Entities operating within the aviation and space sectors face unique and substantial financial exposures. Specialized underwriters provide risk mitigation strategies tailored to these industries. These firms offer protection against potential losses stemming from aircraft damage, liability claims, satellite malfunctions, and other aerospace-related incidents. As an example, a provider might cover a satellite launch or provide liability coverage for an airline.

The role of these specialists is crucial for the stability and growth of the aerospace sector. They enable innovation by allowing companies to undertake ambitious projects with reduced financial risk. Historically, this type of underwriting emerged alongside the development of commercial aviation, evolving to address increasingly complex risks associated with space exploration and advanced aerospace technologies. The financial security they offer supports investment and fosters confidence within the industry.

The following discussion will examine specific types of coverage offered, the factors influencing premiums, and the challenges and opportunities facing those providing this essential service to the aerospace industry.

Effective risk management within the aerospace sector requires a deep understanding of the complexities involved. The following tips provide insights to assist in securing appropriate coverage.

Tip 1: Conduct a Thorough Risk Assessment: A comprehensive evaluation of potential hazards is paramount. Identify vulnerabilities within operations, manufacturing, and deployment to tailor coverage effectively. For example, assess risks associated with satellite launch failures, aircraft component malfunctions, or ground-based facility damage.

Tip 2: Understand Policy Exclusions and Limitations: Scrutinize policy documents to identify specific events or circumstances not covered. Recognize these limitations to proactively mitigate excluded risks through alternative means, such as redundant systems or improved safety protocols.

Tip 3: Maintain Accurate Records and Documentation: Detailed records of maintenance, training, and operational procedures are essential. Accurate documentation facilitates the claims process and demonstrates a commitment to risk management, potentially influencing premium rates favorably.

Tip 4: Engage with Experienced Brokers: Utilize the expertise of brokers specializing in aviation and space-related risks. These professionals possess in-depth market knowledge and can negotiate favorable terms and identify suitable coverage options.

Tip 5: Consider Contingency Planning: Develop robust contingency plans to address potential disruptions or catastrophic events. This proactive approach demonstrates preparedness and can minimize the financial impact of adverse incidents.

Tip 6: Regularly Review and Update Coverage: The aerospace landscape is constantly evolving. Regularly reassess coverage needs to ensure adequate protection against emerging threats and technological advancements. Consider policy adjustments following significant operational changes or equipment upgrades.

Adherence to these guidelines promotes informed decision-making and optimizes the value derived from underwriting services, leading to greater financial security and operational resilience.

The subsequent sections will delve into current market trends and future developments impacting the underwriting of aerospace risks.

1. Global Reach

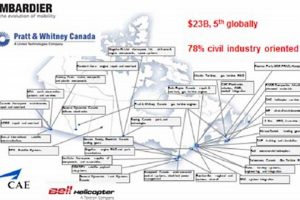

A “global reach” is a fundamental characteristic for an entity underwriting risks in the aerospace sector. The aerospace industry, by its nature, transcends national boundaries, encompassing manufacturing, operations, and supply chains that span continents. A domestic-only underwriter lacks the capacity to adequately assess and manage the geographically dispersed risks associated with international aircraft fleets, satellite deployments conducted from various launch sites, or multinational collaborations in space exploration. Cause and effect are directly linked: aerospace activities are inherently global, therefore, to effectively underwrite them, a commensurate global presence is necessary.

The importance of a “global reach” manifests practically in several ways. Firstly, it enables direct access to local expertise and regulatory knowledge in different regions. This is critical for understanding specific legal liabilities, environmental regulations, and operational nuances that can significantly impact risk profiles. Secondly, it facilitates the establishment of relationships with local aerospace companies, suppliers, and government agencies, fostering a deeper understanding of the industry’s dynamics within specific markets. Consider the example of a satellite launch conducted from French Guiana by a European company, using components manufactured in the United States, and intended for operation over Asia. The underwriter needs a global network to adequately assess and manage the risks associated with this geographically diverse project.

In summary, the ability to operate and underwrite risks on a global scale is not merely an advantage for an entity in the aerospace sector, but a prerequisite for its viability. The sector’s inherent international nature necessitates a global presence to effectively assess, manage, and mitigate the complex and geographically dispersed risks involved. Without a global reach, an underwriter cannot provide comprehensive and reliable coverage to the aerospace industry, potentially jeopardizing the financial stability and operational success of its clients.

