United Technologies Corporation (UTC) finalized its acquisition of Rockwell Collins in November 2018. This acquisition resulted in the formation of a new entity named Collins Aerospace, operating as a business unit within UTC. Rockwell Collins, prior to the acquisition, was a leading provider of aviation and high-integrity solutions for commercial and military customers.

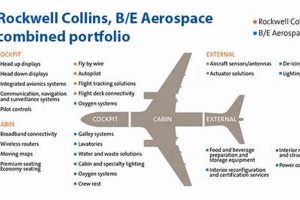

The acquisition provided UTC with enhanced capabilities in aerospace systems and strengthened its position in the broader aerospace industry. The combination of UTC Aerospace Systems and Rockwell Collins created a more comprehensive supplier to aircraft manufacturers and airlines. Historically, Rockwell Collins brought expertise in avionics, communication, and information management systems, which complemented UTC’s existing portfolio of aircraft engines, structures, and other aerospace components. This strategic move aimed to achieve greater efficiency, innovation, and growth through synergistic offerings and expanded market reach.

Therefore, the entity responsible for purchasing Rockwell Collins, thereby establishing Collins Aerospace, was United Technologies Corporation. The resulting entity became a significant player in the global aerospace market, offering a wide array of products and services. This consolidation has impacted competition, innovation, and the supply chain within the aerospace sector.

Key Considerations Regarding the Acquisition of Collins Aerospace

The following points provide essential insights into the implications of United Technologies Corporation’s (UTC) purchase of Rockwell Collins, which led to the establishment of Collins Aerospace.

Tip 1: Understand the Resulting Entity. Collins Aerospace is not an independent company but rather a business unit operating under the umbrella of United Technologies Corporation (now RTX Corporation following a subsequent rebranding). Understanding this hierarchical structure is crucial when analyzing the company’s strategic decisions and financial performance.

Tip 2: Analyze Synergies and Overlap. The acquisition was predicated on the belief that combining Rockwell Collins’ expertise in avionics with UTC Aerospace Systems’ capabilities would generate synergistic benefits. Examine the extent to which these synergies have materialized, considering areas of potential overlap and redundancy.

Tip 3: Assess Market Position. The consolidated entity occupies a significant position in the aerospace market. Evaluating its competitive advantages, market share, and customer relationships is vital for understanding its long-term viability and influence within the industry.

Tip 4: Track Innovation and Development. Investigate the impact of the acquisition on innovation and product development. Determine whether the merger has accelerated or hindered the creation of new technologies and solutions within Collins Aerospace.

Tip 5: Monitor Financial Performance. Assess the financial performance of Collins Aerospace as a business unit within RTX Corporation. Examine revenue growth, profitability, and return on investment to gauge the success of the acquisition from a financial perspective.

Tip 6: Consider Supply Chain Implications. The merger has implications for the aerospace supply chain. Analyze the impact on suppliers, pricing, and overall supply chain efficiency as a result of the consolidation.

Tip 7: Evaluate Regulatory Scrutiny. Major acquisitions often attract regulatory scrutiny. Understand the regulatory approvals required for the deal and any ongoing monitoring of the combined entity’s activities to ensure compliance with antitrust laws.

Careful consideration of these factors is necessary for a complete understanding of the strategic importance and ongoing consequences surrounding the acquisition.

These insights set the stage for a more detailed exploration of the lasting effects of this industry-shaping event.

1. United Technologies Corporation

United Technologies Corporation (UTC), now known as RTX Corporation, plays the central role in the answer to “who bought Collins Aerospace.” It was UTC that initiated and finalized the acquisition of Rockwell Collins in November 2018, subsequently forming the Collins Aerospace business unit.

- Acquisition Strategy

UTC’s acquisition strategy involved identifying strategic opportunities to expand its aerospace capabilities. Rockwell Collins, with its expertise in avionics, communication, and information management systems, presented a valuable complement to UTC Aerospace Systems’ existing product portfolio. This acquisition was a calculated move to enhance UTC’s competitive position and expand its offerings to aircraft manufacturers and airlines.

