The financial investment required to obtain advanced credentials in aeronautical and astronautical engineering is a significant consideration for prospective students. This investment encompasses tuition fees, accommodation, textbooks, and other academic expenses. The actual sum varies significantly based on the institution’s type (public or private), location, and program duration.

Understanding the cost of higher education is crucial for informed financial planning and can influence students’ decisions regarding college selection, financial aid applications, and career paths. Historically, the price of a college education has steadily increased, making it essential for students to research various funding opportunities and explore cost-effective educational strategies. This investment yields potential benefits in terms of increased earning potential, career advancement, and specialized knowledge in a rapidly evolving field.

This analysis will explore the diverse factors influencing the overall price, investigate typical expenditure ranges across different educational institutions, examine potential funding and scholarship options, and evaluate the long-term return on investment associated with pursuing a specialized career path in this demanding sector.

Financial Planning for Aerospace Engineering Education

Careful financial planning is essential when considering the pursuit of an aerospace engineering degree. The following tips offer guidance on navigating the costs associated with this field of study.

Tip 1: Research Tuition Costs Across Institutions: Investigate the tuition fees charged by various universities, both public and private. Public institutions often offer lower tuition rates for in-state residents.

Tip 2: Factor in Living Expenses: Account for accommodation, food, transportation, and personal expenses. The cost of living varies significantly depending on the location of the university.

Tip 3: Explore Scholarship Opportunities: Actively search for scholarships offered by universities, government agencies, and private organizations. Many scholarships are specifically targeted towards students pursuing STEM fields.

Tip 4: Consider Financial Aid Options: Investigate eligibility for federal and state financial aid programs, including grants and loans. Complete the Free Application for Federal Student Aid (FAFSA) to determine potential aid eligibility.

Tip 5: Evaluate Loan Repayment Strategies: Understand the terms and conditions of any student loans, including interest rates and repayment options. Explore income-driven repayment plans to manage debt effectively.

Tip 6: Investigate Co-op Programs and Internships: Participate in cooperative education programs and internships to gain practical experience and earn income while pursuing a degree.

Tip 7: Create a Detailed Budget: Develop a comprehensive budget to track income and expenses, ensuring that educational costs are managed effectively.

Proactive planning and diligent research are key to mitigating the financial burden associated with obtaining an aerospace engineering degree. Careful consideration of tuition costs, living expenses, and funding opportunities can significantly impact the overall affordability of higher education.

The subsequent sections will provide a more in-depth analysis of the return on investment and career prospects related to an aerospace engineering degree.

1. Tuition and fees

Tuition and fees constitute a primary determinant of the overall financial investment required for an aerospace engineering degree. These expenses represent the direct charges levied by educational institutions for instruction, access to facilities, and administrative services. Understanding the nuances of these costs is crucial for informed financial planning.

- Public vs. Private Institutions

Tuition rates at public universities are generally lower for in-state residents due to state government subsidies. Conversely, private universities typically have higher tuition rates, irrespective of the student’s residency status. The choice between public and private institutions can significantly impact the aggregate cost.

- Program Length and Credit Hours

The duration of the aerospace engineering program, typically four years for a bachelor’s degree, directly influences the total tuition expense. Moreover, the number of credit hours required for graduation affects the overall cost. Each credit hour incurs a fee, which varies across institutions.

- Mandatory Fees

In addition to tuition, universities often charge mandatory fees for specific services, such as access to libraries, athletic facilities, and student health services. These fees, while often smaller than tuition, contribute to the overall cost and should be factored into the budget.

- Out-of-State vs. In-State Tuition

Public universities often implement higher tuition rates for students residing outside of the state. The difference between in-state and out-of-state tuition can be substantial, potentially doubling or tripling the cost. Students should consider residency requirements and explore options for establishing in-state residency, if possible.

The aggregate of tuition and associated fees forms a considerable portion of the total expense involved in pursuing an aerospace engineering degree. Comprehensive research into institutional costs, program length, and residency requirements is essential for effective financial preparation. Moreover, exploring financial aid and scholarship opportunities can help mitigate the financial burden.

2. Living expenses

Living expenses represent a significant and often variable component of the total investment associated with an aerospace engineering degree. These expenses, encompassing housing, food, transportation, and personal necessities, are directly linked to the geographical location of the educational institution. Higher costs of living in metropolitan areas typically translate to increased expenditures for students attending universities in those regions. Conversely, institutions in more rural or suburban settings might offer comparatively lower living expenses. For instance, a student at a university in New York City or Los Angeles would likely face substantially higher accommodation costs compared to a student at a similar institution in a smaller city or town. The cumulative effect of these ongoing expenses contributes substantially to the overall financial burden of pursuing a degree.