2. Specialized Expertise

The ability to provide appropriate coverage to the global aerospace industry hinges fundamentally on specialized expertise. Underwriting risks within this sector demands more than a general understanding of underwriting principles. It requires in-depth knowledge of aerospace engineering, aviation operations, space technologies, regulatory frameworks, and the specific risks associated with each. A lack of such expertise results in inaccurate risk assessments, inappropriate pricing, and potentially devastating financial consequences for both the underwriter and the insured.

The importance of specialized expertise is illustrated by numerous examples. Consider the complexities of underwriting a satellite launch. An underwriter must understand the intricacies of rocket propulsion systems, satellite communication technologies, and the orbital environment to accurately assess the probability of launch failure or on-orbit malfunction. Similarly, underwriting risks associated with commercial aviation requires a deep understanding of aircraft maintenance procedures, pilot training protocols, air traffic control systems, and the potential consequences of human error. Expertise informs the design of policy terms, the calculation of premiums, and the handling of claims. Without it, an underwriter is essentially operating blindly, exposed to unforeseen risks and potential financial ruin. Global Aerospace providers must have a team of expert to have specialized expertise.

In conclusion, specialized expertise is not merely an added benefit, but a core requirement for effective operation in the global aerospace underwriting market. The sector’s inherent complexity and high-stakes nature necessitate a profound understanding of its technological, operational, and regulatory nuances. Without this specialized knowledge, an underwriter cannot accurately assess risks, provide appropriate coverage, or effectively manage claims, thereby undermining the financial stability of both the underwriter and the aerospace industry as a whole. The challenges include continuously updating expertise with technological advancements, but the benefits of doing so are crucial for long-term success.

3. Risk Mitigation

Risk mitigation is a core function intrinsically linked to the operations of a global aerospace underwriting firm. These entities provide essential services by transferring and managing the potentially catastrophic financial burdens arising from the inherent dangers associated with aviation and space activities. Effective risk mitigation strategies are critical for the financial health of both the underwriters and the aerospace companies they protect.

- Financial Transfer:

The primary risk mitigation mechanism involves the transfer of financial risk from aerospace operators to the underwriter. Through premium payments, companies secure coverage against potential losses stemming from aircraft accidents, satellite failures, and other unforeseen events. This transfer provides financial stability, allowing companies to pursue ambitious projects without the constant threat of crippling financial repercussions. For example, an airline suffering a hull loss due to an accident can rely on its policy to cover the cost of a replacement aircraft, ensuring continued operations.

- Safety Enhancement:

Underwriters indirectly contribute to risk mitigation by incentivizing safer practices within the aerospace industry. Premium pricing is often tied to risk profiles, rewarding companies with strong safety records and proactive risk management programs. This creates a financial incentive for companies to invest in improved training, maintenance, and operational procedures. This impacts areas such as pilot training standards, quality control processes during manufacturing, and improved air traffic management systems.

- Claims Management:

Effective claims management is another critical aspect. When an incident occurs, the underwriter’s claims department investigates the cause and assesses the damage, ensuring fair and timely compensation. Efficient claims processing minimizes the financial impact on the insured and facilitates a swift return to normal operations. This process extends beyond simple payouts to include loss prevention measures informed by claims data, contributing to safer future operations.

- Global Loss Prevention:

Global aerospace underwriters have the resources and expertise to collect and analyze data from incidents occurring worldwide. This information is used to identify emerging trends, common causes of accidents, and areas where safety improvements are needed. Sharing these insights with the aerospace industry contributes to improved safety standards and reduces the likelihood of future incidents. This proactive approach demonstrates the underwriting firm’s commitment to reducing risk beyond simply providing financial protection.

The various risk mitigation strategies underscore the integral role these providers play in the aerospace industry. By assuming financial responsibility for potential losses and actively promoting safety improvements, these firms enable innovation, foster stability, and ultimately contribute to the overall safety and security of air and space travel. The interconnected nature of these strategies reinforces the importance of a holistic approach to risk management, benefiting both the underwriting firm and its clients.

4. Financial Stability

Financial stability is a paramount concern for any entity operating within the global aerospace insurance market. The scale of potential losses associated with aircraft accidents, satellite failures, and other aerospace-related incidents necessitates substantial financial reserves and prudent risk management practices. The viability of the entire sector depends on the capacity of these companies to meet their obligations following catastrophic events.

- Capital Adequacy and Solvency Ratios

Capital adequacy refers to the level of capital an organization holds in relation to its risk-weighted assets. Regulatory bodies mandate specific solvency ratios to ensure these organizations maintain sufficient reserves to cover potential claims. For example, a regulator might require a provider to hold capital equal to a certain percentage of its total insured risk. Failure to maintain adequate capital can lead to regulatory intervention or, in extreme cases, insolvency, jeopardizing their ability to pay out claims. This directly impacts the financial security of their clients.

