Compensation packages for individuals in top-tier management roles within the aircraft and spacecraft manufacturing sector are multifaceted. These packages typically comprise a base amount, performance-based incentives, stock options, and other benefits. The total remuneration can vary significantly based on company size, performance, and the executive’s specific responsibilities.

The financial incentives offered to leaders in this industry reflect the considerable expertise and strategic decision-making required to navigate the complexities of the global market. These individuals are responsible for driving innovation, ensuring operational efficiency, and maintaining regulatory compliance within a highly competitive environment. The levels observed are often aligned with the overall financial health and strategic growth objectives of the employing entity, as well as benchmarks within the broader technology and manufacturing fields.

Understanding the factors influencing these remuneration packages is crucial for stakeholders seeking insight into the economics of the aerospace industry. Further sections will delve into specific determinants, typical ranges observed in different company contexts, and the influence of economic trends on overall executive compensation within this sector.

The following guidelines address key considerations for both employers and individuals navigating compensation structures within the aerospace sector, focusing on aspects directly influenced by market conditions and organizational performance.

Tip 1: Conduct Thorough Market Research: A comprehensive understanding of prevailing levels is essential. Utilize industry-specific surveys and compensation databases to benchmark against comparable roles in similar-sized companies within the aerospace and defense sectors. Account for geographical location and specialization when analyzing data.

Tip 2: Align Incentives with Strategic Objectives: Performance-based bonuses and long-term equity grants should be directly linked to the achievement of key organizational goals. This ensures that remuneration is tied to demonstrable contributions to the company’s success. For instance, incentives may be tied to project milestones, revenue growth, or successful product launches.

Tip 3: Prioritize Transparency and Communication: Compensation structures should be clearly defined and communicated to all stakeholders. Transparency fosters trust and ensures that executives understand how their performance impacts their earnings potential. This includes providing detailed information about bonus metrics, stock option vesting schedules, and other benefits.

Tip 4: Emphasize Non-Monetary Benefits: Beyond base amounts and bonuses, consider offering comprehensive benefits packages, including robust health insurance, retirement plans, and professional development opportunities. These non-monetary benefits can significantly enhance the overall value proposition and attract top talent.

Tip 5: Regularly Review and Adjust Compensation Plans: The market is dynamic. Regularly assess compensation plans to ensure they remain competitive and aligned with evolving industry trends and organizational needs. This includes monitoring competitor practices and adjusting structures as necessary to retain key personnel.

Tip 6: Seek Expert Consultation: Engage experienced compensation consultants to provide objective advice and guidance on designing and implementing effective compensation programs. Consultants can offer valuable insights into best practices and ensure compliance with relevant regulations.

These guidelines provide a framework for approaching compensation decisions strategically. By aligning remuneration with organizational goals and market realities, companies can attract and retain top-tier leaders who drive innovation and growth in the aerospace industry.

The subsequent sections will delve into the legal and ethical considerations surrounding these negotiations.

1. Company Performance

The operational and financial success of an aerospace entity directly correlates with the compensation structures implemented for its senior management. Enhanced profitability, sustained revenue growth, and successful execution of strategic initiatives enable the allocation of larger remuneration packages. This connection between financial health and payment reflects the perception that high-performing leaders drive positive outcomes, warranting increased financial incentives. For example, a company that secures a major government contract and consistently exceeds production targets is likely to provide its executives with substantial performance-based bonuses and stock options.

Conversely, periods of financial underperformance often result in constraints on overall compensation. Companies experiencing reduced profitability or declining market share may implement salary freezes, reduce bonus payouts, or curtail stock option grants. In extreme cases, senior management may face salary reductions as part of broader cost-cutting measures. The aerospace sector, highly dependent on government contracts and long-term projects, is particularly vulnerable to economic downturns and budgetary shifts, which can significantly impact company performance and, subsequently, executive compensation. The cancellation of a major defense program, for example, can trigger a domino effect, leading to reduced earnings and subsequent adjustments to executive packages.

In summary, company performance serves as a primary determinant of remuneration for its leaders. Success enables the allocation of more significant financial rewards, reflecting the perceived value of effective leadership. However, economic challenges and operational setbacks often necessitate adjustments to compensation structures, demonstrating the direct link between organizational health and executive payment. An understanding of this correlation is vital for stakeholders seeking insights into executive compensation practices and the financial dynamics of this industry.

2. Executive Experience

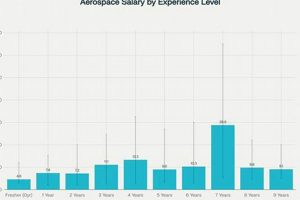

The depth and breadth of an executive’s prior roles significantly influence potential compensation within the aerospace industry. Relevant experience signals a proven capacity to navigate the sector’s complexities, directly impacting negotiation leverage and perceived value.

- Years in Senior Management

The duration of time spent in leadership positions, especially within the aerospace or closely related technology sectors, directly impacts earning potential. A longer track record generally translates to higher negotiation power, based on demonstrated leadership and industry knowledge. For example, an individual with fifteen years of experience as a Vice President at a major aerospace manufacturer would typically command a higher amount than someone with only five years in a similar role.

