The financial instrument representing ownership in Pall Aerospace, a division of Pall Corporation, provides investors with a stake in a company specializing in filtration, separation, and purification solutions within the aerospace sector. These solutions are critical for maintaining the performance and reliability of aircraft and aerospace systems by removing contaminants from fluids and gases.

Investment in this asset class can offer exposure to the aerospace industry’s growth, driven by increasing air travel, defense spending, and the demand for advanced technologies. Historical performance and future prospects are influenced by factors such as technological innovation, regulatory compliance, and the overall health of the global economy. The performance of entities involved in the aerospace supply chain is directly linked to the success and activity within the broader aerospace market.

The following sections will delve into specific aspects, including performance metrics, market influences, and potential risks and opportunities. This exploration will provide a comprehensive understanding of the factors that contribute to its value and trajectory within the investment landscape.

The following guidance aims to provide key considerations for individuals evaluating the potential inclusion of Pall Aerospace holdings within their investment portfolio. These points address crucial aspects to consider before making investment decisions.

Tip 1: Analyze Financial Performance: Scrutinize revenue growth, profitability margins, and debt levels. Consistent positive financial performance is indicative of sound management and a stable business model, vital for sustained value.

Tip 2: Assess Market Position: Determine Pall Aerospace’s competitive advantage within the filtration and separation solutions market. A strong market position, evidenced by a large market share and established customer relationships, can contribute to long-term stability.

Tip 3: Evaluate Technological Innovation: Examine the company’s commitment to research and development. The ability to innovate and adapt to changing technological landscapes within the aerospace industry is crucial for maintaining competitiveness.

Tip 4: Consider Regulatory Landscape: Understand the impact of industry regulations and compliance requirements on Pall Aerospace’s operations. Adherence to stringent regulations is paramount in the aerospace sector, influencing operational costs and market access.

Tip 5: Monitor Macroeconomic Factors: Observe macroeconomic trends, such as global economic growth, interest rates, and inflation. These factors can influence the aerospace industry’s overall performance and, consequently, the value of related holdings.

Tip 6: Review Supply Chain Resilience: Evaluate the robustness of Pall Aerospace’s supply chain. A diversified and resilient supply chain minimizes the risk of disruptions and ensures consistent production capabilities.

Tip 7: Understand Customer Diversification: Analyze the company’s reliance on specific customers. A diversified customer base mitigates the impact of potential losses of individual contracts, ensuring financial stability.

Implementing these investigative steps provides a foundation for understanding the risks and opportunities associated with investment. Rigorous analysis is paramount.

The subsequent sections will build upon these considerations, offering a more detailed perspective on potential opportunities, potential risks and overall investment strategy.

1. Market Volatility

Market volatility, characterized by unpredictable and often rapid price movements, directly influences equity valuations, including those representing Pall Aerospace. Its impact necessitates careful consideration from investors seeking to understand potential risks and returns.

- Geopolitical Events

Global instability, trade disputes, and political tensions trigger uncertainty, leading to broad market sell-offs or sector-specific downturns. For Pall Aerospace, heightened geopolitical risk can affect defense spending, airline profitability, and international trade flows, impacting demand for its products and subsequently its equity value.

- Economic Cycles

Economic expansions and contractions dictate corporate earnings. During recessions, reduced air travel, lower defense budgets, and decreased industrial activity negatively impact revenue streams. Conversely, economic booms drive increased demand, positively affecting the company’s financial performance and equity price.

- Interest Rate Fluctuations

Central bank policies on interest rates affect the cost of capital for businesses and investor sentiment. Rising interest rates can make borrowing more expensive, potentially slowing growth and reducing attractiveness compared to bonds. Falling rates incentivize investment and boost valuations.

- Investor Sentiment

Market psychology, driven by news cycles and broader economic outlooks, exerts a considerable influence. Periods of optimism encourage buying activity, pushing prices higher, while pessimism leads to selling pressure and price declines. News regarding competitor innovations, large contract wins or losses, or regulatory changes related to safety standards can shift sentiment rapidly.