The type of accommodation chosen by the student further influences the magnitude of living expenses. On-campus housing, while often convenient, may not always be the most economical option. Off-campus apartments or shared housing arrangements can sometimes offer lower monthly costs, although they may require additional considerations such as transportation expenses and utility bills. Dietary choices also play a role; students who frequently dine out or rely on convenience foods will likely incur higher food costs compared to those who prepare their own meals. Effective budgeting and prudent spending habits are essential for mitigating the financial impact of living expenses throughout the duration of the degree program. Many universities offer resources and workshops to assist students with financial literacy and budgeting skills, which can be invaluable in managing these expenses effectively.

In summary, living expenses are a critical factor in determining the overall cost of an aerospace engineering degree. The interplay between geographical location, accommodation choices, and personal spending habits significantly impacts the financial burden faced by students. A thorough assessment of these expenses, coupled with careful budgeting and utilization of available resources, is essential for successful financial management and completion of the degree program. Understanding the correlation between living expenses and the overall educational investment empowers students to make informed decisions and minimize financial stress during their academic journey.

3. Books and Supplies

The expenses associated with textbooks and specialized materials represent a significant component of the overall financial burden of an aerospace engineering degree. These costs, while often overlooked in initial financial planning, can accumulate substantially over the course of a four-year program. Understanding the nature and scope of these expenses is crucial for accurate budgetary projections.

- Required Textbooks

Aerospace engineering curricula necessitate a wide array of textbooks covering subjects such as aerodynamics, propulsion, structural analysis, and control systems. These texts are frequently expensive, particularly when new editions are mandated by professors. The cost per book can range from several hundred dollars, and students typically need multiple textbooks each semester. The cumulative expense across all semesters contributes significantly to the overall financial burden.

- Software Licenses

Aerospace engineering relies heavily on specialized software for modeling, simulation, and analysis. Students often need access to software packages such as MATLAB, SolidWorks, ANSYS, or similar tools. Some universities provide access to these software packages as part of tuition, while others require students to purchase individual licenses, which can be costly. The specific software requirements vary depending on the institution and the courses being taken.

- Engineering Equipment and Tools

Certain aerospace engineering courses may require students to acquire specific equipment or tools, such as drafting tools, calculators, or safety equipment. The cost of these items, while typically lower than textbooks or software licenses, can add to the overall financial burden, particularly if specialized instruments are required for laboratory work or design projects.

- Course-Specific Materials

Individual courses may require students to purchase specific course packs, lab manuals, or access codes for online resources. These materials, while essential for completing coursework, contribute to the overall cost of books and supplies. The cost of these materials varies depending on the course and the institution.

The cumulative cost of textbooks, software licenses, engineering equipment, and course-specific materials represents a substantial investment in an aerospace engineering education. Prospective students should carefully research the specific requirements of their chosen program and factor these expenses into their overall budget. Exploring options such as renting textbooks, purchasing used editions, or utilizing open-source software can help mitigate the financial impact of these materials, contributing to a more manageable overall cost of obtaining an aerospace engineering degree.

4. Financial aid options

The availability and utilization of financial aid options directly influence the net price of an aerospace engineering degree. The gross price, encompassing tuition, fees, and living expenses, is often substantially reduced through various aid mechanisms. These mechanisms include need-based grants, merit-based scholarships, and federal and private student loans. Without financial aid, the cost of an aerospace engineering degree can be prohibitively expensive for many qualified students, effectively limiting access to this field. For instance, a student from a low-income background might be eligible for Pell Grants or state-sponsored grants, significantly lowering the out-of-pocket expense. Similarly, a student with exceptional academic performance may secure merit-based scholarships from the university or external organizations, further reducing the financial burden. Federal student loans, while requiring repayment, provide access to funds that might otherwise be unavailable.

The application process for financial aid typically involves completing the Free Application for Federal Student Aid (FAFSA), which assesses a student’s and their family’s financial situation to determine eligibility for federal aid programs. Universities also often require separate applications for institutional grants and scholarships. Effective navigation of the financial aid system is crucial, as deadlines and eligibility criteria vary across programs. Consider, for example, a student who fails to submit the FAFSA by the priority deadline may miss out on certain grant opportunities, thereby increasing their reliance on student loans. Moreover, understanding the terms and conditions of student loans, including interest rates and repayment options, is essential for responsible borrowing and long-term financial stability. The total amount of debt accumulated directly affects the long-term financial impact of the degree.

In summary, financial aid options play a pivotal role in determining the affordability of an aerospace engineering degree. The availability and judicious use of grants, scholarships, and loans can significantly reduce the net cost, enabling more students to pursue careers in this demanding but rewarding field. Failing to adequately explore and leverage these financial resources can result in a substantial increase in the overall investment required and may deter qualified individuals from entering the profession.

