The central question pertains to the corporate relationship between Raytheon Technologies and Collins Aerospace. This inquiry seeks to establish whether Raytheon Technologies holds ownership of Collins Aerospace, thereby determining the organizational structure and control dynamics between these two significant entities in the aerospace and defense sectors.

Understanding the ownership structure is crucial for investors, industry analysts, and stakeholders. It provides insights into the strategic direction, resource allocation, and potential synergies that may exist between the companies. Historically, mergers and acquisitions within the aerospace industry have significantly impacted market competition and technological innovation.

The subsequent analysis will delve into the current corporate structure, outlining the precise relationship between Raytheon Technologies and Collins Aerospace to clarify the ownership status and its implications for the industry.

Examining the Raytheon Technologies and Collins Aerospace Relationship

The following points offer guidance in understanding the relationship between Raytheon Technologies and Collins Aerospace, addressing whether one owns the other.

Tip 1: Clarify Terminology: Understand that “ownership” in this context refers to a parent company’s direct or indirect control over another entity through stock ownership or other legal means.

Tip 2: Investigate Corporate Structure: Research the officially registered corporate structure of both entities. Publicly available information from regulatory filings and company websites can reveal the exact relationship.

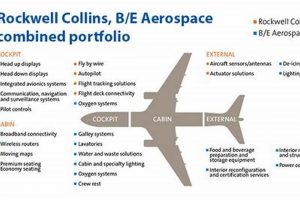

Tip 3: Trace Acquisition History: Investigate the historical acquisition events involving Raytheon Technologies and Collins Aerospace (previously Rockwell Collins) to understand how the current relationship was formed.

Tip 4: Analyze Financial Reports: Examine the consolidated financial statements of Raytheon Technologies. These reports will indicate whether Collins Aerospace’s financials are included, suggesting its operational integration.

Tip 5: Review SEC Filings: Refer to the Securities and Exchange Commission (SEC) filings, particularly 10-K reports, for explicit disclosures regarding the organizational structure and subsidiaries of Raytheon Technologies.

Tip 6: Consider Mergers and Rebrandings: Note that corporate mergers and rebrandings can obscure the original ownership structure. Research these events to determine if they signify a change in control.

Tip 7: Analyze Leadership Structure: A related point, consider a leadership structure change between the companies. See the leadership transition and whether they affect one another or not.

Understanding these relationships is crucial for accurate analysis and informed decision-making in the aerospace and defense sectors.

The following sections will delve into more specific aspects of the business relationship between Raytheon Technologies and Collins Aerospace.

1. Corporate Structure

Corporate structure is paramount in determining whether Raytheon Technologies has ownership of Collins Aerospace. A hierarchical or integrated organizational chart explicitly displays the relationships between different entities within a corporate group. If the corporate structure reveals that Collins Aerospace is listed as a subsidiary of Raytheon Technologies, this indicates that Raytheon Technologies exercises control through ownership of a majority stake in Collins Aerospace. This setup grants Raytheon Technologies the authority to influence and direct Collins Aerospace’s strategic decisions, operational activities, and financial management.

For example, the 2023 Raytheon Technologies’ 10-K filing with the Securities and Exchange Commission outlines the corporate structure, illustrating how different business segments, including Collins Aerospace, fall under the ultimate control of the Raytheon Technologies Corporation. In practice, this control enables Raytheon Technologies to integrate Collins Aerospace’s technologies and resources into larger projects, streamline operations for cost efficiency, and align strategic goals to enhance overall market competitiveness.

In summary, carefully examining the corporate structure is critical in establishing the ownership relationship between Raytheon Technologies and Collins Aerospace. It offers insights into the extent of control, decision-making power, and financial consolidation. Any changes within the organizational framework could indicate shifts in the ownership status, impacting both internal operations and external market dynamics.

2. Acquisition History

The acquisition history serves as a cornerstone in determining whether Raytheon Technologies owns Collins Aerospace. Tracing the timeline of mergers and acquisitions involving these entities reveals the evolution of their corporate relationship. The formation of Raytheon Technologies itself involved a significant merger of equals between United Technologies Corporation (UTC) and Raytheon Company in 2020. Prior to this merger, UTC had acquired Rockwell Collins in 2018, renaming it Collins Aerospace. Therefore, the key lies in recognizing that Collins Aerospace became part of UTC before the merger that created Raytheon Technologies. This means the current corporate structure resulted not from Raytheon directly acquiring Collins Aerospace, but from Collins Aerospace becoming part of a larger entity that then merged with Raytheon.

