The current valuation of shares in General Electric’s aerospace division reflects investor sentiment regarding the company’s performance and prospects. Market activity can indicate the perceived health of the business, influenced by factors such as earnings reports, industry trends, and broader economic conditions. For example, increased trading volume paired with a rising share price might suggest growing confidence in the aerospace sector and the specific company’s ability to capitalize on opportunities.

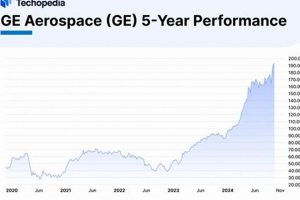

The significance of monitoring these shares lies in their potential to serve as a benchmark for the aerospace industry’s overall stability and growth potential. Examining their past performance offers a historical perspective on market fluctuations and the division’s resilience to economic downturns. This data can be crucial for analysts and investors aiming to understand long-term investment strategies and assessing the risks associated with the aerospace sector.

This analysis will now delve into the key factors influencing the price of these shares, exploring recent news, financial performance indicators, and expert opinions that shape the market’s perception of the aerospace entity and its future trajectory.

The following are key considerations for individuals or entities contemplating investment decisions related to these shares. These tips are designed to promote informed decision-making based on comprehensive analysis.

Tip 1: Assess the Company’s Financial Performance: Examine key financial metrics, including revenue growth, profit margins, and earnings per share. A consistent upward trend suggests a healthy and profitable enterprise.

Tip 2: Evaluate the Competitive Landscape: Analyze the company’s position relative to its competitors within the aerospace industry. A strong market share and technological advantage often translate to sustained success.

Tip 3: Monitor Industry Trends: Stay abreast of emerging trends in the aerospace sector, such as advancements in sustainable aviation and the increasing demand for air travel. Understanding these trends can provide insight into future growth opportunities.

Tip 4: Analyze Management’s Strategy: Scrutinize the company’s strategic plans, including investments in research and development, mergers and acquisitions, and international expansion initiatives. A clear and well-defined strategy can signal future success.

Tip 5: Consider Macroeconomic Factors: Account for macroeconomic factors, such as interest rates, inflation, and geopolitical events. These factors can significantly impact the overall market and the performance of individual stocks.

Tip 6: Review Analyst Ratings and Reports: Consult analyst ratings and reports from reputable financial institutions. These resources can provide valuable insights and independent assessments of the company’s prospects.

Tip 7: Understand the Company’s Debt Levels: Analyze the company’s debt-to-equity ratio and ability to service its debt obligations. Excessive debt can pose a risk to financial stability.

Adherence to these guidelines aims to promote responsible and informed decision-making, contributing to a comprehensive understanding of the investment’s potential risks and rewards.

These considerations provide a foundation for further investigation, leading to a more nuanced understanding of the factors influencing the shares’ performance and long-term investment potential.

1. Current Market Value

The current market value of GE Aerospace stock represents the prevailing consensus estimate of its worth within the financial markets. This metric is a dynamic figure, reflecting a multitude of factors that influence investor sentiment and trading activity concerning the stock.

- Price Discovery Mechanism

The current market value emerges from the continuous interaction of buyers and sellers in the stock market. The last traded price establishes this figure, acting as a snapshot of the collective valuation assigned to the company’s shares at a specific moment. This price discovery mechanism is affected by fundamental analysis, technical analysis, and market psychology.

- Impact of Financial Performance

Announcements regarding GE Aerospace’s financial performance, such as quarterly earnings reports, significantly influence its current market value. Positive results, including revenue growth, increased profitability, and strong cash flow, typically lead to an increase in the share price. Conversely, negative results may trigger a decline.

- Influence of Industry Trends and News

Broader industry trends, such as the overall health of the aerospace sector, demand for air travel, and technological advancements, play a crucial role. News events, including regulatory changes, contract wins, and competitive pressures, also contribute to fluctuations in the company’s stock value.