5. Scholarship availability

Scholarship availability directly influences the overall financial investment required for an aerospace engineering degree. The extent to which scholarships can be secured significantly impacts the net cost, effectively mitigating the financial burden for students and families.

- Merit-Based Scholarships

These scholarships are awarded based on academic achievement, standardized test scores, and extracurricular involvement. High-achieving students pursuing aerospace engineering may qualify for substantial merit-based awards from universities, private organizations, or government agencies. Such scholarships can significantly reduce or even eliminate tuition fees, thereby lowering the total cost of the degree.

- Need-Based Scholarships

Need-based scholarships consider a student’s and their family’s financial circumstances. These scholarships aim to provide financial assistance to students from low-income backgrounds, enabling them to afford higher education. Aerospace engineering programs often have need-based scholarships available through the university’s financial aid office or external foundations. These awards can substantially lower the cost of education for eligible students.

- Targeted Scholarships

Targeted scholarships are specifically designed for students pursuing STEM fields, including aerospace engineering. These scholarships may be offered by professional organizations, industry partners, or government initiatives seeking to encourage students to enter these fields. Eligibility criteria often include a demonstrated interest in aerospace, academic excellence, and commitment to the profession. These targeted scholarships can provide significant financial support and can also offer networking opportunities.

- Institutional Scholarships

Many universities offer institutional scholarships specifically for students enrolled in their aerospace engineering programs. These scholarships may be based on merit, need, or a combination of both. The availability and value of institutional scholarships vary widely across universities. Investigating and applying for these scholarships is a crucial step in reducing the overall cost of an aerospace engineering degree.

The combined effect of merit-based, need-based, targeted, and institutional scholarships can substantially offset the cost of an aerospace engineering degree. Proactive research and application for these scholarships are essential for minimizing the financial investment and maximizing the affordability of higher education in this demanding field.

6. Loan interest rates

Loan interest rates exert a considerable influence on the overall financial burden associated with acquiring an aerospace engineering degree. These rates determine the cost of borrowing funds to finance educational expenses and significantly impact long-term repayment obligations.

- Impact on Total Repayment

Higher interest rates on student loans result in a greater total repayment amount over the life of the loan. For example, a difference of just one percentage point in interest rate can translate to thousands of dollars in additional payments. The extended repayment timeline associated with student loans exacerbates the effect of interest rates, increasing the cumulative cost of borrowing for educational purposes. A student borrowing \$50,000 at a 6% interest rate will pay significantly more over a 10-year period than a student borrowing the same amount at a 4% interest rate.

- Types of Interest Rates

Student loans can have either fixed or variable interest rates. Fixed rates remain constant throughout the repayment period, providing predictability and stability. Variable rates, conversely, fluctuate based on market conditions, potentially leading to higher or lower monthly payments. Uncertainty associated with variable rates can complicate financial planning. For example, a borrower with a variable interest rate loan may experience an increase in their monthly payments if the benchmark interest rate rises, impacting their ability to manage other financial obligations.

- Federal vs. Private Loans

Federal student loans typically offer lower interest rates and more flexible repayment options compared to private loans. Private loans are often subject to creditworthiness and may carry higher interest rates, especially for borrowers with limited credit history. Selection between federal and private loan options necessitates careful consideration of interest rates, fees, and repayment terms. Choosing a federal loan over a private loan can often result in significant savings due to lower interest rates and access to income-driven repayment plans.

- Refinancing Options

Borrowers may have the opportunity to refinance their student loans to secure a lower interest rate. Refinancing involves obtaining a new loan with more favorable terms and using it to pay off existing loans. Qualification for refinancing typically depends on credit score, income, and employment history. Successful refinancing can substantially reduce the total repayment amount. A borrower with a high interest rate private loan might refinance to a lower rate federal loan, reducing their monthly payments and overall interest paid.

In conclusion, loan interest rates are a critical factor in determining the ultimate financial commitment associated with pursuing an aerospace engineering degree. Prudent evaluation of interest rates, loan types, and refinancing possibilities is essential for responsible financial planning and minimizing the long-term burden of student loan debt. By carefully managing loan interest rates, students can reduce the overall cost of their education and achieve their career aspirations more efficiently.

7. Opportunity Cost

The pursuit of an aerospace engineering degree necessitates a considerable time commitment, directly impacting potential earnings from immediate employment. This foregone income represents a significant, albeit often overlooked, component of the overall financial investment.

- Foregone Salary

Enrolling in a full-time aerospace engineering program typically precludes full-time employment. The salary that could have been earned during the four or more years of study constitutes a substantial opportunity cost. For instance, a recent high school graduate might have secured a stable job earning \$30,000 to \$40,000 annually, resulting in a loss of \$120,000 to \$160,000 over four years. This income is not available to offset educational expenses or build savings.