- Formation of Collins Aerospace

The direct result of the acquisition was the creation of Collins Aerospace as a business unit within UTC. This involved integrating Rockwell Collins’ operations and personnel into UTC’s existing structure. Collins Aerospace retained its brand identity and continued to operate as a significant supplier of aerospace systems and components.

- Strategic Synergies

UTC aimed to achieve strategic synergies by combining the strengths of both companies. This included leveraging Rockwell Collins’ avionics technology with UTC’s aircraft engine and structural capabilities. The goal was to create a more comprehensive and integrated supplier to the aerospace industry, capable of offering end-to-end solutions.

- Corporate Restructuring and RTX

Following the acquisition and other strategic moves, UTC underwent a corporate restructuring, which included spinning off certain business units and rebranding itself as RTX Corporation. This change reflects a broader strategic shift and reinforces RTX’s focus on aerospace and defense, with Collins Aerospace remaining a critical component of the company’s portfolio.

The acquisition of Rockwell Collins by UTC and the subsequent formation of Collins Aerospace represent a significant event in the aerospace industry. The rebranding to RTX Corporation further solidifies the long-term strategy and industry focus, with the integrated capabilities under the Collins Aerospace banner forming a pivotal part of the corporation’s overall value proposition.

2. November 2018

November 2018 marks the definitive point in time connected to the question of “who bought Collins Aerospace.” It was during this month that United Technologies Corporation (UTC) officially completed its acquisition of Rockwell Collins. This date is not merely an incidental detail; it represents the culmination of negotiations, regulatory approvals, and strategic planning that led to the merging of these two major aerospace entities. Without the events that transpired in November 2018, the entity known as Collins Aerospace, operating under the umbrella of UTC (later RTX Corporation), would not exist. The date signifies the formal transfer of ownership and the commencement of integration activities, marking the beginning of a new chapter for both organizations and the wider aerospace industry.

The precise timing of the acquisition had practical implications for financial reporting, organizational restructuring, and market positioning. For example, Rockwell Collins’ financial results for the year 2018 were impacted by the acquisition, with its final independent reports reflecting the impending change. Moreover, November 2018 triggered internal restructuring efforts within both UTC and Rockwell Collins to align operations and management. Regulatory bodies also monitored the integration process to ensure compliance with antitrust laws. The effects of this acquisition continue to shape the competitive dynamics of the aerospace sector.

In summary, November 2018 is inextricably linked to the issue of determining who bought Collins Aerospace. The month serves as a fixed reference point, signifying the completion of a major corporate transaction that fundamentally altered the structure of the aerospace industry. Understanding the significance of this date is essential for analyzing the strategic motivations, operational changes, and long-term consequences associated with the acquisition.

3. RTX Corporation

RTX Corporation is intrinsically linked to the question of “who bought Collins Aerospace.” Following the acquisition of Rockwell Collins by United Technologies Corporation (UTC), UTC underwent a significant restructuring and rebranding, emerging as RTX Corporation. Thus, RTX Corporation is the successor entity to the corporation that acquired Collins Aerospace.

- Rebranding and Strategic Shift

UTC’s transformation into RTX Corporation involved a strategic shift to focus primarily on aerospace and defense technologies. This rebranding underscores the importance of the Collins Aerospace acquisition, as it became a core component of RTX’s portfolio. The name change signaled a commitment to high-technology solutions within these sectors.

- Collins Aerospace as a Core Business Unit

Within the RTX corporate structure, Collins Aerospace operates as a critical business unit. This unit’s financial performance and technological contributions are directly factored into RTX’s overall valuation and strategic direction. Collins Aerospace represents a significant portion of RTX’s revenue and innovation pipeline.

- Financial Integration and Reporting

The financial results of Collins Aerospace are consolidated into RTX’s financial statements. This integration means that RTX’s shareholders and stakeholders evaluate the success of the Collins Aerospace acquisition through RTX’s financial performance metrics. Investment decisions and strategic adjustments within Collins Aerospace are guided by RTX’s overall financial goals.

- Synergies and Collaborative Development

Under RTX, Collins Aerospace is intended to collaborate with other business units to leverage synergies and develop advanced technologies. This cross-pollination of expertise is designed to enhance RTX’s competitive advantage in the aerospace and defense industries. Joint projects and shared resources aim to create more innovative and comprehensive solutions for customers.

