resulted in the creation of platforms used for surveillance, reconnaissance, and even combat operations. These UAVs demonstrate how advanced aerospace technology can be translated into practical, real-world solutions.

In summary, aerospace technology is not simply an adjunct to the organization’s activities but rather an integral element that defines its capabilities and shapes its strategic direction. While challenges remain in maintaining a competitive edge in a rapidly evolving technological landscape, its commitment to aerospace innovation remains a key driver of its success. Understanding this connection is essential for comprehending its role in the broader aerospace and defense industry and its contribution to national security.

4. Cybersecurity Solutions

The demand for Cybersecurity Solutions is critically intertwined with its operational imperative to protect sensitive data, intellectual property, and critical infrastructure. As a prominent developer and manufacturer of advanced aerospace and defense systems, the safeguarding of digital assets becomes paramount. The proliferation of sophisticated cyber threats necessitates robust measures to ensure the integrity of products and services, protect against espionage, and maintain operational continuity. Therefore, Cybersecurity Solutions are not merely an add-on but an intrinsic component of its core business functions.

The integration of Cybersecurity Solutions extends across diverse operational areas. For instance, safeguarding the communication channels between command centers and deployed systems, protecting the data stored in advanced sensors, and ensuring the integrity of the software controlling autonomous platforms are all critical applications. Furthermore, compliance with international standards and regulations mandates adherence to stringent cybersecurity protocols. Real-world examples include thwarting attempts to gain unauthorized access to missile defense system data and protecting against disruptions to satellite communication networks. Effective implementation of these protocols is crucial for maintaining trust with customers and preventing significant financial and reputational damage.

In conclusion, Cybersecurity Solutions represent an indispensable element of this aerospace and defense organization. The understanding of the interplay between cybersecurity and its operational imperatives underscores the need for continuous investment in advanced technologies, skilled personnel, and proactive security measures. While the challenges of defending against increasingly sophisticated cyber threats persist, the commitment to Cybersecurity Solutions remains essential for maintaining competitiveness and fulfilling its mission-critical responsibilities. The integration of these solutions demonstrates a proactive stance in mitigating risks and reinforcing its position as a trusted provider of aerospace and defense technologies.

5. Unmanned Systems

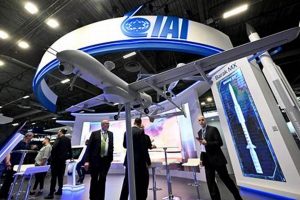

The deployment and development of unmanned systems are integral to the operational framework of IAI. This technological area represents a strategic focus, reflecting both the evolving demands of modern warfare and the increasing need for versatile surveillance and reconnaissance capabilities. The companys portfolio in this domain spans diverse applications, ranging from border security to maritime patrol, demonstrating its commitment to providing comprehensive solutions.

- Unmanned Aerial Vehicles (UAVs)

UAVs, commonly known as drones, constitute a significant portion of IAI’s unmanned systems offerings. These platforms are utilized for intelligence gathering, surveillance, and reconnaissance (ISR), and are capable of operating in diverse environments. Specific examples include the Heron family of UAVs, which have been deployed in various conflict zones for long-endurance missions, providing real-time intelligence to ground forces. The implications of UAV technology extend to civilian applications, such as disaster response and agricultural monitoring.

- Unmanned Ground Vehicles (UGVs)

UGVs enhance ground-based capabilities in hazardous or inaccessible terrains. IAIs UGVs are designed for a variety of missions, including explosive ordnance disposal (EOD), reconnaissance, and perimeter security. These vehicles mitigate risks to human personnel by providing remote operational capabilities. The incorporation of advanced sensors and robotic manipulators allows for precise and safe execution of tasks in complex environments.

- Unmanned Maritime Systems

Unmanned maritime systems are utilized for naval operations, including anti-submarine warfare, mine countermeasures, and maritime surveillance. IAI’s unmanned surface vessels (USVs) and underwater vehicles (UUVs) offer persistent monitoring capabilities, enhancing maritime domain awareness. These systems contribute to coastal security and protection of critical infrastructure, demonstrating their versatility in addressing naval challenges.

