Executive compensation within the aeronautics and space industry leadership is a multifaceted subject, encompassing base pay, bonuses, stock options, and other benefits awarded to the highest-ranking executives of companies operating in this sector. These figures are often tied to company performance, strategic decisions, and the overall economic climate affecting the industry. For example, a Chief Executive Officer of a major aerospace manufacturer might receive a significant bonus following the successful launch of a new commercial aircraft program.

Understanding the remuneration structures for those at the helm of aerospace organizations is crucial for several reasons. It provides insight into corporate governance practices, incentivizes strong leadership, and influences investor confidence. Moreover, historical trends in these figures often reflect the industry’s growth, periods of innovation, or challenges related to market downturns and geopolitical events. These considerations offer a lens through which stakeholders can evaluate corporate success and strategic effectiveness.

Consequently, analyzing factors that determine executive pay packages, examining the impact of market conditions on compensation, and comparing remuneration across different company sizes and performance metrics are essential considerations in understanding the complexities within the aerospace sector. This analysis can further address stakeholder concerns about executive compensation alignment with long-term shareholder value and overall company health.

The following points offer guidance on understanding and evaluating executive compensation packages within the aeronautics and space industry. These insights are intended to assist stakeholders in forming informed perspectives.

Tip 1: Emphasize Long-Term Value Creation: Executive pay structures should prioritize incentives that align with sustainable growth and long-term shareholder value rather than short-term gains. For example, vesting schedules for stock options should extend over several years, encouraging a focus on strategic planning and innovation with lasting impact.

Tip 2: Incorporate Non-Financial Performance Metrics: Remuneration committees should consider factors beyond purely financial indicators. This includes metrics such as employee satisfaction, environmental sustainability, and safety records. A CEO achieving significant revenue growth while neglecting safety protocols should not be rewarded as highly as one demonstrating holistic leadership.

Tip 3: Promote Transparency and Disclosure: Comprehensive and easily accessible disclosure of compensation packages, including the rationale behind incentive structures, fosters trust among stakeholders. Companies should clearly articulate the link between executive performance and financial rewards.

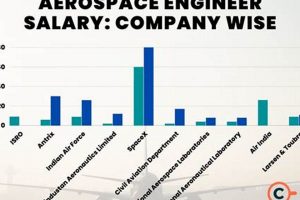

Tip 4: Benchmarking Against Industry Peers: Comparison with similar companies within the aerospace sector provides valuable context for evaluating compensation levels. However, direct comparisons should also consider variations in company size, market position, and strategic priorities.

Tip 5: Regularly Review and Adjust Compensation Plans: Compensation structures should be reviewed periodically to ensure they remain aligned with evolving business objectives and market conditions. Plans should adapt to address shifts in technology, regulatory landscapes, and competitive dynamics.

Tip 6: Independent Compensation Committee Oversight: Ensure that the compensation committee consists of independent members with the expertise to objectively assess executive performance and compensation. This reduces potential conflicts of interest and promotes fair and equitable decisions.

These considerations underscore the need for a balanced and nuanced approach to structuring leadership compensation within the aerospace sector. Alignment of executive incentives with long-term value creation, combined with transparency and independent oversight, contributes to sustainable corporate success and stakeholder confidence.

In conclusion, a thorough understanding of the factors influencing executive pay is critical for informed decision-making and effective governance within the industry.

1. Performance-based Incentives

Performance-based incentives are a foundational element in determining Chief Executive Officer compensation within the aerospace sector. These incentives are structured to align executive actions with company goals, shareholder interests, and overall organizational success. The design and implementation of these incentives directly influence the level and structure of an aerospace CEO’s total remuneration.

- Revenue and Profitability Targets

A significant portion of an aerospace CEO’s bonus and stock options is often tied to achieving specific revenue and profitability targets. For instance, exceeding projected sales figures or improving profit margins on key product lines can trigger substantial payouts. Failure to meet these targets can result in significantly reduced or nonexistent bonuses.

- Strategic Milestone Achievement

Incentives are frequently linked to the attainment of critical strategic milestones, such as securing major government contracts, completing successful mergers or acquisitions, or launching innovative new technologies. The successful achievement of these milestones demonstrates effective leadership and strategic vision, justifying higher compensation.

- Operational Efficiency Improvements

CEOs are often incentivized to enhance operational efficiency through cost reduction, process optimization, and improved supply chain management. Achieving demonstrable improvements in these areas, such as reducing manufacturing costs or improving delivery times, can positively influence the CEO’s compensation package.

- Shareholder Value Creation

Long-term stock options and restricted stock grants are used to align the CEO’s interests with those of shareholders. These instruments incentivize the CEO to make decisions that drive long-term shareholder value, as their own financial gains are directly linked to the company’s stock performance. Sustained growth in shareholder value typically translates into increased compensation for the CEO.