Understanding this acquisition timeline is crucial because it clarifies the ownership pathway. If Raytheon Company, before the merger, had acquired Collins Aerospace, the present-day Raytheon Technologies would directly own it as a directly acquired subsidiary. However, because Collins Aerospace was already under UTC’s umbrella, it became a part of Raytheon Technologies through a merger of the parent companies. This context is essential for analysts, investors, and anyone evaluating the strategic positioning and potential synergies within the aerospace industry. It further clarifies the operational dynamics between the companies, as the integration strategies have likely been influenced by these events.

In summary, acquisition history provides a factual basis for comprehending the current ownership structure. It demonstrates that Raytheon Technologies does not “own” Collins Aerospace in the sense of having directly acquired it. Instead, Collins Aerospace became a component of Raytheon Technologies through a multi-stage corporate restructuring involving an earlier acquisition by United Technologies and a subsequent merger to form the current entity. Recognizing this nuanced history is crucial for accurate analysis and strategic decision-making within the aerospace and defense sectors.

3. Financial Integration

Financial integration is a pivotal indicator in determining the nature of the relationship between Raytheon Technologies and Collins Aerospace. By examining how their finances are intertwined, a clearer understanding emerges regarding the extent of control Raytheon Technologies exerts over Collins Aerospace.

- Consolidated Financial Statements

Consolidated financial statements combine the financial results of a parent company and its subsidiaries into a single report. If Raytheon Technologies publishes consolidated statements that include Collins Aerospace’s financial results, it indicates a significant level of financial integration. This consolidation reflects Raytheon Technologies’ ability to control Collins Aerospace’s financial operations and assets, supporting the notion of Raytheon Technologies ownership.

- Intercompany Transactions

The frequency and magnitude of intercompany transactions, such as loans, services, and sales between Raytheon Technologies and Collins Aerospace, provide insights into their financial dependencies. Significant intercompany transactions suggest a deep level of integration, with resources and funds flowing regularly between the two entities, indicative of Raytheon Technologies having ownership control over Collins Aerospace.

- Capital Allocation

The power to allocate capital investments within Collins Aerospace resides with Raytheon Technologies if financial ownership exists. Examining how Raytheon Technologies directs capital towards Collins Aerospace’s projects or strategic initiatives reveals the decision-making power exerted by the parent company over its business segment.

- Debt and Equity Structure

The manner in which debt and equity are structured within Collins Aerospace is another telling factor. If Raytheon Technologies guarantees debt or holds a significant portion of Collins Aerospace’s equity, it strengthens the assertion that Raytheon Technologies effectively owns Collins Aerospace, as it bears the financial risks and reaps the rewards associated with its performance.

By analyzing these facets of financial integrationconsolidated statements, intercompany transactions, capital allocation, and the debt/equity structurea comprehensive perspective emerges on the degree to which Raytheon Technologies controls and owns Collins Aerospace. These financial linkages are essential for understanding their relationship and the strategic implications for stakeholders.

4. Operational Control

Operational control serves as a critical indicator regarding the relationship between Raytheon Technologies and Collins Aerospace. The ability of one entity to dictate the day-to-day functions and strategic direction of another strongly suggests an ownership position. Specifically, if Raytheon Technologies exercises significant control over Collins Aerospace’s operational decisions, this supports the assertion that Raytheon Technologies possesses ownership.

This control manifests in several forms. Raytheon Technologies’ directives might influence Collins Aerospace’s research and development priorities, manufacturing processes, and supply chain management. For example, if Raytheon Technologies mandates that Collins Aerospace adopt specific technologies or processes to align with overall company objectives, this demonstrates operational control. Furthermore, the degree to which Raytheon Technologies manages Collins Aerospace’s senior leadership appointments and performance evaluations offers a clear signal of operational influence. The integration of Collins Aerospace’s operations into Raytheon Technologies’ broader business strategy also underscores operational control, as strategic decisions will inherently steer day-to-day activities.

The existence of robust operational control reinforces the conclusion that Raytheon Technologies effectively owns Collins Aerospace, not merely in a nominal sense but also in terms of practical decision-making and management. A nuanced comprehension of these relationships enhances an investor’s, industry analyst’s, or stakeholder’s ability to evaluate the potential for synergistic value creation and effective risk mitigation strategies. Moreover, the degree of operational control can have significant implications for employee morale, supplier relations, and the overall efficiency of the combined entity.

5. Subsidiary Status

The designation of Collins Aerospace as a subsidiary of Raytheon Technologies is central to understanding their relationship and addressing whether a true ownership exists. Subsidiary status implies that Raytheon Technologies controls Collins Aerospace through ownership of a majority stake in its shares or through other forms of legal control. This control allows Raytheon Technologies to direct Collins Aerospace’s policies, management, and operations, fundamentally shaping its strategic direction. The effect of this control is evident in consolidated financial reporting, wherein Collins Aerospace’s financial results are integrated with those of Raytheon Technologies, influencing overall profitability and shareholder value. For example, any significant innovation or cost-saving measure at Collins Aerospace directly impacts Raytheon Technologies’ financial performance, demonstrating the practical importance of this relationship.

