The coverage provided by Forbes within the sectors relating to air and space technology, as well as national security industries, encompasses a wide range of financial news and analysis. This includes reporting on company performance, market trends, technological advancements, and leadership changes within these critical economic areas. For instance, articles might delve into the financial implications of new aircraft development or the economic impact of defense spending policies.

The importance of this sector-specific reporting lies in its ability to inform investors, industry professionals, and policymakers. Access to accurate and timely financial data allows for better-informed decisions regarding investment, strategic planning, and regulatory oversight. Historically, publications focusing on these domains have played a pivotal role in shaping public understanding of the economic forces driving innovation and growth in these technologically advanced and strategically significant fields.

Subsequent analyses will focus on specific companies, emerging technologies, and key market dynamics shaping the financial landscape of these complex and evolving industries.

Insights from Forbes’ Aerospace and Defense Coverage

The following points distill key insights frequently highlighted in the Forbes’ sector-specific coverage. These observations provide a framework for understanding financial performance, market trends, and strategic considerations within these industries.

Tip 1: Track Government Policy Impacts: Defense and aerospace firms are heavily reliant on government contracts. Changes in defense spending, procurement policies, and international trade agreements directly affect revenue streams and profitability.

Tip 2: Monitor Technological Disruptions: The pace of innovation in aerospace and defense is rapid. Companies that fail to adapt to emerging technologies like artificial intelligence, advanced materials, and autonomous systems risk losing competitive advantage.

Tip 3: Analyze Mergers and Acquisitions Activity: Consolidation within the industry is commonplace. Evaluating the rationale behind significant mergers and acquisitions provides insight into strategic priorities and market positioning.

Tip 4: Evaluate Supply Chain Resilience: Global supply chains are vulnerable to disruption. Companies with diversified and resilient supply chains are better positioned to weather economic and geopolitical uncertainties.

Tip 5: Assess Cybersecurity Posture: Aerospace and defense companies are prime targets for cyberattacks. A robust cybersecurity strategy is critical for protecting intellectual property, maintaining operational integrity, and complying with regulatory requirements.

Tip 6: Scrutinize Export Controls and Compliance: Strict regulations govern the export of aerospace and defense technologies. Adherence to export control laws is essential for avoiding legal penalties and reputational damage.

The ability to interpret these factors allows for the development of well-informed investment strategies and the anticipation of emerging market trends.

These insights are relevant for financial professionals, industry leaders, and policymakers seeking to navigate the complexities of the aerospace and defense sectors.

1. Financial Performance

Forbes’ coverage of the aerospace and defense industries frequently emphasizes financial performance as a critical indicator of company health and sector vitality. Investment decisions, strategic planning, and market analysis are all significantly influenced by the reported revenues, profit margins, and earnings per share of major players. Contract awards and project execution, for instance, directly impact a company’s financial standing, and Forbes’ reporting often correlates successful contract acquisition with positive stock market performance. Poor financial results, conversely, can signal underlying issues such as inefficient operations, technological obsolescence, or ineffective management strategies. The practical significance lies in the ability of investors to make informed choices based on quantifiable financial metrics, leading to a more efficient allocation of capital within the sector.

Consider the impact of a significant contract cancellation on a company’s stock price, as reported by Forbes. This event directly and negatively affects revenue projections, prompting investors to reassess the company’s future prospects. Conversely, the announcement of a major technological breakthrough, coupled with strong earnings reports, can drive investor confidence and propel stock prices upward. For example, Lockheed Martin’s successful execution of a large government contract, consistently documented by Forbes, correlates strongly with its financial performance and investor ratings. The reporting allows for direct cause and effect interpretation.

In conclusion, Forbes’ financial reporting within the aerospace and defense industries serves as a crucial benchmark for evaluating company performance and industry trends. The accurate and timely dissemination of financial data empowers stakeholders to make informed decisions, allocate capital effectively, and navigate the complexities of these dynamic sectors. Understanding the interplay between financial performance, reported events, and strategic decisions is essential for all participants in this economically vital domain.

2. Market Trends

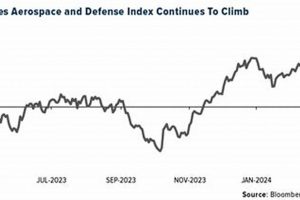

Forbes’ coverage of the aerospace and defense industries meticulously tracks evolving market trends, providing a vital link between broad economic forces and specific company performance. These trends, ranging from increasing demand for unmanned systems to shifting geopolitical alliances, directly influence the financial prospects and strategic priorities of businesses operating within these sectors. The publication’s analysis elucidates the cause-and-effect relationship between market shifts and investment decisions, highlighting opportunities and risks for both established players and emerging companies. Without a clear understanding of these trends, stakeholders face significant challenges in navigating the complexities of these dynamic markets. For instance, Forbes might detail the rising demand for cybersecurity solutions within the defense sector, directly connecting this trend to increased investment in companies specializing in threat detection and prevention technologies.