In conclusion, performance-based incentives serve as a critical mechanism for aligning executive actions with company objectives within the aerospace industry. The effective design and implementation of these incentives are essential for driving long-term shareholder value and rewarding CEOs for achieving strategic, operational, and financial milestones. This direct linkage between performance and remuneration ensures accountability and incentivizes strong leadership.

2. Company Size Influence

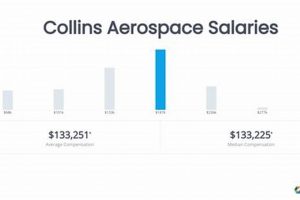

The size of an aerospace company exerts a considerable influence on the compensation packages awarded to its Chief Executive Officer. Revenue, market capitalization, and employee headcount are key determinants of a company’s scale, and these factors correlate directly with the complexity of the CEO’s responsibilities and the scope of their influence. Therefore, larger entities typically offer greater financial rewards.

- Revenue Scale and Executive Compensation

A higher revenue base usually translates to greater complexity in business operations and strategic decision-making. Managing a multi-billion dollar aerospace firm requires a broader skill set and entails greater risks compared to a smaller, niche-focused company. As such, the remuneration reflects the expanded responsibilities and the potential impact of the CEO’s decisions on a larger financial scale. For example, the CEO of a major aerospace manufacturer with annual revenues exceeding $50 billion is expected to receive a significantly higher salary than the CEO of a smaller aerospace parts supplier with revenues under $500 million.

- Market Capitalization and Investor Expectations

Market capitalization reflects investor confidence and the perceived value of the company. CEOs of publicly traded companies with high market capitalizations are under intense pressure to sustain growth and deliver returns to shareholders. A larger market cap often implies a more diversified portfolio of products and services, necessitating a more experienced and strategically astute leader. This heightened pressure and responsibility typically justify a higher level of compensation, incentivizing the CEO to prioritize long-term shareholder value. An example would be comparing the compensation of a CEO of a well-established aerospace company listed on the S&P 500 versus a smaller, privately held aerospace startup.

- Employee Headcount and Organizational Complexity

The number of employees a CEO manages directly correlates with the complexity of organizational structure and internal communication challenges. A larger workforce implies a greater need for effective leadership, talent management, and the implementation of robust human resources policies. Managing a workforce of tens of thousands requires sophisticated leadership skills and experience. Compensation reflects the demand for expertise in leading large, diverse teams and maintaining a cohesive company culture. For example, a CEO overseeing a company with over 100,000 employees will typically earn more than the CEO of a smaller firm with a few thousand employees, as the former faces greater challenges in coordinating and motivating a much larger workforce.

In conclusion, company size plays a pivotal role in determining executive compensation within the aerospace sector. Revenue, market capitalization, and employee headcount are all interlinked factors that influence the scope of a CEO’s responsibilities and the demands placed upon them. These factors justify the substantial variations observed in remuneration packages across companies of different sizes within the industry, reflecting the higher stakes and expanded responsibilities associated with leading larger and more complex organizations.

3. Industry Benchmarks

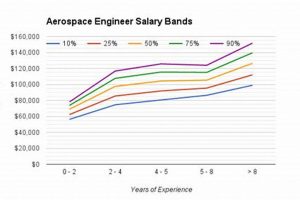

Industry benchmarks play a pivotal role in determining the appropriateness and competitiveness of remuneration packages for Chief Executive Officers within the aerospace sector. These benchmarks, derived from analyzing compensation data across similar companies, serve as crucial reference points for boards of directors and compensation committees when structuring executive pay. The principle rests on ensuring that the compensation offered is commensurate with the responsibilities, performance expectations, and complexities inherent in leading an aerospace organization relative to its peers. For instance, if a CEO’s performance consistently ranks in the top quartile among comparable companies, the board might consider a compensation package that aligns with the upper range of industry benchmarks. Conversely, persistent underperformance relative to these benchmarks could trigger a reassessment of the compensation structure.

The application of industry benchmarks extends beyond simply matching compensation figures. It involves a nuanced assessment of factors such as company size, financial performance, strategic objectives, and geographic location. Compensation consultants often provide detailed analyses that segment aerospace companies based on these characteristics, enabling a more accurate comparison. For example, the CEO of a major defense contractor operating in a high-cost region like California would likely command a higher salary compared to the CEO of a smaller aerospace component manufacturer located in a lower-cost state. Furthermore, specific metrics such as revenue growth, profit margins, and return on invested capital are frequently incorporated into the benchmarking process, linking compensation to quantifiable performance outcomes. This process is exemplified when comparing the salaries of Boeing’s and Airbus’s CEOs, who, while leading similar companies, may have different remuneration structures based on varying company performance and strategic priorities.

