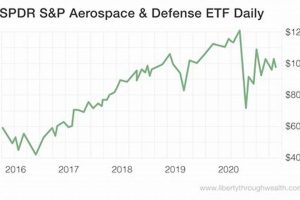

A benchmark reflecting the performance of publicly traded companies involved in the aerospace and defense sectors. This metric offers a consolidated view of the financial health and market sentiment surrounding businesses that manufacture aircraft, military equipment, provide defense services, and engage in related activities. As an example, one might observe the index rising due to increased government spending on defense initiatives or declining amidst economic uncertainty impacting the aviation industry.

Tracking the performance of entities in these fields provides insights into industry trends, investment opportunities, and broader economic conditions. It serves as a tool for investors to gauge the risk and potential returns associated with this specialized market segment. Historically, these values have been sensitive to geopolitical events, technological advancements, and governmental policies affecting defense budgets and international relations.

The subsequent sections will delve into the specific factors influencing these market indicators, examining the methodologies used in their construction, and analyzing their role in informing investment strategies within the aerospace and defense landscape.

Analyzing Aerospace and Defense Market Trends

Understanding the nuances of sector performance is crucial for informed decision-making. The following points offer guidance on interpreting and leveraging these indicators effectively.

Tip 1: Monitor Geopolitical Events: Developments in international relations often trigger significant movements. Increased tensions or conflicts typically lead to heightened investment activity and, consequently, upward pressure.

Tip 2: Track Government Spending: Government budgets are a primary driver of revenue for many companies included. Examine defense appropriations bills and policy statements for clues about future growth or contraction.

Tip 3: Assess Technological Advancements: Breakthroughs in areas such as unmanned systems, advanced materials, and cybersecurity can create new opportunities and disrupt existing market dynamics. Scrutinize industry publications and reports for indications of innovation.

Tip 4: Analyze Supply Chain Resilience: Disruptions to global supply chains can significantly impact production and profitability. Evaluate the ability of companies within the scope to navigate logistical challenges and secure critical resources.

Tip 5: Evaluate Cybersecurity Posture: Given the sensitive nature of data and systems, companies with robust cybersecurity measures are often viewed more favorably by investors. Assess their investments in and adherence to cybersecurity best practices.

Tip 6: Examine Export Regulations: Changes to export control policies and trade agreements can profoundly impact revenue streams. Understanding the regulatory landscape allows for accurate assessment of sales prospects and market access.

Tip 7: Consider Economic Indicators: General economic conditions, such as interest rates and inflation, can indirectly affect defense spending and overall investment sentiment. Monitor these macroeconomic factors to gain a broader perspective.

Employing these approaches can provide a more nuanced understanding of market dynamics and improve the accuracy of predictions related to financial performance within the sphere.

The subsequent segments will provide a more detailed look at the key indicators and factors that shape movements, enabling a comprehensive view of this unique segment of the financial world.

1. Market Capitalization

Market capitalization serves as a critical metric within the aerospace & defense index, reflecting the aggregate value of the publicly traded companies it comprises. Its influence extends to weighting methodologies and overall index performance. Understanding its impact is essential for interpreting movements and assessing investment opportunities.

- Weighting Mechanism

Market capitalization often dictates the weighting of individual companies within an index. Firms with larger market caps exert a greater influence on the index’s overall performance. This approach presumes that larger companies are more representative of the sector’s economic activity. For example, a major defense contractor with a multi-billion dollar market capitalization will have a more significant impact than a smaller component manufacturer.

- Investor Sentiment Indicator

Changes in the market capitalization of constituent companies can indicate shifts in investor confidence. A sustained increase in market capitalization across multiple firms may suggest a bullish outlook on the aerospace and defense industry. Conversely, declining market capitalization could signal concerns about future growth or profitability, potentially triggered by geopolitical instability or budget cuts.

- Liquidity and Trading Volume

Higher market capitalization typically correlates with greater liquidity and trading volume in a company’s stock. This enhanced liquidity can make the index more attractive to institutional investors, allowing them to manage larger positions without significantly impacting prices. Conversely, an index dominated by companies with low market capitalization might experience greater price volatility and be less appealing to larger investment funds.

- Mergers and Acquisitions Impact

Mergers and acquisitions (M&A) activity within the sector can significantly alter the market capitalization of individual companies and, consequently, the index’s composition. When one company acquires another, the market capitalization of the acquiring firm often increases, while the acquired firm is removed from the index. These structural changes necessitate periodic rebalancing to maintain the index’s accuracy and representativeness. The acquisition of a smaller aerospace firm by a larger defense conglomerate, for instance, would affect both the individual market caps and the overall index structure.

The aggregate market capitalization of the companies comprising the index represents a substantial portion of the economic activity within the aerospace and defense sphere. Variations in overall market cap reflect broad trends, potential risks, and emerging opportunities, solidifying its importance as a core element in analyzing and interpreting the movements and signals from the aerospace & defense index.

2. Geopolitical Risk

Geopolitical risk constitutes a significant determinant influencing the performance of the aerospace & defense index. Its effects are multifaceted, impacting defense spending, trade policies, and overall market sentiment within the sector.