- Role of Investor Sentiment and Macroeconomic Conditions

Investor sentiment, often driven by broader macroeconomic conditions such as interest rates, inflation, and geopolitical events, can amplify or dampen the impact of fundamental factors. A positive market environment may support a higher valuation, while economic uncertainty can lead to increased volatility and potential downward pressure.

In essence, the current market value of GE Aerospace stock is not merely a number but rather a complex indicator reflecting the interplay of various factors. It serves as a key data point for investors making decisions about buying, selling, or holding the stock, requiring careful consideration of the underlying factors that drive its fluctuations.

2. Trading Volume Analysis

Trading volume analysis, as applied to General Electric Aerospace stock, provides insights into the level of investor interest and participation. High trading volume, relative to its average, typically signifies a period of heightened activity, often correlated with significant news or shifts in market sentiment.

- Confirmation of Price Trends

Increased trading volume can validate existing price trends. For instance, a rising stock price accompanied by increasing volume suggests strong buying pressure and may indicate the continuation of the upward trend. Conversely, a declining price with increased volume may signal significant selling pressure, potentially foreshadowing further price declines.

- Identification of Reversal Patterns

Spikes in trading volume can sometimes precede or coincide with reversal patterns. For example, after a prolonged downtrend, a sharp increase in volume coupled with a price increase might suggest that the selling pressure is abating, and a potential reversal is imminent. These volume spikes often indicate a shift in market sentiment.

- Gauging Market Liquidity

Trading volume serves as an indicator of market liquidity. High volume generally signifies greater liquidity, making it easier for investors to buy or sell shares without significantly impacting the stock price. Low volume, conversely, may indicate reduced liquidity, potentially leading to wider bid-ask spreads and increased price volatility.

- Assessing Institutional Activity

Analyzing trading volume can provide clues about the involvement of institutional investors, such as hedge funds and mutual funds. Large block trades, characterized by the trading of a significant number of shares in a single transaction, are often indicative of institutional activity. Tracking these large trades can offer insights into the investment strategies and sentiment of these influential market participants.

In summary, trading volume analysis offers a valuable perspective on the market dynamics surrounding General Electric Aerospace stock. By considering volume in conjunction with price movements and other market indicators, analysts and investors can gain a more comprehensive understanding of the underlying forces driving the stock’s performance.

3. Daily Price Fluctuation

Daily price fluctuation is an inherent characteristic of General Electric Aerospace stock, stemming from a confluence of factors that influence market perception and trading activity. This variability, measured by the difference between the highest and lowest price recorded for the stock within a single trading day, serves as a microcosm of the broader market forces at play. For example, the release of quarterly earnings figuresexceeding or falling short of expectationscan trigger substantial price swings within hours. Similarly, announcements related to new contracts, regulatory changes, or industry-wide trends have the potential to induce significant intraday volatility. Consequently, this daily movement represents an accessible, real-time indicator of the market’s immediate response to incoming information.

The magnitude and frequency of these daily fluctuations are critical components in assessing the risk associated with General Electric Aerospace stock. High volatility, characterized by wider price swings, suggests a greater potential for both gains and losses, attracting speculative traders while simultaneously deterring risk-averse investors. Conversely, lower volatility, marked by narrower price ranges, indicates relative stability, potentially appealing to long-term investors seeking steady growth. Analyzing historical patterns of daily price movement, including the average true range (ATR) and standard deviation of daily returns, allows market participants to quantify this risk and tailor their investment strategies accordingly. For instance, a fund manager might adjust position sizes based on the stock’s daily volatility, reducing exposure during periods of heightened uncertainty.

In conclusion, the daily price fluctuation of General Electric Aerospace stock is not merely a random occurrence but a complex reflection of the interplay between information flow, investor sentiment, and market dynamics. Monitoring and understanding these fluctuations enables informed decision-making, allowing investors to navigate the inherent risks and capitalize on potential opportunities within the aerospace sector. However, challenges remain in accurately predicting the magnitude and direction of these movements, underscoring the importance of continuous analysis and a comprehensive understanding of the underlying market forces.

