This financial instrument provides exposure to a basket of publicly traded companies globally that are classified within the aerospace and defense sectors. It is structured as an exchange-traded fund (ETF), meaning it is a type of investment fund traded on stock exchanges, similar to individual stocks. The fund’s performance is benchmarked against a specific index, reflecting the overall performance of companies involved in activities such as the development, manufacturing, and support of aerospace and defense systems and equipment.

Investing in such a fund offers diversification across numerous companies in these specialized industries, potentially mitigating the risks associated with investing in individual securities. Historically, these sectors have been influenced by factors such as government defense spending, technological advancements in aerospace, and geopolitical events. Performance is typically tied to these broader macroeconomic and industry-specific trends, allowing investors to gain or lose based on the overall state of these fields.

Further analysis will delve into the specific constituents of the fund, its expense ratio, historical performance, and potential role within a diversified investment portfolio. The subsequent sections will explore the factors that drive performance within the aerospace and defense industries and the key considerations for investors interested in this particular sector-specific investment vehicle.

Considerations Regarding Sector-Specific Exchange-Traded Funds

This section outlines critical considerations for investors evaluating an investment in the MSCI World Aerospace and Defense Index ETF or similar sector-specific investment vehicles. Due diligence is essential to aligning such holdings with overall investment objectives and risk tolerance.

Tip 1: Expense Ratio Evaluation: Scrutinize the fund’s expense ratio. This fee directly impacts the net return on investment. A higher expense ratio necessitates greater fund performance to achieve comparable returns with lower-cost alternatives.

Tip 2: Portfolio Composition Analysis: Examine the fund’s top holdings and overall portfolio diversification. Over-concentration in a small number of stocks can increase risk, mitigating the benefits of diversification typically associated with ETFs.

Tip 3: Performance Benchmarking: Compare the fund’s historical performance against its benchmark index and similar sector-specific ETFs. Analyze performance across various market cycles to assess its resilience and consistency.

Tip 4: Geopolitical Risk Assessment: Recognize that aerospace and defense industries are inherently sensitive to geopolitical events and government policies. Factor potential impacts of international relations, defense budgets, and regulatory changes into investment decisions.

Tip 5: Understanding Sector Cyclicality: Acknowledge the cyclical nature of the aerospace and defense sectors. Economic downturns or shifts in government spending priorities can significantly affect company revenues and profitability.

Tip 6: Liquidity Assessment: Evaluate the fund’s trading volume and bid-ask spread. Lower liquidity can result in wider spreads and potential difficulties in executing large trades without impacting the market price.

Tip 7: Currency Risk Management: If the fund invests in international aerospace and defense companies, be aware of potential currency fluctuations and their impact on returns. Hedging strategies, if employed by the fund, should be analyzed.

Careful consideration of these factors allows for a more informed investment decision regarding participation in the potential growth of the aerospace and defense industries through targeted investment instruments.

The following section will address potential risks associated with sector-specific investments and strategies for mitigating these risks within a broader portfolio context.

1. Sector Concentration

Sector concentration is a defining characteristic of the MSCI World Aerospace and Defense Index ETF. This type of exchange-traded fund invests exclusively in companies operating within the aerospace and defense industries. Consequently, the fund’s performance is heavily dependent on the collective performance of firms in these specific sectors, making it less diversified than broader market ETFs. The fortunes of the ETF are intrinsically linked to factors such as government defense spending, technological advancements in aerospace, and overall geopolitical stability. For instance, an increase in global military expenditures typically correlates with increased revenues for defense contractors held within the fund. Similarly, breakthroughs in commercial aviation or space exploration can positively impact the value of aerospace companies included in the index.

The elevated sector concentration demands careful consideration by investors. While it presents the potential for outsized returns during periods of growth within aerospace and defense, it also exposes the portfolio to amplified risks. Downturns in these sectors, perhaps stemming from budget cuts or reduced demand for air travel, can disproportionately affect the ETF compared to investments in more diversified portfolios. The practical significance of this concentration is that investors must closely monitor industry-specific trends and geopolitical events to anticipate potential impacts on the fund’s value. They need to consider whether the potential rewards outweigh the inherent risks associated with a focused investment strategy.