- Increased Defense Spending

Heightened geopolitical tensions often trigger increased defense budgets across various nations. This rise in governmental expenditure directly benefits companies within the index that manufacture military equipment, provide defense services, and develop related technologies. For example, escalating regional conflicts or heightened global instability frequently lead to larger procurement contracts for defense contractors, consequently boosting their stock prices and, by extension, the overall index value.

- Trade Restrictions and Export Controls

Geopolitical instability can lead to the implementation of stricter trade restrictions and export controls on military goods and technologies. These regulations may disrupt supply chains, limit market access for certain companies within the index, and negatively impact their financial performance. For instance, sanctions imposed on countries involved in international conflicts can restrict the ability of aerospace and defense firms to sell their products in those markets, thereby reducing revenue and potentially lowering their stock valuations.

- Investor Risk Aversion

Geopolitical uncertainties can induce risk aversion among investors, leading to shifts in investment portfolios. During periods of heightened global instability, investors may seek safer assets, such as government bonds, and reduce their exposure to riskier sectors like aerospace and defense. This shift in sentiment can lead to a decrease in demand for stocks within the index, causing its overall value to decline. Conversely, some investors may view the sector as a safe haven during geopolitical crises, anticipating increased demand for defense products and services.

- Cybersecurity Threats

Increased geopolitical tensions often coincide with a rise in cybersecurity threats targeting aerospace and defense companies. These companies are prime targets for state-sponsored cyberattacks aimed at stealing sensitive information, disrupting operations, or compromising critical infrastructure. Successful cyberattacks can damage a company’s reputation, incur significant financial losses, and negatively impact its stock price. Consequently, companies within the index are compelled to invest heavily in cybersecurity measures, adding to their operational costs and potentially affecting profitability.

These facets collectively illustrate the pervasive influence of geopolitical risk on the aerospace & defense index. While heightened tensions can create opportunities for increased defense spending and revenue growth, they also introduce complexities related to trade restrictions, investor sentiment, and cybersecurity threats, demanding careful assessment when gauging the financial performance of businesses within this sphere.

3. Technological Innovation

Technological innovation functions as a primary driver influencing the aerospace & defense index. Advancements in areas such as unmanned systems, advanced materials, artificial intelligence, and cybersecurity exert a direct impact on the competitiveness and financial performance of companies within the sector. The introduction of novel technologies can lead to increased efficiency, reduced costs, and the development of new product lines, thereby enhancing a company’s market position and profitability. For instance, the development of more fuel-efficient aircraft engines or more precise missile guidance systems directly improves the value proposition offered by aerospace and defense firms, positively affecting stock valuation and index performance. Investment in research and development, therefore, becomes a key indicator for evaluating long-term potential within the sector.

The integration of new technologies also presents challenges and potential disruptions. Companies that fail to adapt to emerging trends or that lag behind in the adoption of critical innovations may face declining market share and reduced profitability. The increasing reliance on software and networked systems, for example, necessitates robust cybersecurity measures to protect against cyber threats, which in turn require ongoing investment and adaptation. Furthermore, the rapid pace of technological change can render existing products and capabilities obsolete, creating both opportunities and risks for established players and new entrants. The successful integration and commercialization of innovative technologies are therefore vital for sustaining growth and maintaining competitive advantage.

In summary, technological innovation is inextricably linked to the performance of the aerospace & defense index. It spurs growth, enhances competitiveness, and shapes investment decisions. A thorough understanding of the technological landscape, including emerging trends, potential disruptions, and the ability of companies to adapt and innovate, is crucial for investors seeking to navigate and capitalize on the opportunities within this dynamic sector. The index serves as a barometer, reflecting the aggregate impact of technological change on the financial health and market valuation of its constituent companies.

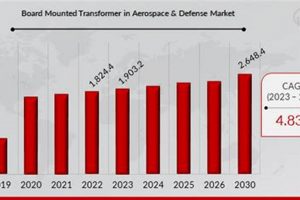

4. Defense Budgets

Defense budgets directly influence the aerospace & defense index. Government allocations for military spending constitute a primary revenue source for companies within the index. An increase in a nation’s defense budget often translates into larger contracts for firms specializing in military equipment, aerospace technologies, and defense-related services. This increased revenue directly impacts their profitability and, consequently, their stock values, which subsequently drive the index upward. For example, if the United States Congress approves a significant increase in funding for missile defense systems, companies involved in missile development and production typically experience a surge in stock prices, contributing positively to the overall index. Conversely, budget cuts can lead to reduced orders and diminished revenue, causing stock prices to decline and negatively impacting the index.

The composition of defense budgets further dictates the specific areas benefiting from government investment. Shifts in spending priorities, such as a move toward unmanned aerial vehicles (UAVs) or cybersecurity initiatives, can advantage companies specializing in these domains while potentially disadvantaging firms focused on traditional military hardware. The type of procurement contracts awarded also matters. Multi-year contracts provide greater stability and predictability for companies, while shorter-term contracts introduce more uncertainty. Moreover, international arms sales also contribute to the revenue streams of companies within the index and are subject to geopolitical factors and export regulations. Observing trends and specific items in national and international defense budgets allows for a more refined forecast of index performance, assisting in the analysis of investment opportunities and risks.

