This specialized investment vehicle concentrates its holdings in companies that derive a significant portion of their revenue from the aerospace and defense sectors. These sectors encompass a broad range of activities, including the manufacturing of aircraft, spacecraft, and defense systems, as well as the provision of related services and technologies. An example of a company held within such a fund might be a major defense contractor specializing in missile defense systems or a satellite communications provider.

Such focused investment strategies offer potential benefits such as concentrated exposure to specific industry growth trends, potentially leading to higher returns during periods of sector expansion. Historically, geopolitical events and technological advancements have significantly influenced the performance of these sectors. Increased defense spending or breakthroughs in aerospace technology can positively impact companies within this investment area.

Subsequent analysis will delve into specific holdings, performance metrics, risk factors, and suitability considerations associated with this type of investment, providing a detailed overview for prospective investors.

Key Considerations for Investing in Sector-Specific Funds

Prior to allocating capital to a sector-specific investment vehicle focused on aerospace and defense, a thorough assessment of associated factors is paramount. The following points offer insight into crucial considerations.

Tip 1: Conduct Due Diligence on Holdings: Examine the fund’s top holdings to understand the underlying companies. Analyze their financial health, competitive positioning, and exposure to specific sub-sectors within aerospace and defense. For example, a fund heavily invested in commercial aviation manufacturers may face different risks than one focused on cybersecurity firms serving the defense industry.

Tip 2: Evaluate Fund Management Expertise: Scrutinize the fund manager’s experience and track record in the aerospace and defense sectors. Determine if they possess specialized knowledge necessary to navigate the complexities of these industries. A manager with a history of successful stock selection within the sector is a positive indicator.

Tip 3: Assess Expense Ratios and Fees: Compare the fund’s expense ratio to those of similar sector-specific funds. Higher expense ratios can erode returns, particularly over the long term. Consider any additional fees, such as sales loads or redemption fees, that may apply.

Tip 4: Understand Sector-Specific Risks: Recognize that the aerospace and defense sectors are subject to unique risks, including government regulation, budgetary constraints, and geopolitical instability. Be prepared for potentially higher volatility compared to broader market indices.

Tip 5: Consider Geopolitical Factors: Analyze global political and economic trends that may influence defense spending and aerospace development. Changes in government policies or international relations can significantly impact the performance of companies within these sectors.

Tip 6: Analyze Technological Disruption: Assess the impact of emerging technologies, such as artificial intelligence, autonomous systems, and advanced materials, on the aerospace and defense industries. Funds that invest in companies at the forefront of technological innovation may offer greater long-term growth potential.

Tip 7: Review Historical Performance: Examine the fund’s historical performance relative to its benchmark and peer group. However, past performance is not indicative of future results. Focus on understanding the factors that drove past performance and assessing whether those factors remain relevant.

These considerations are integral to making informed investment decisions. Diligent research and understanding of these nuances can contribute to a more strategic approach.

The subsequent sections will further explore the intricate elements of sector-specific investing, culminating in a comprehensive understanding of this investment strategy.

1. Sector Concentration

Sector concentration, within the context of investment strategies such as a defense-focused fund, signifies a deliberate allocation of capital towards a narrowly defined segment of the economy. This focused approach carries both inherent opportunities and inherent risks that demand meticulous evaluation.

- Industry-Specific Exposure

Sector concentration implies that a significant portion of the fund’s assets are invested in companies operating within the aerospace and defense industries. This concentrated exposure means that the fund’s performance is heavily reliant on the overall health and performance of these specific sectors. Economic downturns, shifts in government policy, or technological disruptions within these industries can have a magnified impact on the fund’s returns compared to a more diversified portfolio. For example, a major cut in defense spending by a key government could negatively impact the revenue of defense contractors held by the fund.

- Correlation of Holdings

Companies within the same sector often exhibit a high degree of correlation in their stock performance. This correlation stems from shared economic drivers, regulatory environments, and technological trends. A defense-focused fund is likely to hold companies that are similarly affected by geopolitical events or changes in military procurement strategies. This correlation reduces the diversification benefits that can be achieved with a broader investment portfolio, potentially increasing overall portfolio risk.

- Limited Diversification

By its nature, sector concentration limits the diversification potential of the investment. A defense fund offers minimal exposure to other sectors of the economy, such as technology, healthcare, or consumer discretionary. This lack of diversification can leave the fund vulnerable to sector-specific risks and reduce its ability to weather economic downturns in the aerospace and defense industries. In contrast, a diversified fund can potentially offset losses in one sector with gains in another.