In summary, RTX Corporation is not merely a successor name to the entity that acquired Collins Aerospace; it represents a strategic evolution that underscores the importance of the acquisition. The integration of Collins Aerospace into RTX’s core operations and financial structure ensures that the legacy of the acquisition continues to shape the direction and success of the corporation. Understanding RTX is essential to fully comprehend the ongoing impact of the event of “who bought Collins Aerospace.”

4. Aerospace Systems Synergies

The concept of aerospace systems synergies is central to understanding the rationale behind the acquisition of Rockwell Collins, and therefore integral to determining “who bought Collins Aerospace.” United Technologies Corporation (UTC), now RTX Corporation, strategically pursued the acquisition to leverage the complementary capabilities of Rockwell Collins and UTC Aerospace Systems. The anticipated synergies served as a primary driver, with the expectation that combining the avionics expertise of Rockwell Collins with UTC’s broader aerospace systems portfolio would yield significant benefits.

These synergies encompass multiple facets. Operationally, the integration aimed to streamline processes, reduce redundancies, and enhance efficiency across the combined entity. Technologically, the goal was to foster innovation by combining Rockwell Collins’ strength in areas such as cockpit systems and communication technologies with UTC’s capabilities in aircraft engines, structures, and interiors. For instance, integrating flight control systems from Rockwell Collins with engine management systems from UTC allowed for more optimized aircraft performance and fuel efficiency. From a market perspective, the acquisition expanded the range of products and services offered by the combined entity, enabling it to compete for larger contracts and provide more comprehensive solutions to aircraft manufacturers and airlines.

The success of the acquisition, and the realization of these envisioned synergies, directly impacts the ultimate assessment of “who bought Collins Aerospace.” The practical significance lies in how effectively RTX Corporation has integrated Collins Aerospace, leveraged its combined capabilities, and delivered value to shareholders. If the synergies materialize as expected, the acquisition is deemed a strategic success, validating the decision-making process behind it. Conversely, if the synergies fail to materialize or if integration challenges outweigh the benefits, the acquisition may be viewed less favorably. Thus, the assessment of aerospace systems synergies serves as a critical lens through which to evaluate the strategic significance and long-term outcomes of the acquisition by UTC, now RTX Corporation.

5. Competitive Landscape Impact

The acquisition profoundly reshaped the competitive dynamics within the aerospace industry. When analyzing “who bought Collins Aerospace,” it is crucial to consider how the merger affected other companies, market share, and overall industry innovation.

- Market Consolidation and Increased Concentration

The combination of Rockwell Collins and UTC Aerospace Systems led to increased market concentration. This consolidation reduced the number of independent players capable of providing comprehensive aerospace solutions. As the combined entity gained a larger market share, smaller companies faced increased pressure to compete on price, innovation, or niche markets. This consolidation also influenced the bargaining power dynamics between suppliers and aircraft manufacturers.

- Rival Response Strategies and Counter-Moves

The acquisition spurred competitors to re-evaluate their own strategies. Some rivals pursued mergers or acquisitions to achieve similar scale and scope. Others focused on developing differentiated technologies or strengthening customer relationships to maintain their competitive edge. The responses from companies such as Honeywell, Thales, and Safran reflected the heightened competitive intensity. These counter-moves aimed to mitigate the potential disadvantages resulting from the creation of a larger, more powerful competitor.

- Impact on Innovation and Technological Development

The merger influenced the pace and direction of innovation within the aerospace industry. On one hand, the combined entity had greater resources to invest in research and development, potentially accelerating the development of new technologies. On the other hand, reduced competition could stifle innovation if the merged company became less incentivized to disrupt existing markets. The net effect on innovation depends on factors such as the company’s internal culture, regulatory oversight, and the emergence of disruptive technologies from smaller players.

- Supply Chain Realignments and Supplier Relationships

The acquisition triggered realignments within the aerospace supply chain. The combined entity likely sought to optimize its supplier base, potentially leading to consolidation among suppliers or shifts in purchasing patterns. Suppliers had to adapt to the changing demands and priorities of a larger customer, which may have involved adjusting pricing, delivery schedules, or technological capabilities. These realignments affected the stability and efficiency of the entire supply chain.

