The ratio between a company’s earnings and its revenues, specifically within the aeronautics and space sector, indicates financial performance and efficiency. This metric, expressed as a percentage, reveals how much of each dollar earned is retained as profit. For instance, a 10% ratio suggests that for every dollar of revenue, ten cents is retained as profit after accounting for all expenses.

Understanding this key performance indicator is vital for stakeholders, including investors, management, and employees, as it reflects the sector’s overall health and competitiveness. Its analysis provides insights into operational effectiveness, cost management, and pricing strategies. Historically, fluctuations in this metric have been influenced by factors such as government spending, technological advancements, and global economic conditions.

The following analysis delves into the various factors impacting this financial indicator within the aeronautics and space sector, explores regional differences, and examines strategies for improvement. It will also consider the influence of current trends, such as sustainability initiatives and supply chain resilience, on this crucial aspect of industry performance.

Strategies for Enhancing Profitability in Aeronautics and Space

The following are actionable strategies designed to improve the earnings-to-revenue ratio within businesses operating in the aeronautics and space sector.

Tip 1: Optimize Supply Chain Management: Efficiently managing the supply chain is critical. This involves negotiating favorable terms with suppliers, implementing robust inventory management systems to reduce carrying costs, and diversifying sourcing to mitigate disruptions and price volatility.

Tip 2: Invest in Research and Development: Continuous innovation is essential for maintaining a competitive edge. Allocate resources to research and development projects that lead to new, higher-margin products and services. This can include developing more fuel-efficient aircraft components or advanced satellite technologies.

Tip 3: Implement Lean Manufacturing Principles: Embrace lean manufacturing principles to streamline production processes, reduce waste, and improve overall efficiency. This can involve implementing practices such as Six Sigma to minimize defects and optimize resource utilization.

Tip 4: Enhance Operational Efficiency: Improve operational efficiency through the adoption of advanced technologies such as automation, robotics, and artificial intelligence. These technologies can reduce labor costs, improve accuracy, and enhance overall productivity.

Tip 5: Focus on Value-Added Services: Expand revenue streams by offering value-added services such as maintenance, repair, and overhaul (MRO), training, and consulting. These services often have higher profit margins than traditional manufacturing activities.

Tip 6: Strategically Manage Pricing: Implement dynamic pricing strategies based on market demand, competitive pressures, and cost fluctuations. This can involve adjusting prices based on real-time data to maximize revenue and profitability.

Tip 7: Secure Government Contracts: Actively pursue government contracts, which can provide a stable source of revenue and profit. Develop strong relationships with government agencies and ensure compliance with all relevant regulations and requirements.

By implementing these strategies, organizations operating in the aeronautics and space sector can significantly improve their earnings-to-revenue ratio and enhance their long-term financial performance.

The subsequent sections of this article will address specific challenges and opportunities related to profitability within the industry.

1. Market Dynamics

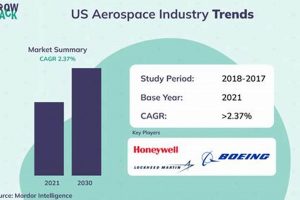

Market dynamics exert a significant influence on the earnings-to-revenue ratio within the aeronautics and space sector. Fluctuations in demand, driven by factors such as economic cycles, geopolitical events, and technological shifts, directly impact revenue streams. A surge in passenger air travel, for instance, stimulates demand for new aircraft, benefiting manufacturers. Conversely, economic downturns can lead to reduced orders and diminished financial returns. The cyclical nature of the aerospace industry necessitates careful monitoring of market trends to anticipate changes in demand and adjust production accordingly. For example, Airbus and Boeing closely track airline profitability and expansion plans to forecast future aircraft orders.

Furthermore, market concentration and competitive intensity affect pricing power and subsequent financial returns. Consolidation among suppliers or manufacturers can lead to increased bargaining power, influencing the prices charged for products and services. The level of competition within specific segments, such as commercial aviation or defense contracting, impacts the ability of companies to maintain favorable profit margins. Fierce competition may necessitate price reductions or increased investment in research and development to maintain market share, potentially eroding profitability. The entrance of new players with disruptive technologies can also reshape the competitive landscape, impacting established companies.

Understanding these dynamic market forces is crucial for companies to make informed strategic decisions regarding production levels, pricing strategies, and investment allocations. By closely monitoring key indicators, such as passenger traffic, defense spending, and technological advancements, organizations can better anticipate market shifts and proactively adapt their operations to mitigate risks and capitalize on opportunities. Ultimately, a comprehensive understanding of market dynamics is essential for maintaining and enhancing the earnings-to-revenue ratio within the complex and highly regulated aeronautics and space sector.