- Specialized Expertise Requirement

Effective management of a sector-concentrated fund requires specialized knowledge and expertise in the relevant industry. Fund managers must possess a deep understanding of the aerospace and defense sectors, including their key players, technological advancements, regulatory landscape, and geopolitical dynamics. This expertise is crucial for identifying promising investment opportunities and mitigating sector-specific risks. Without specialized knowledge, fund managers may struggle to make informed investment decisions and generate competitive returns.

In essence, sector concentration is a defining characteristic of an investment approach centered around companies in these sectors. While it presents the potential for significant gains during periods of sector expansion, it also introduces heightened risks associated with limited diversification and industry-specific vulnerabilities. Therefore, investors should carefully weigh their risk tolerance and investment objectives before allocating capital to a sector-concentrated investment vehicle.

2. Geopolitical Sensitivity

Geopolitical sensitivity is a crucial consideration for any investment vehicle focused on the aerospace and defense sectors. Global political events and international relations exert a substantial influence on the revenue and profitability of companies within these industries, thereby directly impacting the performance of related investments.

- Defense Spending Fluctuations

Geopolitical instability and evolving security threats often lead to increased defense spending by governments worldwide. This increased demand for military equipment, technologies, and services can positively impact the financial performance of companies held within a defense-focused fund. Conversely, periods of relative peace or shifts in political priorities can result in decreased defense budgets, potentially negatively affecting these companies’ revenue streams. The ebb and flow of defense contracts are inherently tied to the global political climate.

- International Arms Trade Regulations

The international arms trade is subject to complex regulations and export controls imposed by governments and international organizations. Changes in these regulations, driven by geopolitical concerns or human rights considerations, can significantly impact the ability of defense companies to sell their products in certain markets. For example, sanctions imposed on a particular country may restrict the sale of military equipment to that nation, thereby reducing revenue for companies operating in this sector. Such limitations directly influence the value of assets within the investment portfolio.

- Cybersecurity Threats and Warfare

The rise of cyber warfare and state-sponsored cyberattacks has created a growing demand for cybersecurity solutions and services. Companies specializing in cybersecurity technologies and services for the defense industry are often beneficiaries of increased government spending and private sector investment in this area. Escalating tensions between nations in the digital realm directly translate to increased opportunities for firms operating within this niche, shaping the investment landscape.

- Impact of Trade Agreements

Trade agreements and international collaborations can influence the aerospace and defense industries through technology sharing, joint ventures, and cross-border supply chains. Shifts in trade policies, driven by geopolitical considerations, can disrupt these arrangements and affect the competitiveness of companies involved. Tariffs and trade restrictions can increase costs, reduce market access, and impact the profitability of firms participating in international trade within these sectors.

In essence, the performance of investment vehicles concentrated in these sectors is intrinsically linked to global political and diplomatic dynamics. Investors must recognize and assess the geopolitical risks and opportunities associated with these investments to make informed decisions and manage potential volatility effectively.

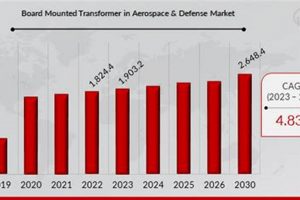

3. Technological Innovation

Technological innovation forms a bedrock component of the aerospace and defense sectors, driving demand, reshaping competitive landscapes, and ultimately influencing the performance of funds that concentrate investments within these industries. New materials science, advanced computing, artificial intelligence, and autonomous systems are directly integrated into next-generation platforms and defense capabilities. The extent to which companies adapt to and implement such innovations significantly impacts their long-term viability and revenue generation, a critical factor for a fund’s investment decisions.

The practical significance of understanding this connection lies in the ability to identify companies poised for growth and future profitability. For example, a company pioneering new hypersonic propulsion technologies may represent a more attractive investment than one relying on legacy systems. Similarly, firms specializing in advanced cybersecurity measures become increasingly vital as geopolitical tensions rise and digital warfare intensifies. Investment decisions premised on identifying technological leaders within these fields can lead to greater returns, provided the associated risks are accurately assessed and managed. The rise of unmanned aerial vehicles (UAVs) exemplifies this dynamic, creating new markets and disrupting traditional aerospace business models.

In conclusion, technological innovation is not merely a feature but a fundamental driver within the aerospace and defense industries. The capacity of companies to innovate and adopt new technologies directly correlates with their competitiveness and long-term value. For a fund with focused investment in these sectors, identifying and investing in technology leaders is paramount to achieving sustained success. This requires a constant evaluation of emerging trends, robust due diligence, and a clear understanding of the competitive dynamics within this technologically intensive environment.

