The leading entities within the aircraft and spacecraft manufacturing industry, often ranked based on revenue, innovation, and market share, play a pivotal role in global technological advancement. These organizations are instrumental in the design, development, and production of a wide array of products, ranging from commercial aircraft and defense systems to satellites and space exploration vehicles. Their operations encompass a broad spectrum of activities, including research and development, engineering, manufacturing, and service provision.

The significance of these dominant organizations extends beyond mere economic output. They are significant contributors to technological progress, pushing the boundaries of engineering and materials science. Historically, their innovations have spurred advancements across diverse sectors, influencing fields such as transportation, communication, and national security. Furthermore, they represent major employers, offering high-skilled jobs and fostering economic growth within their respective regions.

Subsequent discussion will elaborate on the specific factors contributing to the prominence of these industry leaders, examining their core competencies, strategic initiatives, and impact on the broader aerospace ecosystem. This analysis will provide a deeper understanding of their continued success and influence within a dynamic and competitive global market.

Strategic Insights from Industry Leaders

The following points encapsulate best practices observed within prominent organizations in the aerospace sector. These insights address key operational areas and are intended to provide a framework for improving efficiency, innovation, and overall competitiveness.

Tip 1: Emphasize Research and Development Investment: A consistent allocation of resources towards fundamental research and technological advancements is critical. This ensures a sustained competitive edge and the ability to adapt to evolving market demands. For example, significant investment in composite materials research can lead to lighter, more fuel-efficient aircraft.

Tip 2: Prioritize Engineering Excellence: Meticulous design and rigorous testing procedures are paramount. A commitment to exceeding industry standards in product performance and reliability builds trust and strengthens brand reputation. Detailed simulations and extensive flight testing are essential components of this process.

Tip 3: Foster Strategic Partnerships: Collaborative relationships with suppliers, research institutions, and other industry stakeholders can facilitate knowledge sharing and resource optimization. Joint ventures on complex projects allow for the pooling of expertise and risk mitigation.

Tip 4: Implement Robust Supply Chain Management: Efficient and resilient supply chains are essential for ensuring timely delivery and cost-effectiveness. Diversification of suppliers and implementation of advanced inventory management systems are key elements.

Tip 5: Invest in Talent Development: Attracting and retaining highly skilled engineers, scientists, and technicians is crucial for driving innovation. Comprehensive training programs and opportunities for professional growth are essential components of a successful talent management strategy.

Tip 6: Maintain a Focus on Sustainability: Developing environmentally friendly technologies and minimizing the environmental impact of operations are increasingly important considerations. Investments in alternative fuels and energy-efficient manufacturing processes demonstrate a commitment to corporate social responsibility.

Tip 7: Cultivate a Culture of Continuous Improvement: Embrace Lean methodologies and other process improvement techniques to enhance efficiency and reduce waste. Regular audits and feedback mechanisms can identify areas for optimization.

These insights represent fundamental principles that contribute to the success and longevity of leading aerospace entities. Adherence to these guidelines fosters innovation, operational excellence, and sustainable growth within a highly competitive environment.

The subsequent sections will address emerging challenges and opportunities facing the aerospace industry, including the increasing demand for sustainable aviation solutions and the integration of artificial intelligence into aerospace systems.

1. Revenue Generation

Within the aerospace sector, revenue generation serves as a fundamental indicator of a company’s success, stability, and capacity for future growth. For the top ten entities, consistent and substantial revenue streams enable critical investments in research and development, infrastructure expansion, and talent acquisition, thereby solidifying their positions as industry leaders.

- Government Contracts and Defense Spending

A significant portion of revenue for major aerospace companies stems from government contracts related to defense and national security. These contracts, often multi-year and substantial in value, provide a stable revenue base, allowing for long-term planning and investment in advanced technologies. Examples include contracts for military aircraft, missile systems, and satellite programs. Fluctuations in government spending and geopolitical events can significantly impact this revenue stream.

- Commercial Aviation Sales and Services

The sale of commercial aircraft to airlines constitutes a major revenue source. Furthermore, aftermarket services, including maintenance, repair, and overhaul (MRO), generate recurring revenue throughout the lifespan of the aircraft. Factors such as airline profitability, fuel prices, and global economic conditions influence the demand for new aircraft and MRO services. The introduction of new aircraft models with improved fuel efficiency and passenger capacity also drives sales.

