Shares representing ownership in a corporation focused on aerospace endeavors, specifically those characterized by ambitious undertakings or innovative technologies, can be referred to using a descriptive phrase. These equities provide investors with a stake in the financial performance of the aerospace company’s operations. For example, investment portfolios might include holdings of these shares as a means of participating in the potential growth of the aerospace sector.

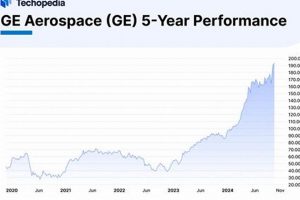

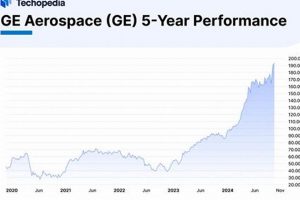

Investment in such securities presents both opportunities and risks. The potential benefits include capital appreciation resulting from successful ventures and technological advancements within the corporation. The historical performance of related companies and the overall trajectory of the aerospace industry are crucial factors to consider. However, inherent volatility within the stock market and the complexities of aerospace projects necessitate a thorough understanding of the associated financial risks.

The subsequent analysis will delve into specific aspects of the company’s financial standing, its competitive positioning within the aerospace market, and prevailing economic conditions that may influence the value of these investment instruments. Further examination will also cover regulatory frameworks and technological advancements affecting its future prospects.

Guidance on Evaluating Aerospace Equities

The following points are offered as informational guidance to those considering investment in securities of aerospace companies known for innovation and ambitious projects. These tips emphasize due diligence and a thorough understanding of inherent risks.

Tip 1: Conduct Comprehensive Financial Analysis: Scrutinize the company’s financial statements, including balance sheets, income statements, and cash flow statements. Evaluate key financial ratios such as debt-to-equity, price-to-earnings, and return on equity to assess financial health and performance.

Tip 2: Assess Technological Innovation: Analyze the company’s research and development investments, patent portfolio, and technological capabilities. Understand the competitive landscape regarding existing and emerging technologies within the aerospace sector.

Tip 3: Evaluate Project Pipeline and Contractual Obligations: Thoroughly review the company’s current projects, backlog of orders, and contractual agreements. Assess the risks associated with project delays, cost overruns, and contract cancellations.

Tip 4: Monitor Regulatory Environment: Stay informed about relevant government regulations, industry standards, and export controls impacting the aerospace industry. Understand the potential implications of regulatory changes on the company’s operations.

Tip 5: Consider Macroeconomic Factors: Analyze macroeconomic trends, including interest rates, inflation, and geopolitical events. Understand how these factors can impact the overall aerospace market and the company’s performance.

Tip 6: Evaluate Management Team: Assess the experience, track record, and strategic vision of the company’s leadership team. A capable and experienced management team is crucial for navigating the challenges of the aerospace industry.

Tip 7: Diversify Investment Portfolio: Reduce overall risk by diversifying investments across different sectors and asset classes. Avoid placing an excessive concentration of capital in any single aerospace company or industry.

Careful evaluation of financial data, technological capabilities, project pipelines, the regulatory climate, and macroeconomic trends, alongside a strong understanding of company management, are crucial for prudent investment decision-making within this sector. Diversification is vital for mitigating risk.

The subsequent discussion will broaden to encompass a conclusion summarizing key insights regarding these aerospace investments.

1. Growth Potential

The connection between growth potential and equities in aerospace companies pursuing innovative or ambitious projects is a fundamental driver of investment interest. The perceived capacity for future expansion and increased profitability directly influences the valuation and desirability of these shares. This potential arises from several factors, including the successful development and deployment of new technologies, the acquisition of lucrative contracts with government or private entities, and the expansion into new markets or service offerings. For example, a company successfully developing a more efficient satellite launch system might exhibit significant growth potential, attracting investors anticipating higher future earnings.

Growth potential also encompasses the effective monetization of intellectual property, the ability to secure favorable financing terms, and the cultivation of strategic partnerships. Companies that secure significant government defense contracts will likely see increases due to higher revenue projections. Investors typically evaluate various indicators like the growth in backlog orders, the rate of revenue increase, and the projected market share gains to assess this potential. These factors directly affect the attractiveness and value of shares.

Understanding the growth potential tied to aerospace shares helps investors and analysts focus on key performance indicators and make better informed investment decisions. While there are always inherent risks and market fluctuations that can potentially impede growth in general, the connection to financial performance ensures that investors prioritize companies with strong potential. In conclusion, assessing the growth factors tied to aerospace ventures is important for both evaluating current market standing and projecting long-term valuation.

2. Technological Innovation

Technological innovation serves as a critical determinant of value for equities in aerospace companies undertaking ambitious projects. It drives competitive advantage, market share, and ultimately, investor returns. The ability to develop and deploy novel technologies is often directly linked to the perceived and actual performance of these shares.