In summary, the pronounced sector concentration of the MSCI World Aerospace and Defense Index ETF is both its strength and its weakness. It provides targeted exposure to potentially lucrative industries but necessitates a thorough understanding of the underlying drivers and vulnerabilities. Investors should carefully weigh the benefits of sector-specific targeting against the heightened risks it entails, aligning their investment decisions with their risk tolerance and overall portfolio strategy. Understanding the implications of sector concentration is paramount for effectively utilizing this financial instrument.

2. Global Exposure

Global exposure is a fundamental attribute of the MSCI World Aerospace and Defense Index ETF, influencing both its potential returns and inherent risks. This aspect distinguishes it from purely domestic or regional funds, presenting a diversified perspective on the aerospace and defense sectors worldwide.

- Geographical Diversification

The ETF’s global mandate necessitates investment in aerospace and defense companies across various countries and regions. This diversification mitigates the risk of over-reliance on the economic or political climate of any single nation. For example, a downturn in US defense spending might be offset by increased procurement in Europe or Asia. However, this also exposes the fund to currency exchange rate fluctuations and varying regulatory environments, impacting returns. A diversified portfolio can enhance stability and reduce the impact of region-specific volatility.

- Access to International Markets

The fund offers investors access to aerospace and defense companies listed on international stock exchanges that may not be easily accessible through direct investment. This includes companies involved in areas where the United States or others don’t participate. For example, some companies may specialize in specific technologies or regional markets not well-represented in US-focused funds. This broader access can potentially unlock investment opportunities and enhance overall portfolio diversification.

- Exposure to Global Supply Chains

The aerospace and defense industries operate within complex global supply chains. The ETF’s international holdings provide exposure to companies that supply components, raw materials, or specialized services to major manufacturers worldwide. Disruptions in these supply chains, whether due to geopolitical events or economic factors, can have widespread effects. Understanding and assessing the stability of these supply chains is vital for investors.

- Sensitivity to Geopolitical Events

Given the nature of the aerospace and defense sectors, the ETF’s global exposure renders it particularly sensitive to international political and military events. Conflicts, trade tensions, or shifts in international alliances can significantly impact the prospects of companies held within the fund. Investment decisions should incorporate an analysis of geopolitical risks and their potential impact on the fund’s performance.

In summary, the global exposure of the MSCI World Aerospace and Defense Index ETF introduces both opportunities and challenges for investors. While it offers diversification and access to international markets, it also exposes the fund to currency risks, regulatory complexities, and heightened sensitivity to geopolitical events. A comprehensive understanding of these factors is essential for effectively managing the risks and potentially capitalizing on the benefits of global exposure within this specific investment vehicle.

3. Defense Spending

Defense spending is a primary driver of performance for companies comprising the MSCI World Aerospace and Defense Index ETF. The allocation of government funds towards military procurement directly impacts the revenue streams of firms involved in the development, manufacturing, and maintenance of defense systems. Increased defense budgets in major economies typically translate to larger contracts for these companies, resulting in enhanced profitability and, consequently, a positive influence on the ETF’s value. Conversely, periods of reduced defense spending can exert downward pressure on the ETF’s performance as companies face decreased demand for their products and services. The nature of defense spending as a component is therefore significant; it is a direct input into the financial health of many of the companies contained within the fund.

A historical example illustrates this dynamic: Following the September 11th attacks, global defense spending increased substantially. This surge in investment led to increased profits for defense contractors such as Lockheed Martin and Boeing, both frequently represented among the top holdings in the ETF. The ETF, in turn, experienced significant growth during this period. Similarly, subsequent periods of budgetary constraints and sequestration measures in some countries have corresponded with periods of slower growth or even decline in the value of the ETF. It is important to note, however, that other factors, such as international conflicts and technological advancements, also play a role, and the relationship between defense spending and ETF performance is not always perfectly correlated.

Understanding the connection between defense spending and the MSCI World Aerospace and Defense Index ETF is of practical significance for investors. By monitoring trends in government defense budgets and geopolitical events that may influence these budgets, investors can make more informed decisions regarding potential investments in this sector-specific ETF. However, it is crucial to recognize that defense spending is subject to political and economic uncertainties. Therefore, a comprehensive investment strategy should incorporate a thorough analysis of the broader macroeconomic environment and industry-specific trends to assess the long-term prospects of this investment.