Understanding the relationship between defense budgets and the aerospace & defense index is crucial for investors and industry analysts. While increased defense spending generally benefits companies within the sector, various factors, including spending priorities, contract types, and geopolitical considerations, can influence the extent of this impact. Monitoring these factors allows for a more nuanced assessment of potential investment returns and the identification of specific companies poised to benefit from shifts in defense spending patterns. The inherent challenge lies in accurately predicting future budget allocations and anticipating how changes in geopolitical dynamics will impact defense spending policies globally.

5. Supply Chain

The aerospace & defense index’s performance is intrinsically linked to the robustness and efficiency of the supply chains supporting the constituent companies. Disruptions within these supply chains, whether due to geopolitical instability, natural disasters, or economic factors, can significantly impact production schedules, increase costs, and ultimately affect the financial performance of these firms. For instance, a shortage of critical raw materials, such as rare earth elements used in the manufacture of advanced electronics, can impede production, delaying deliveries and reducing revenue. This, in turn, negatively affects the company’s stock price and contributes to a decline in the index.

Supply chain complexities are particularly acute in the aerospace and defense industries, given the specialized nature of components, the stringent quality control standards, and the regulatory requirements governing the sourcing of materials. Companies included in the index often rely on a network of global suppliers, increasing vulnerability to disruptions originating in geographically diverse locations. The COVID-19 pandemic exemplified this, as lockdowns and travel restrictions severely hampered the movement of goods and personnel, leading to production delays and cost overruns for many aerospace and defense firms. Furthermore, the industry’s reliance on single-source suppliers for certain critical components amplifies the risk, making diversification of the supply base a crucial risk mitigation strategy. Effective supply chain management, including robust inventory control, proactive risk assessment, and strong supplier relationships, is essential for maintaining operational efficiency and mitigating potential disruptions.

Ultimately, the stability and resilience of the supply chain are vital for sustained growth within the aerospace and defense sector. The aerospace & defense index reflects investor sentiment regarding the sector’s ability to navigate supply chain challenges and maintain consistent performance. A proactive approach to supply chain risk management is thus a competitive imperative for companies aiming to maximize their contribution to, and benefit from, the index’s performance. Therefore, investors carefully evaluate the supply chain strategies of companies within the index as a key indicator of their long-term sustainability and financial health.

Frequently Asked Questions

This section addresses common inquiries regarding market indicators and factors affecting performance within the aerospace and defense industries.

Question 1: What precisely does the “aerospace & defense index” measure?

It tracks the financial performance of publicly traded companies primarily engaged in the manufacturing of aircraft, defense equipment, provision of defense-related services, and associated technologies. The index serves as a benchmark for investment performance in this specific market sector.

Question 2: How are companies selected for inclusion in the index?

Selection criteria typically involve revenue thresholds derived from aerospace and defense activities, market capitalization, liquidity, and adherence to specific listing requirements of the relevant stock exchange. Index providers maintain and publish detailed selection methodologies.

Question 3: What are the primary factors that influence the fluctuations of the “aerospace & defense index”?

Geopolitical events, government defense budgets, technological advancements, supply chain stability, and macroeconomic conditions all contribute to index movements. Each factor exerts varying degrees of influence depending on specific market circumstances.

Question 4: How can investors utilize the “aerospace & defense index” in their investment strategies?

Investors employ the index as a benchmark to evaluate the performance of individual stocks or investment portfolios within the sector. It can also serve as the basis for passively managed investment products, such as exchange-traded funds (ETFs), providing diversified exposure to the aerospace and defense market.

Question 5: Does the “aerospace & defense index” account for ethical or environmental considerations?

Standard indexes primarily focus on financial performance and market capitalization. While some indexes may incorporate environmental, social, and governance (ESG) criteria, traditional market cap-weighted indices typically do not explicitly exclude companies based on ethical or environmental concerns.

Question 6: Where can reliable data on the “aerospace & defense index” be sourced?

Index data is generally available through financial news providers, stock exchanges, and the websites of index providers. It is important to consult reputable sources for accurate and up-to-date information.

A thorough understanding of these points assists in interpreting market dynamics and making informed decisions regarding investments.

The next section will summarize the article.

Conclusion

This exploration has detailed the multifaceted nature of the aerospace & defense index. From its sensitivity to geopolitical events and government budgets to the influence of technological innovation and supply chain dynamics, the index serves as a comprehensive indicator of the sector’s overall health. Market capitalization of constituent companies provides the weighting foundation upon which performance is measured. Understanding these interconnected elements is paramount for informed investment decisions within this complex and strategically important segment of the global economy.

The aerospace & defense index, therefore, demands continual scrutiny and diligent analysis. Its future trajectory hinges on evolving geopolitical landscapes, advancements in defense technologies, and the resilience of global supply chains. Stakeholders are encouraged to remain vigilant, critically assessing these driving forces to effectively navigate the opportunities and challenges that lie ahead.