- Advanced Materials Development

The creation and application of new materials with improved strength-to-weight ratios, thermal resistance, and durability are pivotal in aerospace engineering. Companies pioneering these materials, such as advanced composites or alloys, can achieve significant performance gains in aircraft and spacecraft. This translates to increased fuel efficiency, payload capacity, and operational lifespan, thereby enhancing the value of their equities.

- Autonomous Systems and Robotics

Investment in autonomous systems and robotics offers the potential to reduce operational costs, improve safety, and enable new capabilities in space exploration and air travel. Companies developing autonomous drones, robotic manufacturing processes, or self-navigating spacecraft stand to gain a competitive edge. Success in these areas contributes directly to market perception of ingenuity and the potential for profit, driving demand for the shares.

- Propulsion Systems Advancement

Innovation in propulsion systems, including electric propulsion, hypersonic engines, and advanced rocket technology, is crucial for unlocking new possibilities in space access and high-speed flight. Companies pioneering these technologies can revolutionize transportation and potentially disrupt existing markets. Breakthroughs in propulsion directly impact operational capabilities and fuel costs, factors considered favorable by many investors.

- Digitalization and Data Analytics

The effective application of digitalization and data analytics to aerospace operations can improve efficiency, optimize performance, and enable predictive maintenance. Companies that effectively leverage data to improve aircraft design, optimize flight routes, or predict equipment failures are likely to see cost savings and efficiency gains. The implementation of data-driven solutions to improve design is an example of this innovation.

The interplay between technological advancements and the valuation of these equities is evident in the market’s response to new product launches, patent filings, and research and development spending announcements. Investors analyze these indicators to gauge a company’s commitment to innovation and its potential to generate future revenue streams. The ability to translate technological breakthroughs into tangible market advantages ultimately determines the long-term value and appeal of these aerospace shares.

3. Market Volatility

Market volatility represents a significant factor influencing the investment landscape for equities in aerospace companies engaged in ambitious projects. The inherent uncertainties associated with technological advancements, regulatory approvals, and geopolitical events contribute to fluctuations in stock prices. Understanding these fluctuations is crucial for investors navigating the investment decisions.

- Geopolitical Instability

Global political events, such as international conflicts, trade disputes, and shifts in government policies, can significantly impact aerospace equities. For example, increased tensions between nations may lead to higher defense spending, benefiting companies involved in military aerospace programs. Conversely, trade restrictions or sanctions can disrupt supply chains and limit market access, negatively affecting stock performance. The volatility here comes from the unpredictability of these events.

- Technological Uncertainty

The aerospace sector relies heavily on technological innovation, and companies pursuing ambitious projects face the risk of technical failures, delays, or obsolescence. For example, a company developing a new propulsion system may encounter unforeseen engineering challenges, leading to project setbacks and investor disappointment. This uncertainty can trigger significant price swings in the company’s stock.

- Economic Cycles

Aerospace companies, especially those involved in commercial aviation, are sensitive to economic cycles. During economic downturns, demand for air travel and new aircraft orders typically declines, impacting revenue and profitability. Investors may react by selling off aerospace shares, contributing to increased volatility. The cyclical nature of the global economy introduces a degree of instability to these equities.

- Regulatory Changes

The aerospace industry is subject to stringent regulations related to safety, environmental standards, and export controls. Changes in these regulations can have a material impact on aerospace companies, requiring them to invest in new technologies, modify their operations, or face penalties. For example, stricter emissions standards may force companies to develop more fuel-efficient aircraft, potentially increasing costs and affecting stock prices. The ever-evolving regulatory environment adds a layer of uncertainty.

These factors contribute to the overall volatility of investments and underscore the need for thorough due diligence and risk management strategies when considering investments in aerospace equities. The combined effect of geopolitical, technological, economic, and regulatory uncertainties can lead to unpredictable fluctuations in stock valuations.

4. Financial Performance

Financial performance serves as a critical indicator of the investment viability and overall health of aerospace companies, particularly those involved in innovative endeavors. It provides essential data for evaluating the potential returns and risks associated with related equities. Consistent financial health is usually a signal to long term sustainability.

- Revenue Generation and Growth

Revenue generation, reflecting sales of aerospace products and services, directly impacts the valuation. Consistent revenue growth indicates sustained demand and effective market penetration, which are positive signals for investors. For example, a company securing a significant government contract would likely experience an increase in projected revenue, positively affecting its stock price. Declining revenue trends may suggest market challenges or competitive pressures, leading to diminished investor confidence.