- Diversification of Risk

Diversification of risk is a key strategy for maintaining financial stability. An organization typically underwrites a diverse portfolio of clients across different segments of the aerospace industry and across various geographic regions. This reduces exposure to any single event or market downturn. For instance, instead of solely insuring commercial airlines, they might also cover satellite operators, aircraft manufacturers, and airports. This diversification mitigates the impact of a major loss in any one sector.

- Reinsurance Agreements

Reinsurance agreements are crucial for transferring a portion of the insured risk to other underwriting entities. This allows these organizations to manage their overall risk exposure and protect their capital base from large-scale losses. A firm might enter into a reinsurance treaty that covers losses exceeding a certain threshold, effectively sharing the burden of a catastrophic event with other firms. These agreements are a cornerstone of financial stability, ensuring that even in the face of significant claims, the underwriting firm can continue to meet its obligations.

- Prudent Investment Strategies

The financial performance of the world wide operating firms is heavily influenced by its investment strategies. Prudent investment management is essential for generating returns on capital and maintaining financial stability. Investment portfolios typically consist of a mix of conservative assets, such as government bonds and high-grade corporate securities. Avoiding high-risk investments minimizes the potential for significant losses that could erode capital reserves. Investment income provides a stable source of revenue, bolstering the firm’s ability to meet its claims obligations, particularly during periods of high claims activity.

These interconnected elements underscore the critical importance of financial stability in the global aerospace risk underwriting market. Without robust capital reserves, diversified risk portfolios, reinsurance agreements, and prudent investment strategies, these organizations would be unable to fulfill their essential function of protecting the aerospace industry from catastrophic financial losses. The long-term viability of the sector depends on the financial strength and stability of these crucial service providers.

5. Regulatory Compliance

Regulatory compliance is an inextricable component of operations for entities underwriting aerospace risks on a global scale. The aerospace industry is heavily regulated, encompassing aircraft manufacturing standards, air traffic control procedures, satellite licensing requirements, and a myriad of other operational parameters. Failure to adhere to these regulations can result in significant legal penalties, reputational damage, and, crucially, the invalidation of insurance coverage. Therefore, a robust understanding of and adherence to these regulations are paramount for an underwriting firm operating in this sector. Cause and effect are directly linked: non-compliance by an insured party can void the policy, leaving the underwriter exposed to uncovered losses. For example, an airline operating in violation of FAA maintenance directives could find its claim denied following an accident, placing the full financial burden on the underwriter.

The importance of regulatory compliance extends beyond mere adherence to rules. It demonstrates a commitment to safety and responsible operations, which in turn influences the risk profile assessed by underwriters. A company with a proven track record of compliance signals a lower probability of incidents resulting from negligence or disregard for established protocols. This results in more favorable premium rates and broader coverage terms. Furthermore, international regulations, such as those promulgated by the International Civil Aviation Organization (ICAO), necessitate a standardized approach to safety and security, which underwriters must incorporate into their risk assessments. For instance, compliance with ICAO standards for airport security can significantly reduce the risk of terrorism-related incidents, thereby lowering the underwriter’s exposure.

In summary, regulatory compliance is not merely an administrative burden but a fundamental aspect of responsible risk management in the global aerospace sector. It directly affects the validity of underwriting policies, influences premium pricing, and contributes to overall safety and security. These firms must possess a thorough understanding of national and international regulations to accurately assess risks, provide appropriate coverage, and effectively manage claims. Non-compliance presents a significant threat to both the underwriter and the insured, underscoring the critical importance of a proactive and comprehensive approach to regulatory adherence.

6. Innovation Support

Entities providing risk underwriting for the global aerospace industry play a critical, though often understated, role in fostering technological advancement. This support manifests in several ways, directly impacting the pace and scope of innovation within the sector.

- Mitigating Financial Risk of Novel Technologies

The development and deployment of novel aerospace technologies inherently involve substantial financial risk. Underwriters, by providing coverage for potential failures or unforeseen issues, allow companies to pursue ambitious projects that would otherwise be financially untenable. Consider the development of electric aircraft or reusable rocket technology. The high risk of technical setbacks or operational incidents could deter investment without the availability of suitable underwriting. Underwriters, therefore, enable these companies to secure funding and proceed with their innovative endeavors.