- Delayed Career Advancement

While degree holders often command higher salaries in the long term, the initial years spent in academia delay entry into the workforce. This delay affects the accumulation of professional experience and potential for early career advancement. A peer who enters the workforce immediately after high school may gain valuable experience and promotions, potentially exceeding the starting salary of a new aerospace engineering graduate.

- Lost Investment Opportunities

The income foregone during studies could have been invested, generating returns over time. The potential gains from investments, such as stocks, bonds, or real estate, represent another aspect of opportunity cost. Compounding interest on these investments could have yielded substantial returns over the same four-year period, further increasing the financial trade-off of pursuing a degree.

- Reduced Early Savings

The absence of income during studies also limits the ability to save for future goals, such as purchasing a home, starting a family, or retirement. These savings would have contributed to financial security and long-term wealth accumulation. The delay in building these savings can have lasting effects, requiring a greater savings effort later in life to catch up.

The integration of opportunity cost into the overall financial assessment of an aerospace engineering degree provides a more comprehensive understanding of the total economic commitment. While the potential for increased future earnings remains a primary motivator, acknowledging the immediate financial trade-offs is crucial for informed decision-making and effective financial planning. Ignoring the opportunity cost can lead to an underestimation of the true financial burden and impact long-term financial goals.

Frequently Asked Questions

The following questions address common concerns regarding the financial aspects of obtaining an aerospace engineering degree. The answers aim to provide clarity and guidance for prospective students.

Question 1: What is the typical range for tuition fees at public universities for an aerospace engineering degree?

Tuition at public universities generally varies between \$10,000 and \$20,000 per year for in-state residents. Out-of-state tuition can range from \$25,000 to \$40,000 annually. These figures exclude additional fees and living expenses.

Question 2: How do tuition costs compare between public and private institutions?

Private universities typically have significantly higher tuition fees compared to public institutions. Annual tuition at private universities for an aerospace engineering degree often ranges from \$40,000 to \$60,000 or more, excluding fees and living expenses.

Question 3: What are the primary components of living expenses for students pursuing an aerospace engineering degree?

Living expenses primarily consist of housing, food, transportation, and personal expenses. The cost of these items varies greatly depending on the location of the university. Metropolitan areas generally have higher living expenses compared to smaller cities or rural areas.

Question 4: What types of financial aid are commonly available to students pursuing an aerospace engineering degree?

Common forms of financial aid include federal grants (e.g., Pell Grants), state grants, institutional scholarships, and federal and private student loans. Eligibility for these aid options depends on factors such as financial need, academic merit, and program of study.

Question 5: How can students effectively manage the cost of textbooks and supplies in an aerospace engineering program?

Strategies for managing textbook and supply costs include purchasing used books, renting textbooks, utilizing online resources, and exploring open-source software alternatives. Some universities may offer textbook rental programs or provide access to software licenses.

Question 6: What is the opportunity cost associated with pursuing an aerospace engineering degree, and how should it be considered?

Opportunity cost refers to the income that could have been earned had the student entered the workforce directly instead of pursuing higher education. This cost should be factored into financial planning, along with tuition, fees, and living expenses, to provide a comprehensive assessment of the total investment.

Effective financial planning and diligent research into available resources can mitigate the financial burden of an aerospace engineering degree. Understanding the various cost components and exploring funding opportunities are essential for making informed decisions.

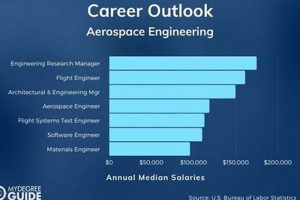

The subsequent sections will explore career prospects and potential earnings associated with an aerospace engineering degree.

Concluding Observations on Aerospace Engineering Degree Costs

The preceding analysis has comprehensively examined the numerous factors influencing the total investment required to obtain an aerospace engineering degree. This analysis has included the costs of tuition, fees, living expenses, and materials, in addition to the often-overlooked opportunity cost of forgoing immediate employment. Various strategies for mitigating expenses, such as scholarship applications, financial aid utilization, and prudent financial planning, have been discussed in detail, with careful consideration of loan interest rates and their long-term impact.

The financial commitment associated with an aerospace engineering degree represents a substantial investment in both time and resources. The decision to pursue this path should therefore be informed by a thorough understanding of all associated costs and a realistic assessment of individual financial circumstances. Prospective students are encouraged to conduct comprehensive research, explore available funding opportunities, and develop a detailed financial plan to ensure the successful completion of their academic goals and a prosperous future career.