Considering these aspects of market volatility enables stakeholders to evaluate their risk tolerance and formulate suitable investment strategies. The ability to analyze and react appropriately to these influences is important for managing portfolio performance when investing in entities related to the aerospace industry.

2. Sector Performance

The performance of the broader aerospace sector exerts a substantial influence on the valuation and trajectory of entities like Pall Aerospace. Understanding the nuances of sector dynamics is therefore critical for investors.

- Defense Spending Cycles

Government budgetary allocations for defense directly impact aerospace companies supplying military equipment and services. Increased geopolitical instability often translates into larger defense budgets, boosting demand for specialized filtration and separation technologies used in military aircraft and vehicles. Conversely, periods of peace or fiscal austerity may lead to reduced spending, negatively impacting related revenue streams.

- Commercial Aviation Growth

The health of the commercial aviation industry, driven by passenger traffic and airline profitability, affects demand for filtration and separation solutions in aircraft manufacturing and maintenance. Increased air travel stimulates production of new aircraft, creating opportunities for suppliers. Economic downturns or external shocks, such as pandemics, can significantly reduce air travel, negatively impacting aircraft production and maintenance activities.

- Technological Advancements

Innovation in aerospace technology, such as the development of more fuel-efficient engines and lighter materials, creates opportunities and challenges for suppliers. Filtration and separation technologies must evolve to meet the demands of these advanced systems. Companies that invest in research and development to stay ahead of the curve are better positioned for long-term success. For example, development of specialized filters for advanced composite aircraft.

- Regulatory Compliance

Stringent regulations governing safety, emissions, and environmental impact heavily influence the aerospace sector. Compliance with these regulations requires investments in advanced technologies, including filtration and separation solutions. Changes in regulations, such as stricter emission standards, can create new market opportunities for companies specializing in compliant technologies. Entities supplying components to Aerospace must comply to stringent requirements. Non-compliance will not be tolerable.

The collective performance indicators within the aerospace sector provide insights into the economic and technological forces shaping the prospects of Pall Aerospace. Factors such as government spending, consumer behavior, technological innovation, and regulatory shifts converge to dictate the demand and profitability potential of participating companies. Investors must carefully weigh these influences to comprehensively assess the long-term value.

3. Financial Health

The financial health of Pall Aerospace serves as a critical determinant of investment value. Strong financial performance typically correlates with a stable or increasing value. Conversely, financial distress can lead to diminished share value. Understanding a corporation’s financial stability is paramount in assessing investment opportunities.

Indicators of financial health include revenue growth, profitability margins, debt levels, and cash flow. Sustained revenue growth signals market demand and effective sales strategies. Healthy profitability margins reflect efficient cost management and pricing power. Manageable debt levels indicate responsible financial management. Robust cash flow provides the company with the capital necessary for investments, acquisitions, and shareholder returns. For example, a period of increased defense spending may yield higher revenues, improving overall stability and potentially increasing the investment value.

Assessment of corporate financial stability contributes to informed investment decisions. Declining revenue, increasing debt, and eroding profit margins create risks. Stable financial performance signals an investment opportunity. The connection between financial health and value of investment consideration for stakeholders. Understanding this relationship is crucial for informed decision-making and risk mitigation.

4. Supply Chains

The efficacy of supply chains directly influences the stability and profitability of aerospace manufacturing, subsequently impacting the valuation of related equity. Disruptions, inefficiencies, or vulnerabilities within supply networks can reverberate through operational performance, creating financial risks.

- Raw Material Availability

Access to specialized materials, such as alloys and polymers critical for manufacturing components, is essential. Shortages or price volatility in these raw materials can increase production costs, reduce profit margins, and delay deliveries, negatively affecting investor confidence.

- Component Sourcing

Aerospace relies on a complex network of suppliers for specialized parts and sub-assemblies. Dependence on a limited number of suppliers increases the risk of disruptions due to production bottlenecks, quality issues, or geopolitical factors. Diversification of sourcing minimizes these risks.

- Logistics and Transportation

Efficient and reliable logistics are crucial for timely delivery of components and finished products. Delays due to transportation disruptions, customs clearance issues, or infrastructure limitations can impact production schedules and increase costs, affecting revenues and profitability.