2. Operational Efficiency

Operational efficiency serves as a cornerstone for achieving and sustaining favorable earnings-to-revenue ratios within the aeronautics and space sector. Increased efficiency directly translates to reduced costs, streamlined processes, and optimized resource utilization. For instance, the implementation of advanced manufacturing techniques, such as additive manufacturing, can significantly reduce material waste and production time, thereby lowering manufacturing costs and boosting profitability. Similarly, improvements in supply chain management, including the adoption of just-in-time inventory systems, minimize carrying costs and prevent production delays, contributing to a healthier financial performance. Therefore, gains in operational efficiency directly influence profitability in this sector.

The impact of operational efficiency extends beyond cost reduction. Enhanced efficiency also contributes to increased output and improved product quality. The deployment of automation and robotics in assembly lines, for example, increases production speed and accuracy, allowing manufacturers to fulfill orders more quickly and minimize defects. This not only lowers warranty costs but also enhances customer satisfaction, leading to repeat business and stronger revenue streams. A practical example of this is seen in the increased use of digital twins for predictive maintenance which minimizes downtime and maximizes the productive life of equipment. Further investment in employee training programs empowers the workforce, equipping employees with the skills and knowledge needed to perform their tasks more efficiently and effectively. Higher-skilled employees will reduce defects, improve cycle times, and increase overall output.

In conclusion, operational efficiency is not merely a desirable attribute but a crucial determinant of financial performance in the aeronautics and space sector. The ability to optimize resource allocation, streamline processes, and enhance productivity directly impacts the earnings-to-revenue ratio. However, achieving and maintaining high levels of operational efficiency requires continuous investment in technology, infrastructure, and human capital. Organizations that prioritize operational efficiency are better positioned to navigate the competitive landscape, adapt to changing market conditions, and achieve long-term financial success within this dynamic and demanding industry.

3. Technological Advancements

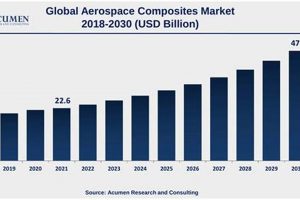

Technological advancements represent a critical driver of financial returns within the aeronautics and space sector. Innovation directly impacts profitability through cost reduction, enhanced performance capabilities, and the creation of new revenue streams. The development of more fuel-efficient engines, for example, significantly reduces operating costs for airlines, creating demand for new aircraft and benefiting manufacturers. Similarly, advancements in materials science, such as the use of lightweight composites, improve aircraft performance and fuel efficiency, contributing to increased profitability. These technologies enhance the value proposition of aerospace products, enabling companies to command premium prices and increase earnings. The transition to electric propulsion systems in smaller aircraft is another example showing how technologies can transform the market by creating more affordable aircraft with greatly reduced operating cost profiles, while also greatly increasing the environmental sustainability profile.

Furthermore, technological innovation facilitates the development of new products and services, opening up new revenue opportunities. The proliferation of commercial space activities, driven by advancements in rocketry and satellite technology, has created a burgeoning market for satellite launch services, data analytics, and space tourism. Companies that successfully develop and commercialize these innovative technologies are positioned to capture a significant share of this rapidly growing market, enhancing their financial returns. An example is reusable rocket technology development, which substantially decreased cost to space and in doing so, increased the economic incentive for space programs. These innovations do not happen by accident – they are built by specific teams with specific goals and they come with a wide range of different tradeoffs.

In conclusion, technological advancements are not merely a desirable attribute but a fundamental prerequisite for sustaining competitiveness and achieving superior financial performance within the aeronautics and space sector. The ability to innovate and develop cutting-edge technologies directly impacts the earnings-to-revenue ratio by reducing costs, enhancing performance, and creating new revenue opportunities. The sector needs to closely monitor emerging technologies and adopt strategies to take advantage of market openings. Companies that prioritize technological innovation are better positioned to thrive in this dynamic and highly competitive industry.

4. Regulatory Landscape

The regulatory landscape significantly shapes the profit margins within the aeronautics and space sector. Stringent regulations governing safety, environmental impact, and operational standards necessitate substantial investments in compliance. These regulations, imposed by national and international bodies, dictate design, manufacturing, and maintenance procedures, directly influencing cost structures. For instance, adherence to Federal Aviation Administration (FAA) standards for aircraft certification requires extensive testing and documentation, adding considerable expense. Similarly, environmental regulations concerning emissions and noise pollution compel manufacturers to invest in cleaner technologies, impacting research and development budgets and potentially increasing production costs. The regulatory landscape can also create barriers to entry, limiting competition and potentially allowing established firms to maintain higher profit margins, or alternately, regulations can increase the compliance costs for established firms while having less impact on new market entrants.