- Space Exploration and Satellite Technologies

Increasingly, space exploration and the development of satellite technologies contribute significantly to revenue generation. Contracts related to satellite launch services, satellite manufacturing, and space-based communication systems are becoming increasingly lucrative. The growing demand for broadband internet access, Earth observation data, and space-based research is fueling growth in this segment. The emergence of private space companies is introducing new business models and competition.

- Diversification and Strategic Acquisitions

Many prominent aerospace companies actively pursue diversification strategies to mitigate risks and expand their revenue streams. This may involve entering new markets, such as cybersecurity or data analytics, or acquiring companies with complementary capabilities. Strategic acquisitions allow for the integration of new technologies and expertise, enhancing the overall competitiveness and revenue potential of the organization.

The ability to consistently generate substantial revenue enables the top ten aerospace companies to maintain their leadership positions, innovate, and adapt to evolving market dynamics. A diversified revenue portfolio, coupled with strategic investments and acquisitions, contributes to long-term stability and sustainable growth within this highly competitive industry.

2. Technological Innovation

Technological innovation forms the bedrock upon which the preeminence of the top ten aerospace companies is built. These organizations invest heavily in research and development, recognizing that sustained leadership within the sector necessitates a continuous stream of groundbreaking advancements. A direct correlation exists: consistent innovation leads to improved products and services, enhanced operational efficiencies, and a resultant competitive advantage. Absent this commitment to pushing technological boundaries, sustained dominance is untenable. Examples abound; consider the development of composite materials, pioneered by entities within this group. These materials, lighter and stronger than traditional alloys, enable the creation of more fuel-efficient and high-performing aircraft, directly impacting airlines’ operational costs and environmental footprint.

The practical significance of understanding this connection lies in the ability to predict future trends and anticipate market disruptions. Companies that proactively invest in emerging technologies, such as advanced propulsion systems, autonomous flight capabilities, and advanced sensors, are better positioned to capitalize on new opportunities and navigate evolving industry landscapes. For example, research into electric propulsion, while still in its nascent stages for large commercial aircraft, represents a potentially transformative shift, with implications for noise reduction, emissions reduction, and overall operational costs. Firms actively involved in this area are gaining a strategic advantage, not just for future markets, but also by attracting talent and securing partnerships.

In summary, technological innovation is not merely an ancillary activity for the top ten aerospace companies; it is an existential imperative. The ability to generate, adapt, and integrate new technologies directly correlates with market share, profitability, and long-term sustainability. While challenges exist in managing the risks associated with ambitious research and development projects, the potential rewards far outweigh the costs, solidifying the position of these organizations as the driving forces behind aerospace progress.

3. Market Capitalization

Market capitalization, a measure of a company’s total value as determined by the stock market, serves as a crucial indicator of investor confidence and overall financial health for the leading aerospace entities. It reflects the collective perception of a company’s future prospects, incorporating elements such as revenue, profitability, growth potential, and competitive positioning. For the top ten aerospace companies, a robust market capitalization provides access to capital markets, facilitates strategic acquisitions, and enhances brand reputation.

- Investor Confidence and Growth Expectations

A high market capitalization signals strong investor confidence in a company’s management, strategy, and future earnings potential. This confidence translates into greater access to capital for investment in research and development, facility expansion, and talent acquisition. For example, a company announcing a major contract win might experience a surge in market capitalization as investors anticipate increased revenue and profitability. Conversely, setbacks in product development or regulatory challenges can lead to a decline in market capitalization.

- Acquisition Currency and Strategic Flexibility

A strong market capitalization provides a company with greater flexibility in pursuing strategic acquisitions. A company with a high market capitalization can use its stock as currency to acquire other companies, integrating new technologies, expanding market share, and diversifying its product portfolio. Companies with lower market capitalizations may face limitations in their ability to pursue such opportunities. The merger and acquisition landscape within the aerospace sector is often influenced by the relative market capitalizations of the participating companies.

- Brand Reputation and Talent Attraction

Market capitalization serves as a tangible measure of a company’s standing within the industry, influencing its brand reputation and ability to attract top talent. A high market capitalization signals stability, success, and growth potential, making the company more appealing to prospective employees. Skilled engineers, scientists, and managers are more likely to seek employment with companies that demonstrate financial strength and a clear path to future success. Furthermore, a strong brand reputation enhances a company’s ability to secure partnerships and attract customers.