4. Regulatory Impact

The aerospace and defense industries are subject to extensive and multifaceted regulations, significantly impacting the operational landscape and financial performance of companies within these sectors. These regulations, imposed by governmental bodies and international organizations, govern various aspects of their operations, from product development and manufacturing to export controls and environmental compliance. For a fund focused on these industries, the ability of portfolio companies to navigate and comply with this complex regulatory framework is a critical determinant of their long-term viability and profitability.

Consider the impact of export control regulations. Companies engaged in the international sale of military equipment and technologies are subject to stringent export controls imposed by national governments and international treaties. These controls dictate which products can be exported to which countries, often based on geopolitical considerations and human rights concerns. Changes in export control policies can have a direct impact on the revenue streams of defense contractors, potentially affecting the value of their stock. Similarly, environmental regulations related to manufacturing processes and waste disposal can impose significant costs on aerospace and defense companies. Compliance with these regulations requires investments in cleaner technologies and waste management systems, impacting profitability. For instance, the implementation of stricter emissions standards for aircraft engines can force manufacturers to invest heavily in research and development, potentially leading to increased costs and reduced profit margins in the short term. Moreover, government contracting regulations exert a substantial influence on the aerospace and defense industries. Companies that rely heavily on government contracts for revenue are subject to specific regulations related to procurement processes, pricing, and performance standards. Changes in government procurement policies, such as increased competition or stricter performance requirements, can impact the ability of companies to win contracts and maintain their profitability. A shift towards fixed-price contracts, for example, can expose companies to greater cost risks if they underestimate the costs of delivering on a project.

In conclusion, a comprehensive understanding of the regulatory landscape is paramount for assessing the potential risks and opportunities associated with investments in the aerospace and defense sectors. The ability of companies to navigate and comply with these regulations is a key factor in determining their long-term success and, consequently, the performance of investment vehicles focused on these industries. A failure to account for regulatory risks can lead to adverse financial consequences and diminished investment returns. Therefore, rigorous due diligence and continuous monitoring of regulatory developments are essential components of an effective investment strategy in these highly regulated sectors.

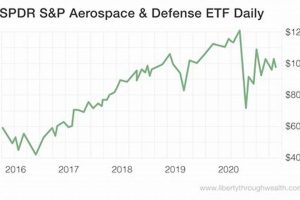

5. Performance Volatility

Performance volatility is a significant characteristic influencing investment decisions related to sector-specific funds, including those focused on the aerospace and defense industries. The inherent nature of these sectors, driven by geopolitical events, technological advancements, and government policies, leads to fluctuations in returns that investors must understand and manage.

- Geopolitical Events and Market Reaction

Geopolitical events, such as international conflicts, shifts in political alliances, or changes in defense spending priorities, can trigger rapid and significant market reactions within the aerospace and defense sectors. These events often create uncertainty and affect investor sentiment, leading to price swings in related stocks. For example, the announcement of a new defense contract can cause a stock to surge, while an unexpected arms control agreement may trigger a decline. Such reactions directly impact the value of a fund heavily invested in these securities.

- Dependency on Government Spending

Aerospace and defense companies often rely heavily on government contracts, making them susceptible to changes in government spending policies and budgetary constraints. Budget cuts, shifts in procurement strategies, or delays in contract approvals can negatively impact revenue streams and profitability. This dependence introduces volatility into the performance of the fund, as its holdings are sensitive to government decisions and political processes. A sudden reduction in military spending, for instance, can create downward pressure on the fund’s net asset value.

- Technological Innovation and Disruption

Rapid technological innovation, while potentially driving long-term growth, can also contribute to short-term volatility. Breakthroughs in areas such as artificial intelligence, autonomous systems, or advanced materials can disrupt established business models and create winners and losers within the aerospace and defense sectors. Companies that fail to adapt to new technologies may face declining revenues and reduced market share, impacting the overall performance of a fund that holds these stocks. The introduction of new technologies can lead to both opportunities and risks.

- Global Economic Factors

Global economic factors, such as economic recessions, trade disputes, and currency fluctuations, can also influence the performance of aerospace and defense companies. Economic downturns may lead to reduced defense spending or decreased demand for commercial aerospace products, affecting the financial performance of these companies. Trade disputes and currency fluctuations can impact the competitiveness of companies engaged in international trade, adding another layer of volatility to the fund’s performance. Macroeconomic conditions, therefore, are external factors.

These factors illustrate the inherent performance volatility associated with investments in aerospace and defense sectors. Investors considering sector-specific funds must acknowledge these influences and assess their risk tolerance before allocating capital. Effective risk management strategies and a long-term investment horizon are crucial for navigating the potential ups and downs inherent in this specialized area of the market.