4. Investor Sentiment

Investor sentiment exerts a significant, often decisive, influence on General Electric Aerospace shares. This sentiment, broadly defined as the overall attitude or feeling of investors toward the stock, manifests in trading behavior and directly affects its price. Positive sentiment, driven by favorable news, strong earnings reports, or optimistic industry forecasts, typically results in increased buying pressure, pushing the share price upward. Conversely, negative sentiment, fueled by concerns about economic conditions, competitive pressures, or unfavorable company news, can lead to selling pressure and a subsequent price decline. The cause-and-effect relationship is demonstrable; for example, following GE Aerospace’s announcement of a major contract win, investor sentiment often improves, leading to a corresponding increase in share value.

Investor sentiment is not merely a peripheral factor but an intrinsic component of the stock’s valuation. It reflects the collective expectations of the market regarding the company’s future performance. These expectations, whether justified or not, drive investment decisions and thus directly shape the stock’s trajectory. The practical significance of understanding investor sentiment lies in its potential to anticipate future price movements. Tools like sentiment analysis, which examines news articles, social media, and financial reports for indicators of optimism or pessimism, can provide insights into the prevailing market mood. Furthermore, monitoring put/call ratios, which compare the volume of put options (bets on a price decrease) to call options (bets on a price increase), can offer a quantitative measure of investor sentiment.

In summary, investor sentiment forms a critical link in the dynamics of General Electric Aerospace shares. It shapes price movements, influences trading decisions, and reflects market expectations. While challenges exist in accurately gauging and predicting sentiment, its impact cannot be overlooked. The ability to interpret and understand investor sentiment provides a valuable advantage for market participants seeking to navigate the complexities of stock valuation and trading strategies, with a comprehensive understanding of financial markets, company performance, and other influencing variables.

5. Industry Performance Correlation

The degree to which the valuation of General Electric Aerospace shares aligns with the broader aerospace and defense sector provides critical context for assessing its individual performance and potential investment appeal. This correlation reveals whether factors affecting the industry as a whole are influencing the stock’s trajectory or if company-specific dynamics are primarily responsible for its movements.

- Benchmarking Against Peers

Comparing the performance of General Electric Aerospace shares against those of its direct competitors, such as Boeing, RTX Corporation (formerly Raytheon Technologies), and Airbus (via relevant indices), allows investors to determine if the stock is over- or undervalued relative to its peers. A stock trading at a discount to its peers may represent a buying opportunity, assuming the company’s fundamentals are sound. Conversely, a stock trading at a premium may signal overvaluation or reflect strong investor confidence in the company’s future prospects. Boeing’s struggles with the 737 MAX, for instance, may temporarily benefit other companies in the same space.

- Sensitivity to Sector-Specific News

The extent to which General Electric Aerospace shares react to sector-specific news, such as changes in defense spending, airline industry performance, or technological advancements in aerospace, indicates its sensitivity to broader industry trends. High sensitivity suggests that the stock is closely tied to the overall health of the aerospace sector, while low sensitivity may indicate that company-specific factors are more dominant drivers of its performance. For example, increased global military spending typically drives positive revenue forecasts for major defense contractors.

- Impact of Economic Cycles

The aerospace industry is inherently cyclical, with its fortunes often tied to broader economic cycles. Analyzing the correlation between General Electric Aerospace stock and economic indicators, such as GDP growth, consumer confidence, and interest rates, can provide insights into its vulnerability to economic downturns. A strong positive correlation may suggest that the stock is susceptible to declines during economic recessions, while a weak correlation may indicate greater resilience. Rising interest rates, for example, can negatively impact the airline industry’s profitability, which subsequently ripples through the entire aerospace supply chain.

- Technological Disruption and Innovation

The aerospace sector is constantly evolving, with disruptive technologies and innovations reshaping the competitive landscape. Assessing the correlation between General Electric Aerospace stock and advancements in areas such as sustainable aviation, autonomous flight, and space exploration can reveal its capacity to adapt to and capitalize on emerging trends. A company with a strong innovation pipeline and a demonstrated ability to commercialize new technologies may be better positioned to outperform its peers in the long run. Companies investing heavily in electric propulsion for aircraft are, for example, potentially positioning themselves for long-term success and gaining favorable public sentiment.