- Autonomous Navigation and Control Systems

The efficacy of unmanned systems depends critically on the sophistication of autonomous navigation and control technologies. IAI invests significantly in the development of advanced algorithms, sensor fusion techniques, and artificial intelligence to enable autonomous operation in complex environments. These advancements are essential for enhancing the reliability, adaptability, and effectiveness of unmanned platforms across diverse applications.

These facets of unmanned systems underscore the strategic importance of this technological domain within IAI’s broader portfolio. The company’s continued investment in research and development, coupled with its expertise in defense and aerospace technologies, positions it as a key player in the global market for unmanned solutions. The implications of these technologies extend beyond military applications, contributing to advancements in civilian sectors such as environmental monitoring, infrastructure inspection, and emergency response. The sustained development and deployment of unmanned systems exemplify IAI’s commitment to providing innovative solutions that address evolving security and operational requirements.

Frequently Asked Questions

This section addresses common inquiries regarding the operations, technologies, and strategic objectives of a prominent aerospace and defense organization. The information provided aims to clarify misconceptions and offer a comprehensive understanding of the entity’s role in the global landscape.

Question 1: What are the primary sectors in which the organization operates?

The organization functions across several key sectors, including aerospace, defense, and cybersecurity. It develops and manufactures a wide array of products, ranging from commercial aircraft components to advanced missile defense systems. These activities span both civilian and military applications.

Question 2: How does the organization contribute to national security?

The organization makes substantial contributions to national security through the development and provision of advanced defense technologies. These technologies include missile defense systems, intelligence gathering platforms, and electronic warfare capabilities. The organization also collaborates with international partners to address shared security challenges.

Question 3: What is the organization’s approach to research and development?

The organization invests significantly in research and development to maintain a competitive edge and develop innovative technologies. This includes funding for basic research, applied research, and technology demonstration projects. The organization also fosters collaboration between academia, industry, and government agencies to accelerate technological advancements.

Question 4: How does the organization manage global partnerships?

The organization cultivates strategic alliances with international partners to expand market reach, access specialized expertise, and share development costs. These partnerships encompass joint ventures, technology licensing agreements, and collaborative research projects. Effective management of these relationships is crucial for achieving mutual benefits and ensuring long-term success.

Question 5: What measures are taken to ensure cybersecurity?

The organization implements robust cybersecurity protocols to protect sensitive data and critical infrastructure from cyber threats. These measures include threat detection, vulnerability assessments, incident response planning, and employee training. Continuous monitoring and adaptation to evolving cyber threats are essential components of its cybersecurity strategy.

Question 6: What is the organization’s stance on ethical and responsible innovation?

The organization upholds a commitment to ethical and responsible innovation in all its activities. This includes adherence to international standards, respect for human rights, and consideration of the potential societal impacts of its technologies. The organization also promotes transparency and accountability in its operations.

This FAQ section provides insights into the multifaceted nature of the organization and its commitment to innovation, security, and ethical practices. Future sections will explore specific technologies and initiatives in greater detail.

Having addressed fundamental questions, subsequent discussions will examine the technological advancements and their impact on the aerospace and defense sectors.

Conclusion

The preceding exploration has illuminated significant facets of IAI Israel Aerospace Industries. This included its diverse operational sectors, contributions to national security, research and development endeavors, global partnerships, cybersecurity measures, and commitment to ethical innovation. The detailed analysis underscored the organization’s pivotal role in advancing aerospace and defense technologies.

Considering the organization’s ongoing contributions to global security and technological advancement, continued scrutiny of its operations and impact is warranted. Such examination facilitates informed decision-making and promotes responsible development within the aerospace and defense sectors, particularly in a rapidly evolving geopolitical landscape. The importance of this entities innovation should not be understated.