- Profitability and Margins

Profitability, measured by metrics such as net profit margin and return on equity, reflects the efficiency with which a company converts revenue into profits. Higher profit margins indicate strong cost control and operational efficiency, making its equities more attractive. For instance, an aerospace company that successfully implements lean manufacturing processes may improve its profit margins, enhancing shareholder value. Conversely, declining margins could indicate rising costs or pricing pressures, signaling a potential red flag for investors.

- Cash Flow Management

Effective cash flow management is crucial for sustaining operations and funding future growth initiatives. Strong cash flow from operations indicates a company’s ability to generate sufficient funds to meet its financial obligations and invest in research and development. Companies with poor cash flow may need to rely on debt financing, increasing their financial risk. Positive cash flow, in other words, allows investors to feel confident about the longevity of the investment.

- Debt Levels and Financial Leverage

The level of debt and financial leverage employed by an aerospace company can significantly influence its financial stability and risk profile. High debt levels may increase the company’s vulnerability to economic downturns and interest rate fluctuations. Conversely, conservative debt management can provide financial flexibility and resilience. Investors closely monitor debt-to-equity ratios and interest coverage ratios to assess a company’s financial health and ability to manage its debt obligations. Companies with manageable levels of debt usually signal long-term health and sustainability.

Overall, evaluating these components of financial performance provides vital insights into investment decisions. Companies with increasing revenue, high profit margins, and strong cash flows demonstrate the financial stability needed to sustain ambitious project undertakings. Investors would do well to monitor these key figures for effective portfolio management.

5. Regulatory Scrutiny

Regulatory scrutiny exerts a significant influence on the valuation and operational dynamics of aerospace companies, particularly those engaged in innovative or ambitious ventures. These regulations often govern safety standards, environmental impact, export controls, and government contracts, creating a complex landscape for investment in related equities. Adherence to these regulations is crucial for maintaining operational licenses and securing government contracts, which directly impact a company’s financial performance and investor confidence.

- Safety and Airworthiness Standards

Regulatory bodies impose stringent safety and airworthiness standards to ensure the safety of passengers and the public. These standards cover various aspects of aircraft design, manufacturing, and maintenance. Compliance with these standards requires significant investment in testing, certification, and quality control processes. Companies failing to meet these standards face potential penalties, grounding of aircraft, and reputational damage, all of which can negatively impact stock performance. For instance, the FAA imposes regulations that require stringent safety protocols.

- Environmental Regulations and Emissions Standards

Environmental regulations, particularly those related to emissions and noise pollution, are becoming increasingly stringent in the aerospace industry. Companies must invest in developing more fuel-efficient engines, reducing noise levels, and minimizing their environmental footprint. Non-compliance with these regulations can lead to fines, restrictions on operations, and reputational harm. For example, international agreements to reduce carbon emissions from aviation are driving innovation in sustainable aviation technologies, potentially impacting long-term profitability.

- Export Controls and National Security Concerns

The aerospace industry is subject to strict export controls and regulations related to national security. These regulations govern the transfer of technology and equipment to foreign countries, particularly those deemed to pose a security risk. Companies must comply with these regulations to avoid penalties, restrictions on exports, and reputational damage. Government regulations like the International Traffic in Arms Regulations (ITAR) in the U.S. may limit international collaboration.

- Government Contracting Regulations and Procurement Processes

Aerospace companies that rely on government contracts are subject to specific regulations and procurement processes. These regulations govern bidding procedures, contract terms, and performance standards. Compliance with these regulations is essential for securing government contracts, which often represent a significant portion of a company’s revenue. Changes in government spending priorities or procurement policies can significantly impact the financial performance of these companies. For instance, companies must follow the regulations outlined in the Federal Acquisition Regulation (FAR) to be eligible for government contracts.

Overall, the degree of regulatory compliance influences the valuations. Navigating this complex landscape requires expertise in regulatory affairs and a commitment to ethical business practices. Companies that effectively manage these regulatory challenges are more likely to maintain investor confidence and achieve long-term success.

6. Geopolitical Risks

Geopolitical risks represent a significant and dynamic influence on equities in aerospace companies that pursue ambitious projects. The inherent global nature of the aerospace industry, coupled with the often-strategic importance of its technologies and products, exposes these companies to a range of geopolitical uncertainties. These uncertainties can significantly impact operational capabilities, market access, and investor sentiment, thereby affecting the valuation and stability of related shares.

- International Conflicts and Security Threats

Armed conflicts, regional instabilities, and terrorist threats can disrupt supply chains, damage infrastructure, and increase security costs for aerospace companies. Companies involved in defense contracting may see increased demand during periods of heightened geopolitical tension, but they also face increased risks of operational disruptions and political backlash. For example, sanctions imposed on certain countries may limit the ability of aerospace companies to sell or service their products in those markets, directly affecting revenue streams and shareholder value. Investment decisions should take into account regions of instability.

