An investment vehicle concentrating on companies within the aerospace and defense industries. These entities are involved in the research, development, manufacture, and support of aircraft, spacecraft, defense systems, and related technologies. These funds provide a way for investors to gain targeted exposure to this specialized sector of the market.

The significance of such an investment approach stems from the unique characteristics of the aerospace and defense sector. It is often driven by government spending, technological innovation, and geopolitical factors. Historically, these industries have played a critical role in national security and economic development. Investing in companies focused on these areas can offer portfolio diversification and potential for long-term growth, influenced by ongoing advancements and global events.

The subsequent sections will delve into specific aspects of investing in the aerospace and defense industries, including the key drivers, potential risks, and strategies for evaluating investment opportunities in this sector. This will provide a broader understanding of the landscape and considerations for prospective investors.

Insights for Evaluating Investments in the Aerospace and Defense Sector

Approaching investments within this industry requires a specific understanding of key factors and market dynamics. The following points offer guidance for navigating this specialized investment landscape.

Tip 1: Assess Geopolitical Factors: The aerospace and defense sector is intrinsically linked to geopolitical events and international relations. Analyze prevailing global tensions and defense spending trends in various nations to anticipate potential market shifts.

Tip 2: Evaluate Government Contracts and Regulations: A significant portion of revenue for aerospace and defense companies is derived from government contracts. Scrutinize the nature, duration, and profitability of these contracts, as well as relevant regulatory changes that could impact company performance.

Tip 3: Analyze Technological Innovation: The sector is characterized by constant technological advancements. Identify companies investing in cutting-edge technologies such as artificial intelligence, unmanned systems, and advanced materials, as these innovations can drive future growth.

Tip 4: Review Financial Performance: Thoroughly examine a company’s financial statements, including revenue growth, profit margins, debt levels, and cash flow. A strong financial foundation is crucial for weathering economic downturns and funding research and development initiatives.

Tip 5: Consider Diversification within the Sector: Diversifying investments across various sub-sectors within aerospace and defense, such as aircraft manufacturers, component suppliers, and cybersecurity firms, can mitigate risk.

Tip 6: Monitor Supply Chain Resilience: Disruptions in the global supply chain can significantly impact the aerospace and defense industry. Assess the resilience of a company’s supply chain and its ability to manage potential disruptions.

Tip 7: Understand the Competitive Landscape: Identify key competitors within the sector and assess their market share, technological capabilities, and strategic partnerships. A strong competitive position is essential for long-term success.

Careful consideration of these factors is essential for making informed investment decisions in the aerospace and defense sector. A comprehensive understanding of the industry’s dynamics can contribute to a more successful investment strategy.

The succeeding sections will provide a more detailed analysis of risks and opportunities, as well as potential strategies for portfolio construction within the aerospace and defense market.

1. Sector Specialization

Sector specialization, as it pertains to investment funds, signifies a focused allocation of capital within a specific industry. For an entity such as the fidelity aerospace defense fund, this concentration dictates that the fund’s holdings predominantly consist of companies operating within the aerospace and defense sectors. This singular focus carries distinct implications for both the fund’s potential returns and associated risks.

- Concentrated Industry Exposure

The fund’s performance is inextricably linked to the health and trajectory of the aerospace and defense industries. Positive developments, such as increased government defense spending or technological breakthroughs, can significantly boost returns. Conversely, downturns in these sectors, due to factors like budget cuts or regulatory changes, can negatively impact the fund’s value. This concentration amplifies both potential gains and losses compared to a more diversified investment approach.

- Technological Innovation as a Key Driver

The aerospace and defense sectors are characterized by rapid technological advancement. Companies that successfully innovate and develop new technologies often experience significant growth. A specialized fund may benefit from identifying and investing in firms at the forefront of these innovations, such as advanced materials, artificial intelligence, or hypersonic systems. However, the fund’s success is contingent upon the accurate assessment of technological trends and the competitive landscape.

- Geopolitical Influence

The aerospace and defense industries are acutely sensitive to geopolitical events and shifts in international relations. Increased global instability or escalating conflicts often lead to higher defense spending, which can benefit companies in this sector. Conversely, periods of peace and disarmament can result in reduced defense budgets and decreased demand for aerospace and defense products. A specialized fund must carefully consider these geopolitical factors and their potential impact on portfolio companies.

- Regulatory and Contractual Dependencies

Many aerospace and defense companies rely heavily on government contracts. The terms and conditions of these contracts, as well as relevant regulations, can significantly impact a company’s profitability and future prospects. A specialized fund needs to thoroughly analyze the regulatory landscape and the contractual relationships of its portfolio companies to assess their long-term viability.