The interplay between regulatory requirements and technological innovation is a critical factor. Regulations often drive technological advancements, as companies seek innovative solutions to meet stringent standards. However, navigating the regulatory approval process for new technologies can be lengthy and expensive, creating both opportunities and challenges. For instance, the development and deployment of unmanned aerial vehicles (UAVs) are heavily regulated, requiring manufacturers to address safety concerns and operational restrictions. Compliance with these regulations necessitates investment in advanced sensor technologies, communication systems, and control algorithms, impacting the overall cost structure and, consequently, profit margins. The pace of technological innovation can outstrip the ability of regulators to adapt, creating a lag that can slow deployment.

In summary, the regulatory landscape acts as a crucial determinant of profitability within the aeronautics and space sector. Compliance costs, the influence on technological innovation, and barriers to market entry all shape the financial performance of companies operating in this industry. Adapting to evolving regulatory requirements and proactively engaging with regulatory bodies are essential strategies for maintaining and enhancing earnings. Navigating this complex environment requires a thorough understanding of applicable regulations, a commitment to compliance, and a proactive approach to engaging with regulatory authorities to shape future standards, allowing for a proactive approach to regulations, which improves the firm’s ability to navigate this environment.

5. Global Competition

Global competition exerts a significant influence on the earnings-to-revenue ratio within the aeronautics and space sector. The dynamics of international markets, characterized by diverse competitive landscapes and evolving economic conditions, directly affect pricing strategies, market share, and overall profitability. Understanding the intricacies of this competition is therefore essential for firms seeking to maintain or improve financial performance.

- Price Pressures from Emerging Markets

The emergence of aerospace industries in developing countries, such as China and India, introduces significant price pressures. These new market entrants, often benefiting from lower labor costs and government subsidies, can offer products and services at competitive prices. Established aerospace companies must respond by reducing costs, enhancing product differentiation, or focusing on specialized market segments to maintain their earnings-to-revenue ratio. The ability to innovate and offer superior value becomes critical in mitigating the impact of lower-priced alternatives.

- Competition for Skilled Labor and Resources

The global aerospace sector faces intense competition for skilled engineers, technicians, and scientists. Companies must invest in training, recruitment, and retention programs to attract and retain top talent, impacting labor costs and overall profitability. Similarly, competition for scarce resources, such as rare earth minerals used in aerospace components, can drive up material costs and erode earnings-to-revenue ratio. Secure access to these resources and efficient supply chain management become essential competitive advantages.

- Government Subsidies and Trade Policies

Government subsidies and trade policies play a pivotal role in shaping the competitive landscape. Government support for domestic aerospace industries, in the form of direct subsidies, tax incentives, and research funding, can provide a competitive advantage. Trade policies, such as tariffs and quotas, can also influence market access and pricing strategies. Aerospace companies must navigate these complex policy environments and advocate for fair trade practices to ensure a level playing field and protect their profit margins. Legal and political environments play a key role in the survival of companies competing in a global market.

- Technological Leapfrogging

Global competition fosters rapid technological innovation, as companies strive to gain a competitive edge. The ability to “leapfrog” competitors by developing and deploying disruptive technologies can lead to significant market share gains and improved earnings. However, the cost of research and development, as well as the risk of technological obsolescence, can also impact profitability. Continuous monitoring of technological trends and strategic investment in innovation are essential for long-term success. Copycat or reverse engineering practices by competitors can cut into the innovative firm’s profits.

These facets of global competition collectively shape the dynamics of the aeronautics and space sector, directly impacting the earnings-to-revenue ratio. The ability to navigate these complexities, adapt to evolving market conditions, and maintain a competitive edge through innovation and efficiency is critical for firms seeking to achieve sustainable financial performance.

6. Supply Chain Resilience

The aeronautics and space sector relies on intricate global supply chains, the stability of which directly influences profitability. Supply chain resilience, defined as the ability to anticipate, withstand, and recover from disruptions, is not merely an operational consideration; it is a critical determinant of the financial performance of companies operating in this industry. Disruptions, whether stemming from geopolitical instability, natural disasters, or supplier bankruptcies, can lead to production delays, increased costs, and ultimately, erosion of profit margins. A resilient supply chain minimizes these disruptions, ensuring consistent production and on-time delivery, factors that are essential for maintaining revenue and customer satisfaction. As an example, Boeing’s struggles with its 787 Dreamliner program, partly attributable to supply chain challenges, resulted in significant delays and cost overruns, negatively impacting its bottom line. This illustrates the direct link between supply chain vulnerabilities and financial outcomes in the aerospace industry.