- Benchmarking and Performance Evaluation

Market capitalization provides a valuable benchmark for evaluating a company’s performance relative to its peers. Investors and analysts routinely compare the market capitalizations of different aerospace companies to assess their relative strengths and weaknesses. This benchmarking process can reveal insights into a company’s operational efficiency, technological innovation, and strategic positioning. Companies that consistently outperform their peers in terms of market capitalization are often viewed as industry leaders and innovators.

In conclusion, market capitalization functions as a critical barometer of success and influence within the aerospace sector. It directly impacts a company’s ability to access capital, pursue strategic initiatives, attract talent, and maintain its competitive edge. The top ten aerospace companies recognize the importance of managing and maximizing their market capitalization, understanding that it is not merely a financial metric but a reflection of their overall value and future prospects.

4. Global Presence

Global presence constitutes a fundamental characteristic of the leading aerospace entities, reflecting their operational scope, market reach, and strategic partnerships across international boundaries. This expansive footprint is not merely a matter of geographical distribution; it is a strategic imperative for sustaining competitiveness, fostering innovation, and mitigating risks in a dynamic and interconnected global marketplace.

- International Manufacturing and Assembly Facilities

Establishment of manufacturing and assembly facilities in diverse locations enables the top ten aerospace companies to optimize production costs, access regional markets, and comply with local regulations. Examples include aircraft assembly plants in countries with favorable labor costs and strategic partnerships with foreign aerospace firms to co-produce aircraft components. This distributed manufacturing model necessitates sophisticated supply chain management and quality control systems to ensure consistent standards across all locations.

- Strategic Alliances and Joint Ventures

Collaboration with international partners through strategic alliances and joint ventures provides access to specialized expertise, shared resources, and expanded market opportunities. These partnerships may involve co-development of new technologies, joint marketing initiatives, or collaborative bidding on large-scale projects. For instance, a leading aerospace company might partner with a foreign research institution to advance the development of sustainable aviation fuels or form a joint venture with a local manufacturer to produce aircraft components for the regional market.

- Global Supply Chain Networks

The top ten aerospace companies rely on intricate global supply chain networks to source components, materials, and services from suppliers around the world. This diversification of the supply base reduces dependence on any single supplier, mitigating risks associated with disruptions due to geopolitical events, natural disasters, or economic instability. Effective management of these complex supply chains requires sophisticated logistics, inventory management, and quality control systems to ensure timely delivery and adherence to stringent standards.

- International Sales and Marketing Operations

A strong global presence necessitates robust sales and marketing operations to cultivate relationships with customers in diverse markets. This involves establishing regional sales offices, participating in international trade shows, and tailoring marketing campaigns to meet the specific needs of different customer segments. Understanding the cultural nuances, regulatory frameworks, and competitive dynamics of each market is essential for success. Furthermore, providing localized support and service capabilities enhances customer satisfaction and strengthens brand loyalty.

In summary, global presence is not simply a geographic expansion but a strategic imperative for the top ten aerospace companies. It encompasses a complex web of international manufacturing facilities, strategic alliances, global supply chains, and localized sales and marketing operations. These elements collectively contribute to enhanced competitiveness, innovation, and resilience in an increasingly interconnected global aerospace industry.

5. Research Investment

A direct correlation exists between research investment and the composition of the entities recognized within the ‘top ten aerospace companies.’ Sustained leadership in this sector necessitates continuous advancement in areas such as propulsion systems, materials science, and autonomous navigation. Companies that prioritize research investment consistently demonstrate superior technological capabilities, which translate into increased market share, enhanced profitability, and, ultimately, a higher ranking within the industry.

The impact of research investment is demonstrable through numerous examples. Consider the development of fuel-efficient aircraft engines. Extensive research into turbine design and combustion technologies has enabled certain companies to produce engines that significantly reduce fuel consumption and emissions. This technological advantage not only benefits airlines but also enhances the manufacturer’s reputation and competitiveness. Similarly, investments in advanced composite materials have led to the creation of lighter, stronger aircraft structures, resulting in improved performance and reduced operating costs. These innovations are not coincidental; they are the direct result of sustained financial commitment to research and development initiatives.