4. Aerospace Innovation

Aerospace innovation constitutes a significant driver of long-term value creation within the companies comprising the MSCI World Aerospace and Defense Index ETF. Continuous advancements in technology and design are crucial for maintaining a competitive edge, securing lucrative contracts, and ultimately enhancing shareholder value. These innovations span a broad spectrum, influencing both the defense and commercial sectors within the aerospace industry.

- Advanced Materials and Manufacturing

The development and implementation of advanced materials, such as carbon fiber composites and lightweight alloys, are transforming aircraft design and manufacturing. These materials enhance fuel efficiency, increase aircraft range, and improve structural integrity. For example, Boeing’s 787 Dreamliner utilizes a significant proportion of composite materials, contributing to its fuel efficiency and operational cost savings. Companies within the MSCI World Aerospace and Defense Index ETF that invest in these materials and associated manufacturing processes are better positioned to capture future growth opportunities.

- Digitalization and Automation

Digitalization and automation are revolutionizing aerospace operations, from design and simulation to manufacturing and maintenance. Digital twins, predictive maintenance, and automated assembly lines are becoming increasingly prevalent. Airbus, for instance, employs digital twins to optimize aircraft performance and predict maintenance needs. Companies that effectively leverage digitalization and automation can improve efficiency, reduce costs, and enhance product quality, thereby boosting their profitability and attractiveness to investors within the MSCI World Aerospace and Defense Index ETF.

- Next-Generation Propulsion Systems

Innovation in propulsion systems is crucial for reducing fuel consumption, emissions, and noise. Developments in electric propulsion, hybrid-electric systems, and advanced engine designs hold significant promise. Companies like Rolls-Royce are actively pursuing next-generation propulsion technologies. Firms that successfully develop and commercialize these technologies can gain a competitive advantage and attract investment, potentially leading to increased valuation within the MSCI World Aerospace and Defense Index ETF.

- Autonomous Systems and Unmanned Aerial Vehicles (UAVs)

Autonomous systems and UAVs are transforming both defense and commercial applications. From military surveillance and reconnaissance to package delivery and infrastructure inspection, UAVs are creating new market opportunities. Companies like General Atomics are leading the way in UAV development. Firms that effectively innovate in autonomous systems and UAV technology can capitalize on these emerging markets and potentially drive significant growth within the MSCI World Aerospace and Defense Index ETF.

The ability of companies within the MSCI World Aerospace and Defense Index ETF to successfully innovate in these areas directly influences their long-term growth prospects and investment appeal. Investors should carefully consider a company’s commitment to research and development, its track record of innovation, and its ability to translate technological advancements into commercially viable products and services when evaluating its potential contribution to the overall performance of the ETF. The integration of new technologies and the ability to adapt to the changing landscape are key determinants of long-term success.

5. Index Tracking

Index tracking is a fundamental principle underlying the operation of the MSCI World Aerospace and Defense Index ETF. The ETF is designed to replicate the performance of its benchmark index, which comprises a selection of publicly traded companies globally involved in the aerospace and defense sectors. Therefore, the ETF’s investment strategy primarily revolves around mirroring the index’s composition and weighting. This passive management approach aims to provide investors with returns that closely resemble the returns of the underlying index, less the ETF’s expense ratio. The accuracy with which the ETF tracks its index is a critical measure of its effectiveness.

The practical significance of index tracking lies in its transparency and cost-effectiveness. Investors can easily understand the ETF’s investment holdings by examining the composition of the underlying index. Furthermore, the passive management style typically results in lower expense ratios compared to actively managed funds, enhancing the potential for higher net returns. For example, if the MSCI World Aerospace and Defense Index increases by 10% in a given year, the ETF should, in theory, also increase by approximately 10%, less the deduction of the fund’s operating expenses. Deviations from this ideal tracking performance can occur due to factors such as transaction costs, fund management fees, and the ETF’s ability to perfectly replicate the index’s holdings. Sampling techniques, where the ETF holds a representative sample of the index constituents rather than all of them, can also lead to tracking differences.