- Scope of Responsibilities

The scale and complexity of past responsibilities significantly contribute to compensation determination. Executives who have managed large budgets, led significant teams, or overseen critical projects are typically valued more highly. An executive who has successfully managed a multi-billion dollar defense contract, for instance, demonstrates a capacity for strategic execution that justifies a premium.

- Proven Track Record of Success

Documented achievements, such as successful product launches, revenue growth, or operational improvements, enhance an executive’s market value. Quantifiable results provide concrete evidence of leadership effectiveness. An executive who oversaw a 20% increase in market share or a significant reduction in production costs can command a higher level than someone with less demonstrable accomplishments.

- Industry-Specific Knowledge and Expertise

Deep understanding of aerospace regulations, technologies, and market dynamics differentiates candidates. Specialized knowledge in areas such as propulsion systems, avionics, or space exploration can significantly increase earning potential. An executive with a background in advanced materials science or a proven ability to navigate complex regulatory frameworks may be particularly sought after, further influencing earnings.

The accumulation of extensive leadership experience translates into a demonstrably higher value proposition for aerospace companies. The ability to leverage proven capabilities in strategic decision-making, operational management, and technological innovation justifies increased compensation expectations, reinforcing the direct correlation between executive experience and financial reward within this industry.

3. Industry Benchmarks

Within the aerospace sector, industry benchmarks serve as crucial reference points for establishing competitive and equitable executive remuneration. These benchmarks provide data-driven insights into prevailing levels across comparable roles, companies, and geographic locations, facilitating informed decisions regarding salary structures.

- Role Similarity and Job Title Standardization

Compensation surveys categorize positions based on responsibilities and scope, ensuring alignment between job titles and actual duties. This standardization allows for direct comparison of remuneration for similar roles across different organizations. For example, the role of “Chief Technology Officer” will have a different set of expectations and compensation at a small, experimental company compared to a major defense contractor.

- Company Size and Revenue Bands

Remuneration benchmarks typically account for the size and revenue of the organization. Larger companies with higher revenues tend to offer more competitive compensation packages to attract and retain experienced executives. A CEO at a large, multi-billion dollar aerospace manufacturer will predictably earn more than a CEO at a smaller, privately held aerospace component supplier.

- Geographic Location Cost of Living

Regional differences in the cost of living influence executive compensation. Locations with higher living expenses, such as major metropolitan areas or areas with specialized skills shortages, often command premium levels. The compensation for a CFO in Los Angeles or Seattle, cities with high costs of living and a concentration of aerospace activity, is likely higher than for a similar role in a less expensive location.

- Performance Metrics and Incentive Structures

Benchmarking data often includes information on performance-based incentives and bonus structures tied to specific metrics, such as revenue growth, profitability, or project milestones. An executive whose compensation package is heavily weighted toward performance-based incentives may have a base amount lower than the benchmark, but the overall potential would be higher.

In summary, adherence to industry benchmarks enables aerospace companies to establish fair and competitive remuneration packages, attracting and retaining qualified individuals to leadership positions. These benchmarks offer a framework for aligning incentives with company goals and market realities, fostering transparency and accountability in compensation practices. The strategic use of benchmarking data ensures that remuneration reflects both the individual’s contributions and the broader market dynamics within the aerospace sector.

4. Geographic Location

Geographic location is a significant determinant of executive compensation within the aerospace industry, influencing salary structures due to variations in cost of living, local tax rates, and the concentration of aerospace-related businesses.

- Cost of Living Adjustments

Metropolitan areas with a high cost of living, such as Los Angeles, Seattle, or Washington D.C., typically require higher salaries to maintain a comparable standard of living. This adjustment accounts for increased expenses related to housing, transportation, and general goods and services. For instance, a Chief Engineer in Los Angeles would likely command a higher amount than an equivalent position in Huntsville, Alabama, where the cost of living is significantly lower.

- State and Local Tax Implications

Differing state and local tax policies impact net compensation, influencing gross pay considerations. Areas with higher income tax rates necessitate adjustments to pre-tax salary levels to ensure comparable post-tax income. An executive in California, which has a relatively high state income tax, would expect a higher gross amount compared to an equivalent role in Texas, which has no state income tax.

- Concentration of Aerospace Industries

Locations with a high concentration of aerospace companies often experience increased demand for qualified executives, driving up salaries due to market competition. Areas like Southern California or the Puget Sound region have a density of aerospace firms, creating a competitive environment for talent acquisition. A Senior Vice President of Operations in a region saturated with aerospace manufacturers is likely to have greater negotiating power due to the abundance of opportunities.

- Access to Talent Pools and Educational Institutions

Regions with access to strong engineering and business programs or large, technically skilled workforces can impact salary levels. A larger, readily available pool of qualified candidates might moderate salary expectations, while a limited supply of specialized talent could drive up amounts. For example, proximity to institutions like MIT or Caltech can influence the executive salary landscape due to the availability of highly skilled potential hires.