In essence, sector specialization within the fidelity aerospace defense fund offers investors targeted exposure to a specific segment of the market. However, it also necessitates a comprehensive understanding of the unique factors that drive the aerospace and defense industries, including technological innovation, geopolitical influences, and regulatory considerations. A thorough assessment of these factors is crucial for making informed investment decisions and managing the inherent risks associated with this focused investment approach.

2. Geopolitical Sensitivity

Geopolitical sensitivity constitutes a critical factor influencing the performance and stability of investment vehicles such as the fidelity aerospace defense fund. This sensitivity arises from the aerospace and defense industries’ direct connection to global political dynamics, international relations, and national security considerations.

- Defense Spending Fluctuations

Government defense budgets are directly influenced by geopolitical tensions and perceived threats. Escalating conflicts or rising international instability typically result in increased defense spending, benefiting companies within the aerospace and defense sectors. Conversely, periods of relative peace or arms control agreements may lead to reduced defense budgets, negatively impacting these companies. The fidelity aerospace defense fund is, therefore, subject to the ebb and flow of government spending driven by global political events.

- International Arms Trade and Export Policies

The aerospace and defense industries are heavily involved in the international arms trade. Changes in export policies, sanctions, or international agreements can significantly affect the ability of companies to sell their products and services to foreign governments. The fidelity aerospace defense fund is vulnerable to policy shifts that restrict or facilitate international arms sales, potentially affecting the revenue streams of its constituent companies.

- Geopolitical Hotspots and Regional Conflicts

Active conflicts or unstable regions create demand for aerospace and defense products and services. Companies that provide equipment, technology, or support to governments involved in these conflicts may experience increased revenue. However, investments in companies directly supporting conflict zones also carry ethical considerations and potential reputational risks for the fidelity aerospace defense fund.

- Technological Competition and Espionage

Nations engage in intense technological competition within the aerospace and defense sectors. Concerns about espionage, intellectual property theft, and cyber warfare drive investments in cybersecurity and advanced defense technologies. The fidelity aerospace defense fund may benefit from companies developing innovative solutions to counter these threats, but it is also exposed to the risks associated with rapidly evolving technologies and potential security breaches.

In summary, the performance of the fidelity aerospace defense fund is intrinsically linked to geopolitical factors. Changes in defense spending, international trade policies, regional conflicts, and technological competition all contribute to the complex interplay between global politics and investment returns. A comprehensive understanding of these geopolitical dynamics is essential for assessing the risks and opportunities associated with investments in the aerospace and defense industries.

3. Technological Innovation

Technological innovation serves as a core determinant of value and growth within the aerospace and defense industries, directly influencing the potential returns of investment vehicles such as the fidelity aerospace defense fund. Constant advancements in materials, propulsion, sensors, and computing power are reshaping the competitive landscape, driving demand for new capabilities and creating investment opportunities.

- Advanced Materials and Manufacturing

The development of lightweight, high-strength materials, coupled with advanced manufacturing techniques like 3D printing, enables the production of more efficient and cost-effective aircraft and defense systems. Companies that pioneer these technologies gain a competitive edge, potentially increasing their market share and profitability, thereby affecting the fidelity aerospace defense fund positively. Examples include the use of carbon fiber composites in commercial aircraft and additive manufacturing for complex engine components.

- Autonomous Systems and Robotics

Autonomous systems, including drones and unmanned ground vehicles, are transforming military and commercial operations. Companies developing advanced autonomy algorithms, sensor fusion technologies, and robotic platforms are poised for significant growth. Investment in these companies through the fidelity aerospace defense fund can provide exposure to this rapidly expanding market. Military applications range from surveillance and reconnaissance to combat support, while commercial applications include package delivery and infrastructure inspection.

- Cybersecurity and Electronic Warfare

As reliance on digital systems increases, the threat of cyberattacks and electronic warfare becomes more pronounced. Companies specializing in cybersecurity solutions, encryption technologies, and electronic warfare systems are critical for protecting sensitive data and critical infrastructure. The fidelity aerospace defense fund benefits from investments in these companies, which are experiencing increased demand from both government and commercial sectors. Examples include companies developing advanced threat detection systems and secure communication protocols.