In conclusion, index tracking is the cornerstone of the MSCI World Aerospace and Defense Index ETF’s investment philosophy. This strategy seeks to deliver returns that mirror the performance of the aerospace and defense sectors worldwide, providing investors with a cost-efficient and transparent investment option. While perfect tracking is unattainable due to various operational constraints, the ETF’s success is contingent upon its ability to minimize tracking error and accurately represent the index’s performance over time. Any challenges in this process should be clearly communicated with any additional investment strategy for end user.

6. Expense Ratio

The expense ratio is a critical factor to consider when evaluating the MSCI World Aerospace and Defense Index ETF. It represents the annual cost to investors for operating the fund, expressed as a percentage of the fund’s average net assets. A thorough understanding of the expense ratio and its implications is essential for making informed investment decisions regarding this sector-specific ETF.

- Definition and Calculation

The expense ratio encompasses various operational costs, including management fees, administrative expenses, and other overhead costs incurred in managing the ETF. It is calculated by dividing the total annual operating expenses by the fund’s average net asset value. For instance, an expense ratio of 0.50% indicates that for every $10,000 invested in the ETF, $50 is deducted annually to cover operating expenses. Lower expense ratios generally lead to higher net returns for investors, assuming all other factors remain constant. This is a direct calculation that has a one to one impact on final return percentage.

- Impact on Returns

The expense ratio directly reduces the potential returns generated by the MSCI World Aerospace and Defense Index ETF. Even seemingly small differences in expense ratios can compound significantly over time, particularly in long-term investment horizons. For example, an ETF with an expense ratio of 0.20% will outperform a similar ETF with an expense ratio of 0.70% by 0.50% annually, assuming both funds track the same index and generate identical gross returns. This effect is seen across the fund industry in similar products.

- Comparison with Other ETFs

When evaluating the MSCI World Aerospace and Defense Index ETF, it is crucial to compare its expense ratio with those of similar sector-specific ETFs and broader market ETFs. Higher expense ratios are justifiable only if the ETF consistently delivers superior risk-adjusted returns compared to its peers. Investors should also consider the potential benefits of active management versus passive management, as actively managed funds typically have higher expense ratios. This comparison also depends on the investment strategy of the investor.

- Transparency and Disclosure

The expense ratio is clearly disclosed in the ETF’s prospectus and other fund documents, providing investors with readily accessible information regarding the fund’s operating costs. Fund companies are legally required to provide this information to prospective investors. Investors should carefully review these documents to understand the expense ratio and any other fees associated with investing in the ETF. This is a useful metric on the fund for investors.

In summary, the expense ratio is a crucial factor in assessing the overall value proposition of the MSCI World Aerospace and Defense Index ETF. By understanding its definition, impact on returns, and comparative context, investors can make informed decisions about whether this sector-specific ETF aligns with their investment objectives and risk tolerance. While focusing on a specific segment, the expense is a direct detractor on the potential returns of the product, making the expense ratio very important.

7. Geopolitical Sensitivity

The performance of the MSCI World Aerospace and Defense Index ETF exhibits a pronounced sensitivity to geopolitical events. This sensitivity stems from the fundamental nature of the aerospace and defense industries, which are directly influenced by international relations, military conflicts, and government policies. Increases in global tensions, armed conflicts, or heightened security concerns often lead to increased defense spending by governments worldwide. This increased spending, in turn, benefits companies involved in the production of military equipment, aerospace technologies, and related services, ultimately driving up the value of the ETF. Conversely, periods of relative peace, arms control agreements, or decreased military budgets can negatively impact the financial prospects of these companies and result in a decline in the ETF’s performance. Thus, geopolitical instability is a key factor in the health of the fund.