Ultimately, the effects of “who bought Collins Aerospace” are deeply intertwined with the evolving competitive landscape. The acquisition served as a catalyst for strategic responses and industry-wide adjustments. This continuous interplay between market consolidation, competitive strategies, innovation, and supply chain dynamics remains a central consideration for understanding the lasting effects of the UTC-Rockwell Collins merger.

Frequently Asked Questions

The following questions address common inquiries and clarify key details surrounding the acquisition of Collins Aerospace, providing factual information and avoiding speculative claims.

Question 1: Who ultimately acquired Rockwell Collins, leading to the formation of Collins Aerospace?

United Technologies Corporation (UTC) acquired Rockwell Collins in November 2018. Subsequent to the acquisition and a broader strategic restructuring, UTC became RTX Corporation, under which Collins Aerospace operates as a business unit.

Question 2: Why was Rockwell Collins acquired?

The acquisition was strategically driven to combine the strengths of Rockwell Collins in avionics and UTC Aerospace Systems in aerospace manufacturing. This synergy aimed to create a more comprehensive supplier to the aerospace industry, enhancing capabilities and market reach.

Question 3: What is the current relationship between Collins Aerospace and RTX Corporation?

Collins Aerospace functions as a significant business unit within RTX Corporation. Its financial performance and strategic direction are integrated into RTX’s overall operations and corporate goals.

Question 4: How has the aerospace market been affected by the acquisition of Rockwell Collins?

The consolidation led to a more concentrated market, influencing competition, supply chains, and innovation. Competitors have adapted strategies in response, and suppliers face evolving demands from the larger entity.

Question 5: What was the timeline for the acquisition process?

The acquisition process concluded in November 2018 with the formal completion of the transaction by United Technologies Corporation. This timeline reflects the culmination of regulatory reviews and strategic planning.

Question 6: How can the success of the Collins Aerospace acquisition be measured?

The success is gauged by evaluating the realization of anticipated synergies, financial performance metrics, technological advancements, and the overall competitive position of RTX Corporation within the aerospace sector. Independent analysis and monitoring are essential for objective assessment.

This FAQ clarifies the key aspects related to the acquisition, providing a concise and informative overview.

This foundation permits a deeper analysis of specific facets of the acquisition and its ongoing implications.

Conclusion

The investigation into who bought Collins Aerospace unequivocally identifies United Technologies Corporation (UTC), now operating as RTX Corporation, as the acquiring entity. This strategic maneuver, finalized in November 2018, involved the integration of Rockwell Collins into UTC Aerospace Systems, resulting in the formation of Collins Aerospace as a core business unit within RTX. The acquisition was driven by the pursuit of aerospace systems synergies, combining avionics expertise with broader manufacturing capabilities. The consolidation reshaped the competitive landscape, prompting responses from rival firms and influencing the dynamics of the aerospace supply chain.

The implications of this acquisition extend beyond a simple change in ownership. The formation of Collins Aerospace under RTX Corporation represents a significant shift in the aerospace industry. Continued scrutiny of the combined entity’s performance, innovation, and market behavior is warranted to fully understand the long-term consequences. The success of the acquisition will be judged by the extent to which the envisioned synergies materialize and contribute to sustained value creation within RTX Corporation.

![U.S. Hubs: Collins Aerospace US Locations Guide [2024] Innovating the Future of Flight with Reliable Aviation Solutions U.S. Hubs: Collins Aerospace US Locations Guide [2024] | Innovating the Future of Flight with Reliable Aviation Solutions](https://mixaerospace.com/wp-content/uploads/2026/03/th-97-300x200.jpg)

![Collins Aerospace Holiday Schedule: [Year] Dates & Guide Innovating the Future of Flight with Reliable Aviation Solutions Collins Aerospace Holiday Schedule: [Year] Dates & Guide | Innovating the Future of Flight with Reliable Aviation Solutions](https://mixaerospace.com/wp-content/uploads/2026/03/th-71-300x200.jpg)