The practical significance of analyzing market trends through the lens of Forbes’ reporting becomes evident when evaluating investment strategies. Consider the burgeoning space exploration market. Forbes might analyze the financial viability of companies involved in satellite launch services, space tourism, or asteroid mining. This analysis would encompass factors such as government funding, technological advancements, and competitive landscapes, enabling investors to make informed decisions regarding resource allocation. Similarly, Forbes could dissect the impact of increasing global tensions on defense spending, identifying potential beneficiaries among companies specializing in advanced weaponry or intelligence gathering. These sector analyses offer tangible benefits by providing actionable insights based on real-world developments and industry-specific data.

In conclusion, Forbes’ reporting on market trends within the aerospace and defense industries provides a critical navigational tool for investors, industry professionals, and policymakers. By identifying emerging opportunities, assessing potential risks, and analyzing the financial implications of evolving market dynamics, the publication empowers stakeholders to make informed decisions and navigate the complexities of these strategically important sectors. Staying abreast of market trends is not merely an academic exercise but a practical necessity for ensuring competitiveness and achieving sustainable growth in the rapidly changing landscape of aerospace and defense.

3. Technological Innovation

Forbes’ aerospace and defense coverage inherently emphasizes technological innovation as a primary driver of competitive advantage and financial success within these sectors. Rapid advancements in materials science, propulsion systems, artificial intelligence, and cybersecurity directly impact the valuation, strategic positioning, and long-term sustainability of companies operating in these technologically intensive industries.

- Advanced Materials and Manufacturing

The development and application of advanced materials, such as composites, alloys, and nanomaterials, are critical for enhancing aircraft performance, reducing weight, and improving fuel efficiency. Forbes reports on companies investing in additive manufacturing (3D printing) to produce complex components with greater precision and lower costs. The implications include the potential for increased production rates, reduced lead times, and the creation of lighter, stronger, and more durable aerospace and defense systems.

- Autonomous Systems and Artificial Intelligence

The integration of autonomous systems and artificial intelligence (AI) is transforming various aspects of aerospace and defense, from unmanned aerial vehicles (UAVs) to automated cybersecurity solutions. Forbes analyzes the financial impact of AI-driven decision-making, autonomous navigation, and predictive maintenance, noting how these technologies improve operational efficiency, reduce human error, and enhance situational awareness. The implications include the automation of tasks previously performed by humans, the development of more sophisticated and resilient defense systems, and new business models centered on AI-powered services.

- Space Technology and Exploration

The commercialization of space, driven by private companies and government initiatives, is creating new opportunities in satellite communications, space tourism, and resource extraction. Forbes provides insights into the financial performance of companies involved in space launch services, satellite manufacturing, and space exploration, highlighting the technological challenges and economic potential of this rapidly expanding market. The implications include the development of new industries, the expansion of human presence beyond Earth, and the potential for significant returns on investment in space-related technologies.

- Cybersecurity and Information Warfare

The increasing reliance on digital technologies in aerospace and defense has created new vulnerabilities to cyberattacks and information warfare. Forbes reports on companies developing advanced cybersecurity solutions, including threat detection, intrusion prevention, and data encryption, emphasizing the importance of protecting sensitive information and critical infrastructure from malicious actors. The implications include the need for increased investment in cybersecurity infrastructure, the development of more robust defense systems, and the implementation of stricter regulations governing data security and privacy.

These technological advancements, as reported by Forbes, not only shape the competitive landscape within the aerospace and defense sectors but also have profound implications for national security, economic growth, and global innovation. The ability to adapt to and leverage these technological changes will determine the long-term success of companies operating in these strategically important industries.

4. Strategic Partnerships

Strategic partnerships, as observed within Forbes’ coverage of aerospace and defense, represent a crucial element in navigating the complex technological and economic landscapes of these sectors. The formation of alliances, joint ventures, and cooperative agreements allows companies to access specialized expertise, share development costs, and expand market reach, ultimately influencing financial performance and competitive positioning. For example, a partnership between a large defense contractor and a smaller, innovative technology firm, reported on by Forbes, can accelerate the development and deployment of cutting-edge capabilities, enabling both entities to capitalize on emerging market opportunities. The financial success and stability of such arrangements are frequently highlighted, emphasizing the tangible benefits derived from collaborative endeavors in technologically advanced industries.

Forbes’ analyses often illustrate the practical applications of strategic partnerships through case studies. A merger between two aerospace component manufacturers, discussed in detail, can create economies of scale, reduce supply chain vulnerabilities, and improve bargaining power with key customers. Similarly, joint ventures between defense contractors and foreign governments, detailed in Forbes, facilitate access to international markets, enhance interoperability with allied forces, and promote the transfer of technology and expertise. The rationale behind these partnerships typically centers on achieving synergistic effects, where the combined capabilities of the partners exceed the sum of their individual contributions. Failures in strategic partnerships, also occasionally covered, highlight the importance of careful due diligence, clear contractual agreements, and effective communication to ensure long-term success.

In summary, strategic partnerships are a defining characteristic of the aerospace and defense sectors, driving innovation, fostering market expansion, and influencing financial performance, all as reflected in Forbes reporting. Understanding the motivations, structures, and outcomes of these collaborations is essential for investors, industry analysts, and policymakers seeking to navigate the intricacies of these critical industries. The challenges inherent in forming and managing successful partnerships underscore the need for rigorous analysis, careful planning, and a long-term strategic vision.