An example of subsidiary control can be seen in strategic alignment initiatives. Raytheon Technologies might direct Collins Aerospace to focus on developing specific technologies that support broader Raytheon Technologies’ objectives, such as advanced avionics systems or sustainable aviation solutions. This directive influences Collins Aerospace’s research and development priorities, product roadmaps, and market strategies. The practical significance is further illustrated when Collins Aerospace’s products are integrated into larger Raytheon Technologies systems, leveraging their complementary capabilities to create enhanced value propositions for customers. Furthermore, potential challenges might arise due to competing interests or differing operational cultures between the parent company and its subsidiary, necessitating careful management and clear communication to ensure effective integration and alignment.

In summary, the subsidiary status of Collins Aerospace within Raytheon Technologies provides a foundational understanding of their operational and financial relationship. This status underscores the capacity of Raytheon Technologies to exert control over Collins Aerospace, shaping its strategies and integrating its performance into the broader organizational framework. Recognizing the dynamics of this relationship is crucial for stakeholders seeking to assess the strategic value and potential risks associated with Raytheon Technologies’ overall portfolio, influencing investment decisions and market analyses within the aerospace and defense industries.

Frequently Asked Questions Regarding the Raytheon Technologies and Collins Aerospace Relationship

The following section addresses common inquiries regarding the corporate structure and ownership dynamics between Raytheon Technologies and Collins Aerospace. These questions aim to clarify the relationship in a concise and factual manner.

Question 1: Does Raytheon Technologies directly own Collins Aerospace?

Raytheon Technologies does not directly “own” Collins Aerospace in the sense of having originally acquired it as a standalone entity. Collins Aerospace became part of Raytheon Technologies through a merger involving United Technologies Corporation (UTC), which had previously acquired Rockwell Collins (later renamed Collins Aerospace) in 2018.

Question 2: What is the current corporate structure between Raytheon Technologies and Collins Aerospace?

Collins Aerospace operates as a business segment within Raytheon Technologies. Raytheon Technologies exercises control over Collins Aerospace through its position as the parent corporation.

Question 3: How does the merger of United Technologies and Raytheon Company affect the ownership structure?

The merger resulted in the formation of Raytheon Technologies. Since Collins Aerospace was already a part of UTC, it became integrated into the newly formed Raytheon Technologies structure as a business unit.

Question 4: Are Collins Aerospace’s financial results consolidated within Raytheon Technologies’ financial statements?

Yes, Collins Aerospace’s financial results are consolidated into Raytheon Technologies’ financial statements. This consolidation indicates a significant level of financial integration and control.

Question 5: Does Raytheon Technologies have operational control over Collins Aerospace?

Raytheon Technologies exercises operational control over Collins Aerospace, influencing its strategic direction, research and development priorities, and operational processes.

Question 6: What is the strategic importance of the relationship between Raytheon Technologies and Collins Aerospace?

The relationship is strategically important due to the synergies and capabilities that Collins Aerospace brings to Raytheon Technologies, enhancing its position in the aerospace and defense industries through advanced technologies and integrated solutions.

In summary, Raytheon Technologies maintains control over Collins Aerospace, positioning it as a key component of the broader corporate structure. This relationship shapes the direction of both entities, resulting in strategic alignments that benefit the organizations as a whole.

The next section will present a conclusion encapsulating the points discussed.

Determining Corporate Ownership

The preceding analysis has clarified the corporate relationship between Raytheon Technologies and Collins Aerospace. While Raytheon Technologies does not directly hold ownership of Collins Aerospace in the traditional sense of having acquired it independently, the latter operates as a subsidiary within Raytheon Technologies’ broader corporate structure. This structure stems from a series of mergers and acquisitions, including United Technologies’ acquisition of Rockwell Collins and the subsequent merger of United Technologies with Raytheon Company to form Raytheon Technologies. This integration has resulted in Collins Aerospace’s financial results being consolidated within Raytheon Technologies’ financial statements, as well as Raytheon Technologies exercising operational control over Collins Aerospaces strategic direction and activities.

Understanding these complex corporate dynamics is vital for informed decision-making within the aerospace and defense sectors. Stakeholders must recognize that the integration of Collins Aerospace into Raytheon Technologies reflects a strategic alignment designed to enhance competitiveness and drive innovation. Further analysis should focus on the ongoing impacts of this relationship on market competition, technological advancements, and the overall strategic positioning of Raytheon Technologies within the global aerospace landscape.