- Global Interdependencies

Aerospace supply chains are often global, with components and sub-assemblies sourced from multiple countries. Geopolitical tensions, trade barriers, and currency fluctuations can introduce complexity and risk, potentially disrupting supply flows and increasing costs.

Disruptions in the supply chain negatively affect production. Management of supply chains impacts financial performance and long-term value, thereby shaping investor perceptions. The resilience and adaptability of these networks are vital indicators of operational stability and financial strength.

5. Technological Edge

Technological advancement within Pall Aerospace critically influences its financial performance and investment appeal. Innovation drives product differentiation, enhances efficiency, and addresses evolving industry needs, all of which directly impact revenue generation and shareholder value.

- Advanced Filtration Materials

The development and implementation of novel filtration materials, capable of removing increasingly smaller contaminants at higher flow rates, provides a significant competitive advantage. Examples include utilizing nanofiber technology to create filters with enhanced particle capture efficiency and lower pressure drop. This directly translates to improved aircraft performance, reduced maintenance costs for airlines, and thus increased demand for Pall Aerospace products, influencing value.

- Smart Filtration Systems

Integrating sensors and data analytics into filtration systems enables real-time monitoring of filter performance and predictive maintenance capabilities. These “smart” systems allow airlines to optimize filter replacement schedules, reducing downtime and operational costs. Development of predictive maintenance will greatly enhance the reliability of the aircraft and reduce the probability of catastrophic failure.

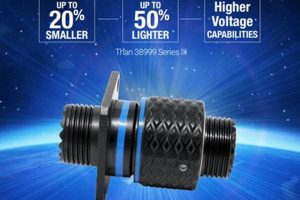

- Miniaturization and Weight Reduction

Reducing the size and weight of filtration components is crucial for improving aircraft fuel efficiency and payload capacity. Investing in research and development to create smaller, lighter filters without compromising performance provides a competitive edge. The impact is realized as airlines seek to reduce weight to save fuel and lower emissions. These components must be of the highest quality to ensure safe operation.

- Sustainable Filtration Solutions

Developing environmentally friendly filtration solutions, such as biodegradable filters or systems that reduce waste generation, aligns with growing sustainability concerns within the aerospace industry. Addressing increasing pressure to reduce the environmental footprint appeals to airlines and governments prioritizing sustainable practices. For example, filtration systems that reduce waste generated during aircraft maintenance will likely be in high demand as pressure is exerted on aerospace companies to improve sustainability.

These technological advancements collectively contribute to enhanced product value, improved operational efficiency, and strengthened competitive positioning. The degree to which Pall Aerospace continues to invest in and successfully implement these innovations directly shapes its long-term financial performance and, consequently, impacts the investment prospects. Sustained investment in R&D is paramount for maintaining a technological advantage.

6. Regulatory Impact

The regulatory landscape exerts a profound influence on the valuation of aerospace-related investments, including those associated with Pall Aerospace. Stringent regulations governing safety, emissions, and environmental impact necessitate continuous investment in compliant technologies and operational practices. These regulations act as both a cost driver and a market enabler. Compliance requires expenditures on research and development, testing, and certification, potentially impacting short-term profitability. Conversely, adherence to and innovation within these regulatory frameworks create market opportunities for companies possessing the requisite expertise and technological capabilities. For instance, regulations mandating the reduction of aircraft emissions drive demand for advanced filtration systems capable of improving fuel efficiency and reducing particulate matter, benefiting companies like Pall Aerospace that offer such solutions.

The Federal Aviation Administration (FAA) and the European Aviation Safety Agency (EASA) are central in shaping the operating environment for the aerospace industry. Their regulations impact nearly every aspect of aircraft design, manufacture, and operation. Pall Aerospace, as a supplier of critical filtration and separation components, must adhere to these standards to ensure its products meet the stringent requirements for airworthiness and safety. Changes in these regulations, such as the implementation of new fuel efficiency standards or stricter guidelines for cabin air quality, can trigger significant shifts in demand for specific types of filtration systems. Understanding these regulatory dynamics is crucial for investors as it provides insights into potential growth areas and risks associated with Pall Aerospace. For example, an increase in regulations regarding aircraft maintenance could lead to a greater demand for Pall Aerospace’s filtration and separation solutions, potentially boosting revenue.