5. Geopolitical Influences

Geopolitical influences exert a significant impact on the sectors covered by Forbes’ aerospace and defense reporting. Global political dynamics, including international conflicts, trade agreements, and national security policies, directly shape the demand for military equipment, aerospace technologies, and related services. Changes in geopolitical landscapes can trigger shifts in defense spending priorities, leading to both opportunities and challenges for companies operating in these industries. For example, escalating regional tensions may drive increased demand for advanced weaponry and surveillance systems, benefiting defense contractors that specialize in these areas. Conversely, a period of relative peace or arms control agreements could lead to reduced defense budgets and increased pressure on companies to diversify their product offerings.

Forbes’ coverage often highlights specific instances where geopolitical events have demonstrably affected the financial performance of aerospace and defense companies. The imposition of trade sanctions against a particular country, for example, could restrict the export of certain technologies or products, impacting the revenue streams of companies that rely on these markets. Conversely, the formation of new military alliances or security partnerships can create new opportunities for companies to supply equipment and services to allied nations. The publication may also analyze the impact of political instability in certain regions on the supply chains of aerospace and defense companies, highlighting the risks associated with relying on suppliers located in volatile areas. Consider, for instance, the impact of the war in Ukraine on defense budgets and procurement strategies across Europe, a trend regularly analyzed by Forbes. This situation has directly translated into increased demand for specific weapon systems and heightened scrutiny of defense spending priorities, altering the financial outlook for numerous companies.

In summary, geopolitical influences serve as a critical external factor that shapes the financial performance, strategic decisions, and market dynamics of the aerospace and defense sectors. Forbes’ comprehensive reporting provides valuable insights into the complex interplay between global politics and the business operations of companies operating in these strategically important industries. A thorough understanding of geopolitical trends is essential for investors, industry professionals, and policymakers seeking to navigate the challenges and opportunities presented by an ever-changing global landscape.

Frequently Asked Questions

This section addresses common inquiries regarding sector coverage, providing concise answers to enhance comprehension and inform decision-making.

Question 1: What types of companies are typically covered within this sector’s financial reporting?

Coverage typically encompasses publicly traded companies involved in the design, manufacture, and maintenance of aircraft, spacecraft, weapon systems, and related technologies. This includes defense contractors, aerospace manufacturers, satellite operators, and cybersecurity firms specializing in the protection of sensitive information within these industries.

Question 2: What key financial metrics are analyzed to assess the performance of aerospace and defense companies?

Key metrics include revenue growth, profit margins, earnings per share, return on investment, debt-to-equity ratio, and order backlog. These indicators provide insights into a company’s profitability, efficiency, financial stability, and future growth prospects. Government contracts and procurement trends are also closely monitored.

Question 3: How do geopolitical events impact the financial performance of aerospace and defense companies?

Geopolitical events, such as international conflicts, trade agreements, and shifts in defense spending, can significantly affect the demand for military equipment and aerospace technologies. Increased global tensions may drive up defense budgets and boost revenues for defense contractors, while periods of relative peace could lead to reduced spending and increased competition.

Question 4: What role does technological innovation play in shaping the competitive landscape of these industries?

Technological innovation is a primary driver of competitive advantage. Companies that invest in research and development, adopt emerging technologies, and develop innovative products and services are better positioned to succeed in the long term. Areas such as advanced materials, autonomous systems, artificial intelligence, and cybersecurity are particularly important.

Question 5: How are strategic partnerships utilized within these industries?

Strategic partnerships, including joint ventures, mergers, and acquisitions, enable companies to access specialized expertise, share development costs, and expand market reach. These collaborations can enhance competitiveness, promote innovation, and improve financial performance.

Question 6: What factors should investors consider when evaluating investment opportunities in the aerospace and defense sectors?

Investors should consider factors such as the company’s financial performance, technological capabilities, competitive positioning, regulatory environment, and exposure to geopolitical risks. A thorough understanding of these factors is essential for making informed investment decisions.

The information provided in this FAQ aims to offer clarity on salient topics. Continued engagement with credible resources is recommended for a comprehensive understanding.

The subsequent section delves into sector-specific case studies.

Forbes Aerospace and Defense

The preceding analysis has examined coverage within the aerospace and defense sectors through the lens of Forbes’ reporting. Key elements, including financial performance, market trends, technological innovation, strategic partnerships, and geopolitical influences, have been dissected. These factors collectively shape the competitive landscape and investment climate within these strategically vital industries. The interplay between these dynamics demands continuous monitoring and informed assessment.

The information presented provides a foundation for navigating the complexities of this sector. Continuous engagement with credible sources, including Forbes’ ongoing analyses, remains crucial for a comprehensive understanding and the formulation of sound strategic decisions. The future trajectory of aerospace and defense will be defined by technological advancements, evolving geopolitical realities, and the adaptability of key industry players. Vigilant awareness of these forces is paramount.