Ultimately, understanding the industry performance correlation of General Electric Aerospace shares provides a valuable tool for assessing its relative value, identifying potential risks and opportunities, and making informed investment decisions. This correlation should be viewed in conjunction with company-specific factors and broader market conditions to develop a comprehensive investment strategy. It is useful to remember the cyclical nature of the aviation and aerospace industries when making long-term investment decisions.

Frequently Asked Questions

This section addresses common inquiries regarding the variables that impact the valuation and performance of General Electric Aerospace shares in the market.

Question 1: What are the primary drivers of GE Aerospace stock price fluctuations?

The stock price is primarily influenced by GE Aerospace’s financial performance (revenue, earnings, profit margins), industry trends (air travel demand, defense spending), macroeconomic factors (interest rates, inflation), and investor sentiment. Significant news events, such as contract wins or losses, also play a crucial role.

Question 2: How does the overall health of the aerospace industry affect GE Aerospace stock?

The overall health of the aerospace industry has a direct impact. An expanding aerospace market typically benefits GE Aerospace, leading to increased demand for its products and services. Conversely, a contraction in the industry can negatively affect its revenue and profitability, impacting the stock price.

Question 3: What financial metrics should investors monitor when evaluating GE Aerospace stock?

Key financial metrics include revenue growth, earnings per share (EPS), profit margins, cash flow, debt-to-equity ratio, and return on invested capital (ROIC). Analyzing these metrics provides insights into the company’s financial health and its ability to generate shareholder value.

Question 4: How does investor sentiment impact the stock price?

Investor sentiment reflects the overall attitude of investors towards GE Aerospace. Positive sentiment, driven by optimism about the company’s prospects, leads to increased buying pressure and a higher stock price. Negative sentiment can result in selling pressure and a lower stock price. Investor sentiment is affected by market news, economic outlook, and company-specific events.

Question 5: How does GE Aerospace’s position in the competitive landscape influence its stock?

GE Aerospace’s competitive position is a significant factor. A strong market share, technological leadership, and a diversified product portfolio provide a competitive advantage, enhancing its ability to generate revenue and earnings. The presence of strong competitors, technological disruptions, and changes in market dynamics are monitored to assess the company’s competitive position.

Question 6: What role do macroeconomic factors play in GE Aerospace stock’s performance?

Macroeconomic factors, such as interest rates, inflation, and global economic growth, affect the aerospace industry and GE Aerospace’s performance. Higher interest rates can increase borrowing costs for airlines, potentially reducing demand for new aircraft and aftermarket services. Economic recessions can lead to reduced air travel and defense spending, negatively impacting the company’s financials and stock.

These responses serve as a foundation for understanding the complexities influencing GE Aerospace stock. Further research and due diligence are recommended before making any investment decisions.

The following section offers information for those interested in investing.

GE Aerospace Stock Today

This examination of General Electric Aerospace shares has traversed various facets impacting its valuation and market behavior. Key elements discussed include financial performance indicators, industry dynamics, investor sentiment, and the influence of broader economic conditions. The analysis aimed to provide a comprehensive understanding of the factors that collectively shape the share’s current standing and potential trajectory.

Investment decisions concerning General Electric Aerospace shares require diligent consideration of these multifaceted influences. Continuous monitoring of relevant data, coupled with independent financial consultation, is strongly advised. The future performance of these shares will undoubtedly be shaped by ongoing developments within the aerospace sector and evolving market dynamics.

![Is GE Aerospace Stock [GE] a Buy? Future of Aerospace Stocks Innovating the Future of Flight with Reliable Aviation Solutions Is GE Aerospace Stock [GE] a Buy? Future of Aerospace Stocks | Innovating the Future of Flight with Reliable Aviation Solutions](https://mixaerospace.com/wp-content/uploads/2026/02/th-137-300x200.jpg)