Conversely, companies that neglect research investment risk obsolescence and market share erosion. The aerospace sector is characterized by rapid technological advancements, and a failure to keep pace can lead to a decline in product quality, increased costs, and loss of competitive advantage. While short-term cost-cutting measures may provide temporary financial relief, they ultimately undermine the long-term viability of the organization. Therefore, research investment should not be viewed as an optional expense but rather as a strategic imperative for maintaining a position among the top ten aerospace companies.

Frequently Asked Questions About Leading Aerospace Companies

The following section addresses common inquiries regarding the preeminent entities within the global aerospace industry, providing clarity on their operations, influence, and future trajectory.

Question 1: What criteria are typically used to rank the ‘top ten aerospace companies’?

Rankings often consider a combination of factors, including annual revenue, research and development investment, market capitalization, order backlog, technological innovation, and global presence. Different ranking methodologies may assign varying weights to these criteria, resulting in potential discrepancies across different lists.

Question 2: How do geopolitical events impact the performance of leading aerospace firms?

Geopolitical instability and shifting international relations can significantly influence defense spending, export controls, and international collaborations, all of which directly affect the revenue streams and strategic direction of major aerospace companies. Increased geopolitical tensions typically lead to higher defense budgets, benefiting companies with substantial government contracts.

Question 3: What role do government regulations play in shaping the activities of these companies?

Government regulations pertaining to safety standards, environmental compliance, and export controls exert considerable influence on the operations of aerospace companies. Strict adherence to these regulations is paramount for maintaining operational licenses and accessing international markets. Furthermore, government policies regarding research funding and procurement practices directly impact technological innovation and market competitiveness.

Question 4: How is the increasing demand for sustainable aviation impacting these firms?

The growing emphasis on environmental sustainability is prompting leading aerospace companies to invest in research and development of fuel-efficient aircraft, alternative propulsion systems, and sustainable aviation fuels. This transition requires significant capital investment and technological innovation, presenting both challenges and opportunities for industry players. Compliance with increasingly stringent environmental regulations is also a key driver of change.

Question 5: What are the primary challenges facing the aerospace industry in the coming decade?

Key challenges include managing supply chain disruptions, addressing workforce shortages, adapting to evolving regulatory landscapes, mitigating cybersecurity threats, and accelerating the development of sustainable aviation technologies. Furthermore, maintaining technological superiority in an increasingly competitive global market remains a paramount concern.

Question 6: How are emerging technologies such as artificial intelligence and autonomous systems being integrated into aerospace operations?

Artificial intelligence and autonomous systems are being increasingly integrated into various aspects of aerospace operations, including aircraft design, manufacturing processes, flight control systems, and air traffic management. These technologies offer the potential to improve efficiency, enhance safety, and reduce costs. However, ethical considerations and regulatory frameworks surrounding the deployment of autonomous systems are still under development.

In summary, understanding the multifaceted challenges and opportunities confronting the leading aerospace companies requires a holistic perspective, encompassing technological advancements, geopolitical dynamics, regulatory frameworks, and environmental considerations.

Subsequent analysis will delve into the strategies employed by these companies to navigate these complex issues and maintain their competitive edge.

Concluding Assessment

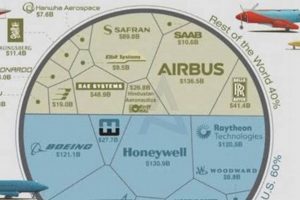

The preceding analysis has explored various facets of the entities comprising the ‘top ten aerospace companies,’ emphasizing revenue generation, technological innovation, market capitalization, global presence, and research investment as critical determinants of their prominence. These factors, when strategically managed and consistently cultivated, collectively contribute to sustained leadership within a highly competitive global market. The demonstrated ability to adapt to evolving geopolitical landscapes, stringent regulatory requirements, and the increasing demand for sustainable solutions remains paramount for these organizations.

Continued monitoring of these performance indicators and proactive engagement with emerging technological trends will be essential for stakeholders seeking to understand the future trajectory of the aerospace industry. The decisions made by these leading organizations will invariably shape the direction of technological progress, economic growth, and global security in the years to come. Understanding these dynamics is critical for informed decision-making across diverse sectors.

![Top Michigan Aerospace Companies: [Your Company] & More Innovating the Future of Flight with Reliable Aviation Solutions Top Michigan Aerospace Companies: [Your Company] & More | Innovating the Future of Flight with Reliable Aviation Solutions](https://mixaerospace.com/wp-content/uploads/2026/02/th-289-300x200.jpg)