- Space Technologies and Exploration

The renewed focus on space exploration and the commercialization of space-based services are creating new opportunities for companies involved in satellite manufacturing, launch services, and space-based data analytics. Companies that are innovating in areas such as reusable rockets, satellite constellations, and deep space exploration technologies are attracting significant investment. The fidelity aerospace defense fund may capitalize on this trend by investing in companies at the forefront of space technology innovation, aligning with the growing importance of space-based assets for both defense and commercial purposes.

These facets of technological innovation highlight the dynamic nature of the aerospace and defense industries. The fidelity aerospace defense fund‘s success depends on its ability to identify and invest in companies that are driving these technological advancements, adapting to evolving market demands, and securing a competitive advantage in a rapidly changing global landscape. Furthermore, careful evaluation of the risks associated with technological obsolescence and disruptive innovations is essential for long-term investment success.

4. Government Contracts

Government contracts constitute a fundamental pillar supporting the financial stability and growth prospects of companies within the aerospace and defense industries. The fidelity aerospace defense fund, as an investment vehicle focused on this sector, is significantly influenced by the acquisition, execution, and potential renewal of these agreements.

- Revenue Generation and Predictability

Government contracts often represent a substantial portion of the revenue stream for aerospace and defense companies. These contracts, which can span multiple years, provide a degree of predictability in earnings and cash flow, making these companies attractive to investors. The fidelity aerospace defense fund‘s performance is directly tied to the ability of its constituent companies to secure and fulfill these revenue-generating agreements. For instance, a multi-billion dollar contract for fighter jet production provides a stable income stream for the manufacturer, positively impacting the fund’s value.

- Influence of Political and Budgetary Factors

Government defense budgets and political priorities exert a significant influence on the allocation of contracts. Changes in administration, shifts in foreign policy, or budgetary constraints can lead to fluctuations in defense spending, directly impacting the opportunities available to aerospace and defense companies. The fidelity aerospace defense fund is susceptible to these political and budgetary shifts, requiring careful monitoring of government policies and spending trends. Cancellation of a major defense program due to budget cuts, for example, can negatively affect the funds portfolio companies.

- Rigorous Regulatory Oversight and Compliance

Government contracts are subject to stringent regulatory oversight and compliance requirements. Companies must adhere to complex regulations regarding cost accounting, quality control, and ethical conduct. Failure to comply with these regulations can result in penalties, contract termination, and reputational damage. Therefore, the fidelity aerospace defense fund implicitly invests in companies capable of navigating this complex regulatory landscape, mitigating risks associated with non-compliance. Regular audits and compliance checks are crucial for companies holding these contracts.

- Technological Advancement and Innovation Mandates

Government contracts often incentivize or mandate technological advancement and innovation. These agreements may include provisions for research and development, pushing companies to invest in cutting-edge technologies. The fidelity aerospace defense fund benefits from the resulting innovation and technological progress, as it invests in companies at the forefront of aerospace and defense technology. For instance, contracts for developing next-generation missile defense systems drive advancements in radar technology and artificial intelligence.

In essence, government contracts are a critical lifeline for the companies held within the fidelity aerospace defense fund. While these contracts offer stability and revenue, they are also subject to political, budgetary, and regulatory influences that investors must carefully consider. A comprehensive understanding of the government contracting environment is essential for assessing the risks and opportunities associated with investments in this sector.

5. Risk Mitigation

Risk mitigation strategies are critical considerations for investors evaluating the fidelity aerospace defense fund. The specialized nature of the aerospace and defense industries necessitates a comprehensive approach to managing potential downsides and preserving capital.

- Diversification within the Sector

The fidelity aerospace defense fund can employ diversification within the aerospace and defense sector as a risk mitigation technique. This involves allocating investments across various sub-sectors, such as aircraft manufacturers, component suppliers, cybersecurity firms, and space technology companies. Diversification reduces the impact of adverse events affecting a single company or sub-sector on the overall performance of the fund. For example, if one aircraft manufacturer experiences production delays due to supply chain issues, the fund’s exposure to other, unaffected companies can help offset the negative impact.

- Geopolitical Analysis and Hedging

Given the inherent geopolitical sensitivity of the aerospace and defense industries, rigorous analysis of global political trends is essential for risk mitigation. The fidelity aerospace defense fund may utilize hedging strategies to protect against adverse geopolitical events. This could involve taking positions in companies that benefit from increased defense spending during times of international tension, or using currency hedges to mitigate the impact of exchange rate fluctuations on international revenue streams. Proactive assessment of geopolitical risks allows for strategic adjustments to the fund’s portfolio, minimizing potential losses.