6. Expense Ratio

The expense ratio represents a pivotal consideration when evaluating investment prospects, especially those focused within specialized sectors such as the aerospace and defense industries. For an investment vehicle concentrating its holdings within these sectors, the expense ratio directly reduces the total return realized by investors. The expense ratio comprises the annual costs associated with managing and operating the fund, expressed as a percentage of the fund’s average net assets. Higher expense ratios translate directly to lower net returns for investors, all other factors being equal. For example, if a specific investment vehicle achieves a gross return of 10% in a given year, and its expense ratio is 1.5%, the net return to investors would be 8.5%.

The importance of the expense ratio is amplified in the context of sector-specific funds due to their inherent volatility and potential for fluctuating returns. In periods of market turbulence or underperformance, a high expense ratio can significantly erode the overall value of the investment. Consequently, prospective investors should carefully compare the expense ratios of similar funds within the aerospace and defense sector, seeking to identify options that offer competitive pricing without sacrificing fund quality or management expertise. Lower expense ratios allow a greater portion of the fund’s returns to accrue to the investor, contributing to improved long-term investment outcomes. Conversely, funds with higher expense ratios must generate commensurately higher returns to justify the added cost. However, consistently achieving such superior performance is not guaranteed, increasing the risk associated with high-expense funds.

In conclusion, the expense ratio is a fundamental determinant of investment value, particularly within sector-focused funds. The interplay between potential returns and associated costs should be rigorously analyzed to inform investment decisions. Investors should seek out strategies that offer competitive expense ratios while maintaining a strong track record and a clearly defined investment approach. Effective management of expenses is crucial for maximizing net returns and achieving long-term investment objectives. Challenges, though, arise when additional due diligence is required to assess fees associated with the fund. This assessment is critical to accurately forecast potential returns and manage investments effectively.

Frequently Asked Questions

The following questions address common inquiries regarding investment vehicles focused on the aerospace and defense sectors. These answers provide objective information to aid in informed decision-making.

Question 1: What constitutes the core investment focus of a fund targeting the aerospace and defense industries?

The fund concentrates its investments in companies deriving a significant portion of their revenue from the aerospace and defense sectors. This encompasses firms involved in the design, manufacture, and support of aircraft, spacecraft, defense systems, and related technologies.

Question 2: How does geopolitical instability impact the performance of such an investment fund?

Geopolitical instability can directly influence the fund’s performance. Heightened global tensions may lead to increased defense spending, benefiting companies within the aerospace and defense sectors. Conversely, periods of relative peace or arms control agreements may negatively impact defense spending and, consequently, fund performance.

Question 3: What risks are associated with sector-specific investment in aerospace and defense?

Risks include concentration risk, geopolitical risk, regulatory risk, and technological obsolescence risk. Concentration risk arises from limited diversification across sectors. Geopolitical risk stems from the sensitivity of the industry to international events. Regulatory risk relates to changes in government policies and export controls. Technological obsolescence risk arises from the rapid pace of innovation in the industry.

Question 4: How does technological innovation affect the long-term prospects of companies held within the fund?

Technological innovation plays a crucial role in the long-term prospects of companies held within the fund. Companies that successfully develop and adopt new technologies are more likely to maintain their competitiveness and profitability. Those that fail to innovate may face declining revenues and reduced market share.

Question 5: What role do government contracts play in the financial performance of aerospace and defense companies?

Government contracts are a significant source of revenue for many aerospace and defense companies. The ability to win and execute government contracts efficiently is a key determinant of financial performance. Changes in government procurement policies or budgetary constraints can significantly impact the revenue streams of these companies.

Question 6: How should potential investors evaluate the suitability of this type of investment for their portfolios?

Potential investors should carefully consider their risk tolerance, investment objectives, and time horizon. Sector-specific investments are generally more volatile than diversified portfolios. Investors should also assess the fund’s expense ratio, management expertise, and historical performance before making an investment decision.

Understanding these factors is crucial for managing potential investment risks and maximizing returns within this specialized sector.

The following segments will delve into practical considerations for managing investment portfolios in specialized sectors.

Fidelity Aerospace and Defense Fund

This analysis has provided a comprehensive examination of the fidelity aerospace and defense fund, elucidating its operational focus, inherent sensitivities, and potential benefits. The discussion has emphasized the critical importance of understanding sector concentration, geopolitical influences, technological advancements, regulatory impacts, performance volatility, and expense ratios. These elements collectively shape the investment characteristics of the fund and dictate its responsiveness to market forces and external events.

The fund represents a strategic investment option for those seeking targeted exposure to the aerospace and defense sectors. However, prospective investors must conduct thorough due diligence, carefully weighing the potential rewards against the inherent risks. Prudent assessment and informed decision-making are paramount for navigating the complexities of this specialized investment area, ensuring alignment with individual financial goals and risk tolerance.