In summary, the regulatory environment is a critical factor influencing the prospects of Pall Aerospace. Investment decisions must account for both the costs associated with compliance and the opportunities created by regulatory-driven demand for innovative technologies. Diligence in tracking regulatory changes and assessing their impact on Pall Aerospace’s operations and market position is essential for informed investment strategies. The complexities of international regulations and their potential effects on global operations must also be considered for a complete assessment of investment risks and opportunities.

Frequently Asked Questions

The following provides answers to frequently asked questions regarding investment in equities tied to Pall Aerospace, addressing critical aspects for potential investors.

Question 1: What factors primarily influence the value of Pall Aerospace holdings?

Key factors include overall aerospace sector performance, defense spending trends, commercial aviation growth, technological advancements in filtration, regulatory compliance mandates, and general macroeconomic conditions. Company-specific elements, such as revenue growth, profit margins, and debt levels, also exert significant influence.

Question 2: How does market volatility affect this investment type?

Market volatility, driven by geopolitical events, economic cycles, interest rate fluctuations, and investor sentiment, can cause significant price fluctuations. Geopolitical instability, for example, may impact defense spending, while economic downturns can reduce air travel, impacting demand for aircraft and related services. Investors must therefore assess their risk tolerance and employ appropriate risk management strategies.

Question 3: What risks are associated with Pall Aerospace’s supply chains?

Risks include raw material shortages, dependence on limited suppliers, logistics disruptions, and global interdependencies. Disruptions can lead to increased production costs, delays in deliveries, and ultimately, reduced profitability. Supply chain resilience and diversification are therefore critical for mitigating these risks.

Question 4: How does technological innovation impact the investment?

Technological innovation in areas such as advanced filtration materials, smart filtration systems, miniaturization, and sustainable solutions drives product differentiation and enhances efficiency. Companies that invest in research and development to stay ahead of technological trends are better positioned to capitalize on market opportunities and enhance shareholder value.

Question 5: What role do regulatory agencies play?

Regulatory agencies like the FAA and EASA set stringent standards for safety, emissions, and environmental impact. Compliance with these regulations requires investments in technology and processes, creating both costs and opportunities. Companies that anticipate and adapt to regulatory changes gain a competitive advantage.

Question 6: What are key metrics for evaluating the financial health?

Key metrics include revenue growth, profitability margins, debt levels, and cash flow. Sustained revenue growth and healthy profit margins indicate efficient operations and strong market demand. Manageable debt levels and robust cash flow provide flexibility for investments and shareholder returns.

Understanding the complexities of market dynamics is essential when analyzing investment performance. By paying close attention to these factors and understanding their potential implications, stakeholders can improve their understanding of the risks and opportunities associated with this type of instrument.

This provides a foundational insight into these specific instruments. The subsequent section will explore long-term investment considerations.

Considerations for Pall Aerospace Stock

This exploration has illuminated key factors influencing the value of instruments related to Pall Aerospace. These considerations encompass market volatility, sector performance, financial health, supply chain dynamics, technological advancements, and regulatory compliance. Understanding these interdependent elements is essential for evaluating potential opportunities and inherent risks.

The aerospace industry presents both challenges and prospects. Ongoing due diligence and a comprehensive understanding of evolving market conditions are crucial for navigating the complexities. Informed investment strategies, guided by thorough analysis and an awareness of future trends, remain paramount for maximizing potential returns and mitigating exposure within this sector.

![Is GE Aerospace Stock [GE] a Buy? Future of Aerospace Stocks Innovating the Future of Flight with Reliable Aviation Solutions Is GE Aerospace Stock [GE] a Buy? Future of Aerospace Stocks | Innovating the Future of Flight with Reliable Aviation Solutions](https://mixaerospace.com/wp-content/uploads/2026/02/th-137-300x200.jpg)