In conclusion, industry benchmarks are not merely guidelines but are essential components of a defensible and equitable approach to executive compensation in aerospace. They provide a rational framework for aligning executive pay with company performance and market realities. While the use of benchmarks can mitigate concerns about excessive or unwarranted compensation, challenges remain in accurately capturing the nuances of individual leadership contributions and the long-term strategic impact of executive decisions. Effective governance structures and transparent compensation practices are crucial in ensuring that industry benchmarks are utilized appropriately and in the best interests of shareholders and other stakeholders.

4. Stock Options Prevalence

The widespread use of stock options in executive compensation packages within the aerospace industry significantly influences the overall remuneration received by Chief Executive Officers. This prevalence reflects a deliberate strategy to align executive interests with long-term shareholder value and incentivize performance that drives sustained growth.

- Alignment with Shareholder Value

Stock options grant the right to purchase company shares at a predetermined price, typically the market price at the time of grant. The CEO benefits financially only if the stock price appreciates, directly linking their compensation to the creation of shareholder wealth. For instance, if a CEO receives options to purchase 100,000 shares at $50 each, they only realize a gain if the stock price exceeds $50. This mechanism incentivizes decisions that enhance the company’s long-term performance and, consequently, its stock value.

- Long-Term Performance Incentives

Stock options typically have vesting schedules that extend over several years, encouraging CEOs to focus on strategies that yield results over the long term rather than prioritizing short-term gains. A common vesting schedule might require the CEO to remain with the company for three to five years before the options become fully exercisable. This encourages a long-term perspective in strategic planning and decision-making, minimizing the risk of actions that boost short-term profits at the expense of long-term sustainability.

- Risk and Reward Considerations

Stock options inherently involve risk, as their value depends on the future performance of the company’s stock. If the company underperforms or the stock price declines, the options may become worthless. This risk motivates CEOs to make prudent decisions and manage the company effectively. Conversely, if the company performs exceptionally well, the CEO can realize substantial gains, further incentivizing strong leadership and strategic execution. This risk/reward balance is a key characteristic of stock option compensation.

- Tax Implications and Accounting Standards

The tax treatment of stock options and the accounting standards governing their expensing can influence their prevalence and structure. Companies must account for the expense associated with granting stock options, which can impact reported earnings. Furthermore, the tax implications for both the company and the executive upon the exercise of options must be considered when designing the compensation package. These factors can influence the number of options granted and the vesting schedules employed.

In conclusion, the prevalence of stock options is a significant determinant of CEO compensation within the aerospace sector. By aligning executive interests with shareholder value, promoting long-term performance, and incorporating risk and reward considerations, stock options serve as a powerful tool for incentivizing effective leadership and driving sustainable growth. The structure and utilization of these options are further shaped by tax implications and accounting standards, creating a complex interplay of factors that ultimately influence the overall remuneration received by aerospace CEOs.

5. Long-Term Agreements

Long-term agreements in the aerospace industry significantly shape the compensation structure for Chief Executive Officers. These agreements, typically spanning multiple years, define the terms of employment and provide a framework for incentives tied to sustained company performance and strategic objectives. Their existence often dictates not just the base remuneration, but also the performance-based bonuses, stock options, and other benefits awarded to these top executives.

- Stability and Strategic Vision

Long-term contracts provide stability for the CEO, allowing them to focus on long-range strategic initiatives without the distraction of imminent contract renewal negotiations. This stability can result in more effective long-term planning and execution, which are crucial in the capital-intensive and technologically advanced aerospace sector. For example, a five-year contract enables a CEO to spearhead a multi-year research and development program with confidence, knowing they will be in place to oversee its implementation. This predictability can translate to better company performance, which subsequently influences compensation.

- Performance-Based Vesting Schedules

These agreements frequently incorporate performance-based vesting schedules for stock options and other equity-based compensation. This means that the CEOs ability to realize the full value of these incentives is contingent upon achieving specific milestones outlined in the agreement, such as revenue growth, market share expansion, or successful product launches. A CEO aiming to maximize their compensation under such an agreement is incentivized to prioritize long-term value creation. An example would be a vesting schedule tied to the successful completion of milestones in a major government contract over several years.

- Clawback Provisions and Risk Mitigation

Long-term agreements often include clawback provisions that allow the company to recoup compensation in the event of financial restatements, ethical breaches, or significant performance failures. These provisions protect shareholders and incentivize responsible decision-making by the CEO. Knowing that compensation could be forfeited in the event of misconduct encourages a focus on ethical conduct and diligent risk management. For instance, if a CEOs actions lead to a substantial financial loss or a violation of regulations, the company may invoke the clawback provision to recover previously paid compensation.