- Contractual Due Diligence

The fidelity aerospace defense fund‘s success relies on the ability of its constituent companies to secure and fulfill government contracts. Thorough due diligence of these contracts is crucial for risk mitigation. This involves analyzing the terms and conditions of contracts, assessing the financial stability of the contracting parties, and evaluating the potential for contract disputes or cancellations. Understanding the intricacies of government contracting allows the fund to identify and avoid investments in companies with high-risk contractual relationships. Scrutinizing contract clauses and performance metrics can prevent exposure to companies with poorly structured or unsustainable agreements.

- Technological Risk Assessment

The aerospace and defense industries are characterized by rapid technological advancements. However, not all technological innovations are successful, and companies that fail to adapt to new technologies risk becoming obsolete. The fidelity aerospace defense fund must conduct thorough technological risk assessments to identify companies with sustainable competitive advantages. This involves evaluating the potential for disruptive technologies to displace existing products and services, as well as assessing the ability of companies to innovate and adapt to changing market demands. Careful analysis of research and development spending, patent portfolios, and technological partnerships allows the fund to identify and mitigate risks associated with technological obsolescence. Investing in companies with diversified technology portfolios can minimize the impact of any single technology failing to achieve commercial success.

These facets of risk mitigation demonstrate the importance of a proactive and informed approach to investing in the aerospace and defense industries. The fidelity aerospace defense fund can employ these strategies to protect investor capital and enhance long-term returns in this specialized sector.

Frequently Asked Questions Regarding the Fidelity Aerospace Defense Fund

The following questions and answers address common inquiries and concerns regarding investment in the Fidelity Aerospace Defense Fund, providing clarification on its objectives, strategies, and inherent risks.

Question 1: What constitutes the primary investment objective of the Fidelity Aerospace Defense Fund?

The fund’s objective is to seek capital appreciation by primarily investing in securities of companies engaged in aerospace and defense industries. It aims to provide investors with targeted exposure to this specialized sector.

Question 2: What are the principal investment strategies employed by the fund?

The fund invests predominantly in common stocks of companies involved in the design, manufacture, or sale of aerospace or defense products and services. Investment decisions are based on fundamental analysis, evaluating factors such as financial health, competitive positioning, and growth potential.

Question 3: What are the primary risks associated with investing in the Fidelity Aerospace Defense Fund?

The fund is subject to sector-specific risks, including fluctuations in government defense spending, geopolitical events, and technological advancements. It may also experience greater volatility compared to more broadly diversified investment options.

Question 4: How does the fund address the geopolitical sensitivity inherent in the aerospace and defense industries?

The fund’s investment managers closely monitor global political and economic trends to assess potential impacts on portfolio companies. Strategies may include diversification across geographic regions and hedging against currency fluctuations.

Question 5: What is the fund’s approach to evaluating technological innovation within the aerospace and defense sectors?

The fund assesses companies’ investments in research and development, patent portfolios, and competitive positioning in emerging technologies. It seeks to identify companies with sustainable advantages in areas such as autonomous systems, cybersecurity, and advanced materials.

Question 6: How does the fund manage the risks associated with government contracts?

The fund evaluates the terms and conditions of government contracts, assesses the financial stability of contracting parties, and monitors compliance with regulatory requirements. It aims to minimize exposure to companies with poorly structured or high-risk contractual relationships.

Key takeaways include the fund’s focus on capital appreciation through investments in aerospace and defense companies, its reliance on fundamental analysis and monitoring of geopolitical factors, and its awareness of sector-specific risks.

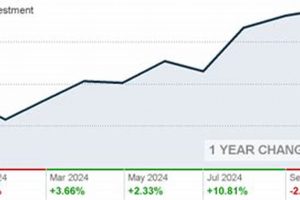

The succeeding sections will provide a more in-depth look at the historical performance and portfolio composition of the Fidelity Aerospace Defense Fund.

Concluding Remarks

This exploration of the fidelity aerospace defense fund has underscored its unique characteristics and investment dynamics. The fund’s performance is inextricably linked to a confluence of factors, including government spending patterns, geopolitical stability, and the pace of technological innovation within the aerospace and defense industries. Careful consideration of these elements is crucial for informed investment decisions.

The fidelity aerospace defense fund presents a specialized investment opportunity with both inherent potential and associated risks. Prospective investors should conduct thorough due diligence, assess their individual risk tolerance, and carefully evaluate the fund’s suitability for their specific financial objectives. Continued monitoring of market trends and geopolitical developments remains essential for navigating this dynamic sector.