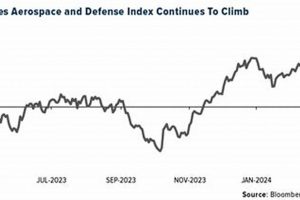

For example, a real-world illustration of this sensitivity can be seen in the performance of the ETF following significant geopolitical events, such as the Russian invasion of Ukraine. This event triggered a surge in defense spending across many European countries, leading to increased orders for military equipment and positive impacts on the stock prices of major defense contractors included in the ETF. Conversely, periods of detente or arms reduction talks between major global powers have historically led to decreased defense budgets and dampened the performance of aerospace and defense companies. The practical significance of understanding this geopolitical sensitivity lies in the ability to anticipate potential market movements based on evolving geopolitical landscapes. Investors who closely monitor global political and military trends can make more informed decisions regarding their investment in this sector-specific ETF. Knowing the sensitivity provides an indicator for investment.

In summary, geopolitical sensitivity is an inherent characteristic of the MSCI World Aerospace and Defense Index ETF. Fluctuations in global political and military environments directly influence the financial performance of the companies that comprise the index. Investors must carefully assess geopolitical risks and opportunities to effectively manage their investments in this sector. Failure to account for these dynamics can result in unexpected losses or missed opportunities. A broader understanding of geopolitics provides another tool for the management of investments.

Frequently Asked Questions

The following questions address common inquiries regarding the MSCI World Aerospace and Defense Index ETF, providing a concise and informative overview of its key characteristics and investment considerations.

Question 1: What is the primary investment objective of the MSCI World Aerospace and Defense Index ETF?

The primary objective is to replicate the performance of the MSCI World Aerospace & Defense Index, providing investors with exposure to a basket of global companies involved in the aerospace and defense sectors.

Question 2: What are the key components or criteria for inclusion in the MSCI World Aerospace and Defense Index?

Companies included in the index are classified based on their involvement in activities such as the development, manufacturing, and support of aerospace and defense systems and equipment. The index employs a market-capitalization weighted methodology.

Question 3: How does the expense ratio of this ETF compare to similar sector-specific investment products?

The expense ratio should be compared to other aerospace and defense ETFs and actively managed funds focusing on these sectors to determine relative cost-effectiveness. A lower expense ratio generally benefits investors, assuming comparable performance.

Question 4: What are the primary risks associated with investing in a sector-specific ETF like this one?

Concentration risk is a primary concern. The fund’s performance is heavily reliant on the performance of a single sector, making it more vulnerable to industry-specific downturns and regulatory changes than broader market ETFs. Geopolitical instability is another key aspect to consider.

Question 5: How can investors use this ETF as part of a broader diversified investment portfolio?

The ETF can be utilized to gain targeted exposure to the aerospace and defense sectors, potentially enhancing portfolio returns. However, its sector-specific nature necessitates careful consideration of asset allocation and risk management strategies to maintain overall portfolio diversification.

Question 6: How is the ETF’s performance affected by fluctuations in global defense spending?

The ETF’s performance is typically positively correlated with increases in global defense spending, as higher military budgets often translate to increased revenues for companies within the aerospace and defense sectors. Conversely, decreases in defense spending can negatively impact the ETF’s performance.

These FAQs provide a foundational understanding of the MSCI World Aerospace and Defense Index ETF. Further research and consultation with a financial advisor are recommended before making any investment decisions.

The following section will delve into potential strategies for incorporating this ETF into various investment scenarios and risk profiles.

Concluding Remarks on the MSCI World Aerospace and Defense Index ETF

This exposition has detailed the MSCI World Aerospace and Defense Index ETF, clarifying its composition, influencing factors, and inherent risks. Key discussion points included sector concentration, global exposure, sensitivity to defense spending and geopolitical events, the impact of aerospace innovation, index tracking methodology, and the critical importance of the expense ratio. Each element contributes significantly to the fund’s overall performance and its suitability within various investment strategies.

The information provided serves as a foundation for informed decision-making. The potential investor must independently evaluate alignment with individual financial goals, risk tolerance, and time horizon. Continued monitoring of industry trends and geopolitical developments remains essential for managing investments in this sector-specific instrument.

![Your Guide: Mid America Aerospace & Defense Summit [2024] Innovating the Future of Flight with Reliable Aviation Solutions Your Guide: Mid America Aerospace & Defense Summit [2024] | Innovating the Future of Flight with Reliable Aviation Solutions](https://mixaerospace.com/wp-content/uploads/2026/02/th-239-300x200.jpg)