- Succession Planning and Leadership Continuity

Multi-year contracts facilitate effective succession planning and ensure leadership continuity, especially during critical periods of technological advancement or market disruption. A long-term commitment from the CEO allows the company to develop internal talent and prepare for a smooth transition when the time comes. This stability in leadership can have a positive impact on investor confidence and the overall performance of the company, which ultimately influences the CEO’s total compensation. A documented succession plan, developed and implemented under the long-term contract, can ensure a seamless transfer of responsibilities and prevent disruptions in the organizations strategic direction.

In conclusion, long-term agreements are not merely contractual formalities; they are strategic tools that shape executive behavior, promote long-term value creation, and influence the overall compensation received by aerospace CEOs. These agreements create a framework for aligning executive incentives with shareholder interests, mitigating risks, and ensuring leadership continuity, all of which are critical for success in the complex and competitive aerospace industry.

Frequently Asked Questions

This section addresses common inquiries regarding executive compensation within the aeronautics and space industry. The information presented aims to provide clarity and understanding of the factors influencing Chief Executive Officer remuneration.

Question 1: What are the primary components of an aerospace CEO’s total compensation package?

An aerospace CEO’s compensation typically comprises a base salary, performance-based bonuses, stock options, restricted stock grants, and other benefits such as retirement contributions, health insurance, and perquisites. The proportion of each component can vary depending on the company’s size, performance, and overall compensation philosophy.

Question 2: How does company performance influence executive pay in the aerospace sector?

Company performance is a critical determinant of executive compensation. Bonuses and stock options are often tied to achieving specific financial targets, such as revenue growth, profitability, and return on investment. Strategic milestones, such as securing major contracts or launching new products, can also trigger bonus payouts.

Question 3: Are there specific regulations governing executive compensation in the aerospace industry?

While there are no industry-specific regulations solely targeting aerospace executive pay, general corporate governance regulations and securities laws apply. Publicly traded companies must disclose executive compensation details in proxy statements, allowing shareholders to scrutinize and vote on pay packages.

Question 4: How do compensation committees determine appropriate pay levels for aerospace CEOs?

Compensation committees, typically composed of independent board members, are responsible for setting executive pay. They consider factors such as company size, financial performance, industry benchmarks, and the CEO’s experience and expertise. Independent compensation consultants may be engaged to provide expert advice and ensure that pay levels are competitive and aligned with market practices.

Question 5: What role do shareholders play in influencing executive compensation decisions?

Shareholders have the opportunity to express their views on executive compensation through advisory votes on pay packages (“say-on-pay”). While these votes are non-binding, they provide valuable feedback to the board and compensation committee. Significant shareholder opposition can prompt companies to reassess and modify their compensation practices.

Question 6: How does the long-term nature of aerospace projects impact executive compensation structures?

Given the long development cycles and capital-intensive nature of aerospace projects, compensation structures often emphasize long-term performance. Stock options with multi-year vesting schedules and performance-based equity grants incentivize CEOs to focus on sustainable growth and value creation, rather than short-term gains. Furthermore, clawback provisions allow companies to recoup compensation in cases of misconduct or financial restatements, ensuring accountability.

In summary, executive pay within the aerospace industry is a complex matter influenced by a variety of factors, including company performance, industry benchmarks, regulatory requirements, and shareholder input. Transparent compensation practices and effective corporate governance are essential for ensuring that executive pay is aligned with the long-term interests of the company and its stakeholders.

The following section explores the ethical considerations surrounding CEO pay within the aeronautics and space sector.

Aerospace CEO Salary

This analysis has explored the multifaceted aspects of executive compensation within the aeronautics and space industry, focusing on the variables influencing Chief Executive Officer remuneration. Factors such as performance incentives, company scale, industry benchmarks, the employment of stock options, and long-term contractual agreements have been examined to provide a holistic view of executive pay structures.

Given the criticality of strategic leadership in this sector, and the impact of executive decisions on innovation, market competitiveness, and long-term shareholder value, the continuous evaluation and refinement of compensation frameworks remain essential. Transparency, performance alignment, and robust governance structures are paramount in ensuring that executive compensation practices support sustainable growth and foster stakeholder confidence within the aerospace domain.

![Unlock: Aerospace Scientist Salary [2024 Guide] Insights Innovating the Future of Flight with Reliable Aviation Solutions Unlock: Aerospace Scientist Salary [2024 Guide] Insights | Innovating the Future of Flight with Reliable Aviation Solutions](https://mixaerospace.com/wp-content/uploads/2026/02/th-220-300x200.jpg)

![Aerospace Engineer Salary: CS vs Aero Eng? [2024] Innovating the Future of Flight with Reliable Aviation Solutions Aerospace Engineer Salary: CS vs Aero Eng? [2024] | Innovating the Future of Flight with Reliable Aviation Solutions](https://mixaerospace.com/wp-content/uploads/2026/02/th-71-300x200.jpg)