Therefore, geographic location exerts considerable influence over executive remuneration in the aerospace industry. These variations, driven by economic factors and industry clustering, necessitate careful consideration to establish competitive and equitable compensation packages that attract and retain top talent in specific regions. This, in turn, informs strategic decisions regarding corporate location and executive recruitment strategies.

5. Stock Options

Stock options represent a significant component of executive compensation packages within the aerospace sector. These instruments grant executives the right to purchase company shares at a predetermined price (the strike price) within a specified timeframe, aligning executive interests with shareholder value and long-term company performance.

- Alignment of Interests

Granting stock options incentivizes executives to make decisions that increase the company’s stock price, thereby benefiting both the executive and the shareholders. If the stock price rises above the strike price, the executive can exercise the option, purchasing shares at the lower price and realizing a profit upon selling them at the current market price. For example, an executive granted options at \$50 per share benefits significantly if the stock price climbs to \$75, thereby directly profiting from the company’s success. This direct financial stake in the company’s performance fosters a commitment to long-term value creation.

- Retention and Attraction of Talent

Stock options serve as a powerful tool for attracting and retaining top-tier talent in the highly competitive aerospace industry. The potential for substantial financial gain through stock appreciation incentivizes executives to remain with the company and contribute to its growth. A lucrative option package can be a decisive factor for an experienced executive considering a move to a different aerospace firm, particularly if it offers a significant opportunity for wealth accumulation based on company performance.

- Risk and Reward Balance

Stock options inherently involve risk, as their value is contingent upon the company’s performance and stock market fluctuations. If the company’s stock price declines or stagnates, the options may become worthless. This risk encourages executives to make prudent decisions and manage the company effectively to maximize shareholder value. For instance, an executive might prioritize strategic investments and cost-cutting measures to improve the company’s financial health and boost its stock price, knowing that their own financial gain is directly linked to these outcomes.

- Vesting Schedules and Long-Term Incentives

Stock options typically vest over a period of several years, aligning executive incentives with the long-term success of the company. Vesting schedules encourage executives to remain with the company and focus on long-term growth rather than short-term gains. A typical vesting schedule might involve options vesting in equal installments over a four-year period, rewarding sustained commitment and discouraging short-term, potentially detrimental decision-making.

Stock options, therefore, function as a key instrument in structuring aerospace executive compensation, fostering alignment of interests, incentivizing long-term performance, and attracting top-tier leadership. The judicious use of stock options enables companies to drive sustainable growth and value creation within this highly dynamic and competitive industry.

Frequently Asked Questions

This section addresses common inquiries regarding compensation structures for individuals in top-tier management roles within the aerospace sector. The following questions and answers provide a concise overview of key considerations.

Question 1: What factors primarily influence the determination of an aerospace executive’s compensation?

Company performance, executive experience, industry benchmarks, geographic location, and the inclusion of stock options constitute the primary determinants of an executive’s total remuneration.

Question 2: How does company size impact compensation packages in the aerospace sector?

Larger companies, typically characterized by higher revenues and more complex operations, tend to offer more competitive compensation packages to attract experienced executives capable of managing their scale.

Question 3: What role do stock options play in executive remuneration?

Stock options serve as a tool to align executive interests with shareholder value. They provide executives with the opportunity to profit from increases in the company’s stock price, incentivizing decisions that promote long-term growth.

Question 4: How does geographic location influence salary considerations?

Variations in the cost of living, state and local tax rates, and the concentration of aerospace-related businesses within a given region all impact salary structures. Metropolitan areas with higher costs of living generally necessitate higher compensation levels.

Question 5: What are industry benchmarks and how are they used?

Industry benchmarks are data-driven insights into prevailing compensation levels for comparable roles across similar companies. These benchmarks provide a reference point for establishing competitive and equitable remuneration structures.

Question 6: What are the implications of underperformance for executive pay?

Periods of financial underperformance often result in constrained executive compensation, potentially leading to salary freezes, reduced bonus payouts, or limitations on stock option grants.

In summary, understanding the dynamics of aerospace executive compensation requires consideration of multiple interrelated factors, including company performance, individual experience, market forces, and strategic use of incentives. These FAQs offer a foundational understanding of the core elements influencing remuneration within this sector.

The subsequent sections will explore the legal and ethical considerations surrounding aerospace executive compensation.

Aerospace Executive Salary

The examination of compensation for senior leaders within the aerospace sector reveals a complex interplay of factors. Company performance, individual experience, industry benchmarks, geographic location, and stock options all contribute to the overall remuneration package. Understanding these elements is crucial for stakeholders seeking to comprehend the financial dynamics and talent management strategies within this specialized industry. Variations in any of these factors can significantly impact the financial incentives offered to those steering the direction of aerospace entities.

Continued analysis of compensation trends remains essential, particularly given the rapidly evolving technological landscape and global economic fluctuations. A thorough understanding of the forces shaping is vital for ensuring fairness, attracting capable leaders, and maintaining competitiveness within the global aerospace market. This focus allows for future investigations into the ethical and governance considerations surrounding this important topic.