- Incentivizing Responsible Innovation Through Risk Assessment

Underwriting firms do not blindly accept risk; they carefully assess the potential vulnerabilities associated with new technologies. This assessment process incentivizes aerospace companies to prioritize safety and implement rigorous testing protocols during development. For example, before underwriting the first commercial flights of a new aircraft model, an underwriter will scrutinize the manufacturer’s design specifications, testing data, and maintenance plans. This scrutiny promotes a culture of responsible innovation, ensuring that safety is not sacrificed in the pursuit of technological advancement.

- Facilitating Access to Capital Markets

The presence of robust underwriting options increases investor confidence in aerospace ventures. When a project is insurable, it signals to investors that the financial risks are manageable and that potential losses can be mitigated. This enhances the attractiveness of aerospace companies to capital markets, facilitating access to funding for research, development, and commercialization. A well-underwritten space tourism venture, for example, is more likely to attract investment than one lacking adequate coverage.

- Enabling Global Collaboration in Research and Development

The collaborative nature of many aerospace innovation projects, often involving partnerships between companies and research institutions from different countries, necessitates a global approach to underwriting. Firms with international expertise and resources can provide coverage for projects spanning multiple jurisdictions, facilitating cross-border collaboration and accelerating the pace of innovation. The development of a new satellite system involving contributions from European, Asian, and North American entities, for instance, requires a global underwriting solution to manage the diverse risks associated with the project.

The connection between innovation and those underwriting risk is symbiotic. Innovation generates new risks requiring specialized coverage, while the availability of that coverage enables further innovation by mitigating those risks. The dynamic interplay between these two forces is crucial for the continued growth and technological advancement of the aerospace industry worldwide. Providers of global underwriting must continue to adapt their practices and expertise to effectively support the evolving landscape of aerospace innovation.

Frequently Asked Questions

The following provides answers to commonly asked questions regarding global aerospace risk underwriting. It is intended to offer clarity and insight into this specialized sector.

Question 1: What constitutes “global aerospace risk underwriting?”

It encompasses the provision of financial risk transfer mechanisms, via insurance policies, to entities operating within the aviation, space, and related industries on an international scale. This includes coverage for aircraft, satellites, launch vehicles, airports, manufacturers, and related service providers.

Question 2: What types of risks are typically covered?

Coverage generally extends to property damage (e.g., aircraft hull loss, satellite malfunction), liability claims (e.g., passenger injury, third-party damage), and business interruption (e.g., grounding of a fleet, launch delay). Specific policy terms and conditions dictate the precise scope of coverage.

Question 3: How are premiums determined?

Premium calculation involves a comprehensive assessment of risk, considering factors such as the type of operation, the age and condition of equipment, the safety record of the insured, geographic location, and prevailing market conditions. Underwriters employ actuarial analysis and expert judgment to determine appropriate pricing.

Question 4: Why is global coverage necessary?

The aerospace industry operates on a global scale, with aircraft and satellites traversing international borders, supply chains spanning multiple continents, and multinational collaborations being commonplace. Global coverage ensures consistent protection regardless of location or jurisdiction.

Question 5: What role does regulatory compliance play?

Adherence to national and international aviation and space regulations is essential for obtaining and maintaining insurance coverage. Non-compliance can void a policy and expose the insured to significant financial liabilities. Underwriters assess an applicant’s compliance record as part of the risk evaluation process.

Question 6: How does innovation affect underwriting practices?

The introduction of new technologies, such as electric aircraft, autonomous drones, and reusable launch vehicles, presents new risks that underwriters must assess and manage. This requires continuous learning and adaptation to evolving technological landscapes. Underwriters play a key role in enabling innovation by providing coverage for these novel ventures.

In summary, global aerospace providers offer crucial financial protection and support the continued growth and safety of the aviation and space industries by understanding and mitigating the sectors unique risks. Navigating its complexities requires a thorough understanding of its operations, legal landscape, and constant innovation.

The following section will explore future trends and opportunities shaping the industry.

Conclusion

This analysis has explored the multifaceted nature of entities that provide risk mitigation services to the worldwide aviation and space sectors. Core competencies, including global reach, specialized expertise, rigorous risk mitigation strategies, demonstrable financial stability, adherence to stringent regulatory frameworks, and facilitation of sector innovation, have been examined. These elements collectively define the characteristics of a capable and responsible risk partner within the demanding environment of global aerospace operations.

The continued safety, security, and technological advancement of the global aerospace industry depend, in part, on the vigilance and financial strength of these underwriting providers. Sector stakeholders should prioritize comprehensive risk assessment and select underwriting partners capable of adapting to the evolving challenges and opportunities presented by technological developments and geopolitical shifts. The future viability of the sector hinges on proactive risk management and responsible financial stewardship.