The components of a resilient supply chain in the aeronautics and space sector extend beyond simple diversification of suppliers. It involves proactive risk assessment, robust inventory management, and the establishment of strong, collaborative relationships with key suppliers. Companies must invest in technology to monitor supply chain performance, identify potential vulnerabilities, and implement contingency plans. For example, predictive analytics can be used to forecast potential disruptions based on historical data and real-time monitoring of geopolitical and economic conditions. Furthermore, strategic partnerships with suppliers, characterized by transparency and shared risk management, can enhance responsiveness to unforeseen events. The utilization of alternative manufacturing processes, like additive manufacturing, to alleviate reliance on specific suppliers or regions can also bolster resilience. Rolls-Royce, for instance, has invested in additive manufacturing to produce certain engine components internally, reducing its dependence on external suppliers and mitigating supply chain risks.

In conclusion, supply chain resilience is an indispensable element in safeguarding profit margins within the aeronautics and space sector. The intricate and globalized nature of these supply chains necessitates a proactive and comprehensive approach to risk management. By investing in advanced technologies, fostering strong supplier relationships, and implementing robust contingency plans, companies can minimize the impact of disruptions and maintain consistent production, thereby protecting their financial performance. The understanding and implementation of these principles are no longer optional but are essential for companies seeking to thrive in this competitive and dynamic industry.

Frequently Asked Questions About Profit Margins in the Aerospace Industry

The following addresses common inquiries regarding financial returns within the aeronautics and space sector, providing concise and authoritative responses based on industry standards and practices.

Question 1: What constitutes a “healthy” profit margin for companies within the aerospace industry?

A healthy financial return is highly dependent on the specific segment of the industry (e.g., commercial aviation, defense contracting, space exploration) and prevailing economic conditions. However, generally, a financial return exceeding 10% is considered indicative of strong performance, while values below 5% may signal potential financial challenges.

Question 2: Which factors have the most significant impact on these margins?

Several key factors exert considerable influence, including fluctuations in demand for aircraft and space-related products, technological advancements that drive cost reductions or performance enhancements, the regulatory landscape governing safety and environmental standards, global competition, and supply chain resilience in the face of disruptions.

Question 3: How does government regulation affect the profitability of companies in this sector?

Government regulations, particularly those related to safety, environmental protection, and export controls, necessitate substantial compliance costs, influencing product design, manufacturing processes, and operational procedures. While compliance can increase expenses, adherence to these standards is crucial for maintaining market access and avoiding penalties.

Question 4: What strategies can companies employ to improve their earnings-to-revenue ratio?

Strategies include optimizing supply chain management to reduce costs, investing in research and development to enhance product differentiation and performance, implementing lean manufacturing principles to improve operational efficiency, and strategically managing pricing to capture maximum value.

Question 5: How does global competition impact profit margins?

Global competition introduces price pressures from emerging markets, intensifies the competition for skilled labor and resources, and necessitates continuous innovation to maintain a competitive edge. Companies must adapt to these challenges by reducing costs, differentiating their products, and leveraging technological advancements.

Question 6: What role does supply chain resilience play in maintaining or improving profit margins?

Supply chain resilience is essential for mitigating disruptions that can lead to production delays, increased costs, and lost revenue. A robust supply chain, characterized by diversified suppliers, proactive risk management, and strong supplier relationships, ensures consistent production and on-time delivery, thereby safeguarding earnings.

Understanding these factors and strategies is crucial for stakeholders seeking to analyze and improve financial performance within the aeronautics and space sector. A holistic approach that considers both internal and external influences is essential for navigating this complex and dynamic industry.

The subsequent sections will delve deeper into specific strategies for maximizing profitability in the aerospace industry.

Conclusion

This exploration has examined the factors influencing the financial returns within the aeronautics and space sector. Key determinants include market dynamics, operational efficiency, technological advancements, the regulatory landscape, global competition, and supply chain resilience. Each element exerts a distinct impact on revenue generation and cost management, collectively shaping the profitability of aerospace enterprises.

Effective navigation of these complex dynamics is critical for sustainable financial performance. Businesses are encouraged to implement strategic adaptations, foster innovation, and maintain a proactive approach to risk management. The continued health and competitiveness of the aeronautics and space sector depend on informed decision-making and a commitment to excellence in all aspects of operation.