- Trade Wars and Economic Sanctions

Trade disputes and economic sanctions imposed by governments can disrupt international trade flows and create barriers to market access. Aerospace companies that rely on global supply chains or export their products to sanctioned countries may experience significant financial losses. For example, tariffs imposed on imported aerospace components can increase production costs and reduce competitiveness. Changes to governmental structure and stability in a region will likely affect performance.

- Changes in Government Policies and Regulations

Shifts in government policies, such as changes in defense spending priorities, export control regulations, or investment restrictions, can have a significant impact on aerospace companies. For example, a decision by a government to reduce its military budget may lead to decreased demand for defense-related products and services, negatively affecting the stock prices of companies involved in that sector. Similarly, stricter export control regulations may limit the ability of companies to sell certain technologies to foreign customers. Government policy represents an essential consideration.

- Resource Scarcity and Geopolitical Competition

Competition for scarce resources, such as rare earth minerals used in aerospace manufacturing, can create geopolitical tensions and disruptions to supply chains. Countries that control access to these resources may use their leverage to exert political influence or impose trade restrictions. Aerospace companies that rely on these resources must carefully manage their supply chains and diversify their sources to mitigate the risk of disruptions. Investors should monitor geopolitical factors related to resource control and distribution, with consideration of its effects on industries.

In conclusion, the complex interplay between geopolitical forces and the aerospace sector necessitates a thorough understanding of these factors for informed investment decisions. The global footprint and strategic importance of aerospace companies make them particularly vulnerable to geopolitical risks, requiring investors to carefully assess the potential impact of these risks on company performance and shareholder value. Effective risk management strategies, including diversification, supply chain resilience, and political risk insurance, are essential for mitigating the adverse effects of geopolitical instability on these aerospace ventures.

Frequently Asked Questions

The following questions and answers address common inquiries regarding factors relevant to assessing equities of aerospace entities pursuing ambitious or innovative projects. The focus remains on providing objective information for potential investors.

Question 1: What key financial metrics should be evaluated when considering an investment in pursuit aerospace stock?

Critical metrics include revenue growth, profitability margins (gross and net), cash flow from operations, debt-to-equity ratio, and return on invested capital. These metrics provide insights into the financial health and operational efficiency of the company.

Question 2: How does technological innovation impact the valuation of pursuit aerospace stock?

Technological advancements significantly influence market perception and the long-term growth potential. A company demonstrating leadership in areas such as advanced materials, autonomous systems, or propulsion technologies may command a premium valuation due to its perceived competitive advantage.

Question 3: What are the primary geopolitical risks associated with investing in pursuit aerospace stock?

Geopolitical risks encompass international conflicts, trade disputes, changes in government regulations, and resource scarcity. These factors can disrupt supply chains, limit market access, and impact the financial performance of aerospace companies. Monitoring geopolitical stability is essential when considering an investment in related companies.

Question 4: How does regulatory scrutiny affect aerospace enterprises?

Stringent regulations governing safety, environmental standards, export controls, and government contracts add complexity to operations. Companies must navigate these complexities to maintain operational licenses and secure government contracts. Increased expenses for compliance can impact financial performance.

Question 5: Is market volatility a significant concern for pursuit aerospace stock investments?

The aerospace sector is subject to market volatility influenced by economic cycles, technological uncertainties, and geopolitical events. The inherently long development cycles and capital-intensive nature of aerospace projects can contribute to pronounced price swings.

Question 6: How can investors mitigate risks associated with investing in pursuit aerospace stock?

Diversification of investment portfolios, comprehensive due diligence, and continuous monitoring of financial performance, technological developments, regulatory changes, and geopolitical events are essential risk mitigation strategies.

Careful consideration of these factors allows for more informed decisions.

The succeeding section presents concluding statements encompassing principal observations regarding prospective investments within the aerospace sphere.

Conclusion

The analysis has illuminated critical factors influencing investment decisions related to pursuit aerospace stock. Understanding the complexities of financial performance, technological innovation, regulatory scrutiny, geopolitical risks, and inherent market volatility is paramount for informed investment choices. Companies characterized by strong financials, technological leadership, and effective risk management are generally positioned for long-term success. However, the inherent uncertainties within the aerospace sector necessitate careful evaluation and a strategic approach to investment.

The future trajectory of pursuit aerospace stock remains dependent on various interrelated factors. Continuous technological advancements, shifts in geopolitical landscapes, and evolving regulatory frameworks will undoubtedly shape the investment outlook. Vigilant monitoring of these elements, coupled with a thorough comprehension of the aerospace industry’s unique dynamics, is essential for investors seeking to navigate this complex and evolving investment landscape. It is prudent to consult with qualified financial professionals before making any investment decisions.