Oklahoma offers a financial incentive designed to attract and retain skilled professionals in a critical sector. This initiative operates through the state’s tax code, providing a reduction in tax liability for eligible individuals employed in the aerospace industry. To qualify, individuals generally must hold specific engineering roles within companies engaged in aerospace activities within the state. The specific amount of the benefit, eligibility criteria, and application processes are defined by state statutes and regulations.

The provision serves as a tool to bolster economic development and workforce expertise within Oklahoma. By lowering the after-tax cost of employing aerospace engineers, the state aims to incentivize both qualified professionals to relocate to or remain in Oklahoma and companies to expand or establish operations there. This, in turn, can lead to job creation, increased investment in research and development, and a strengthening of the aerospace industry’s presence within the state. Historical context would involve examining the legislative history of the particular tax credit, the economic conditions that prompted its creation, and its impact on the industry since its inception.

Further investigation into the topic should include a detailed review of the applicable statutes and regulations that define the specifics of the incentive. Understanding the nuances of eligibility requirements, the calculation of the benefit, and the procedural aspects of claiming the reduction are crucial for both potential beneficiaries and businesses operating within the aerospace sector. Furthermore, an analysis of the initiative’s economic impact, its effectiveness in achieving its intended goals, and any potential areas for improvement would be beneficial.

This section provides essential guidance for individuals and businesses seeking to leverage the financial benefit intended to attract and retain aerospace engineering talent within Oklahoma.

Tip 1: Understand Eligibility Criteria: Carefully review the specific requirements outlined in Oklahoma’s tax code to determine if the role and qualifications meet the standards. This includes verifying the type of engineering work performed and the nature of the employing company’s operations.

Tip 2: Confirm Employer Qualification: Ascertain that the aerospace company employing the engineer meets the state’s definition of an eligible business. This may involve checking for specific industry classifications or revenue thresholds defined by state regulations.

Tip 3: Document Employment Details: Maintain thorough records of employment, including job descriptions, employment contracts, and pay stubs. This documentation will be crucial for substantiating eligibility when claiming the tax credit.

Tip 4: Consult with a Tax Professional: Seek expert advice from a qualified tax advisor familiar with Oklahoma’s tax laws and the specific requirements of the credit. They can provide personalized guidance and ensure compliance.

Tip 5: Track Legislative Updates: Monitor any changes to Oklahoma’s tax laws that may impact the availability or terms of the incentive. Tax regulations are subject to revision, and staying informed is crucial.

Tip 6: Utilize State Resources: Explore resources offered by the Oklahoma Tax Commission and the Oklahoma Department of Commerce. These entities may provide guidance and clarification on the tax credit application process.

A thorough understanding of eligibility requirements, meticulous documentation, and expert consultation are paramount to successfully navigating and maximizing the benefit. Staying informed about legislative updates and utilizing available state resources can further streamline the process.

Applying these tips will provide a solid foundation for individuals and businesses in the aerospace industry operating in Oklahoma.

1. Eligibility Requirements

The “Eligibility Requirements” represent a critical component of Oklahoma’s financial incentive for aerospace engineers. These prerequisites dictate who can access the benefit, shaping its accessibility and impact on the targeted workforce.

- Educational Qualifications

A foundational element is the attainment of a relevant academic degree. Typically, a bachelor’s degree in aerospace engineering, or a closely related field such as mechanical or electrical engineering with an aerospace focus, is mandatory. This ensures a baseline level of technical competence deemed necessary for the qualifying roles. Absence of the requisite educational background invariably disqualifies an applicant, regardless of practical experience.

- Professional Certifications and Licensure

Certain roles may mandate specific professional certifications or state-issued engineering licenses. These credentials demonstrate adherence to industry standards and legal compliance. Examples include Professional Engineer (PE) licensure, signifying competence in engineering principles and practices. The necessity of certifications often depends on the specific job duties and level of responsibility within the aerospace organization.

- Specific Job Functions

The tax incentive is typically reserved for individuals performing engineering tasks directly related to aerospace activities. This includes design, development, testing, and manufacturing of aircraft, spacecraft, and related systems. Individuals in management or administrative roles, even within aerospace companies, may not qualify if their primary responsibilities do not involve direct engineering work. The determination hinges on the nature of the engineer’s day-to-day tasks.

- Employment by a Qualified Oklahoma Aerospace Company

A crucial condition is employment by an aerospace company that meets the state’s defined criteria for eligibility. This may involve demonstrating a certain percentage of revenue derived from aerospace-related activities, or meeting specific industry classification codes. Employment by a company outside of this defined scope, even if the individual’s work is aerospace-related, typically renders the engineer ineligible for the incentive.

These multifaceted eligibility standards ensure that the Oklahoma tax credit for aerospace engineers is channeled toward individuals and companies genuinely contributing to the aerospace sector within the state. Rigorous adherence to these requirements is paramount for both applicants and the state agencies administering the incentive.

2. Qualifying Employment

Qualifying employment constitutes the direct link between an aerospace engineer’s work and eligibility for the Oklahoma tax credit. The state offers the financial incentive specifically to attract and retain professionals actively engaged in advancing the aerospace industry within its borders. Therefore, the nature of employment fundamentally determines whether an engineer can benefit. For instance, an aerospace engineer designing aircraft components at a company headquartered in Oklahoma would likely be engaged in qualifying employment, assuming all other eligibility criteria are met. Conversely, an engineer in a similar field employed by a company that doesn’t derive a significant portion of its revenue from aerospace activities within Oklahoma would likely not qualify. The tax credit serves as a direct incentive for specific economic activity, making the connection to qualifying employment paramount.

The definition of qualifying employment encompasses not only the sector of employment but also the specific roles and responsibilities undertaken by the engineer. Engineers performing tasks directly related to the design, development, testing, or manufacturing of aircraft, spacecraft, and related systems are typically eligible. However, individuals in managerial or administrative roles, even within aerospace companies, may not qualify if their primary duties do not involve direct engineering work. For example, a project manager overseeing an aerospace engineering project might not qualify if they do not possess direct engineering responsibilities. The distinction centers on the application of engineering knowledge and skills to tangible aerospace products or processes. The details of qualifying employment can be complex, with grey areas requiring careful interpretation of relevant statutes and regulations.

In summary, the relationship between qualifying employment and the Oklahoma tax credit is one of direct cause and effect. Engaging in qualifying employment, as defined by Oklahoma law, is a prerequisite for receiving the tax benefit. This stipulation ensures that the incentive is appropriately targeted, fostering growth and innovation within the state’s aerospace sector. Navigating the intricacies of this relationship requires a thorough understanding of eligibility requirements and a clear assessment of the engineer’s role within their respective organization. The complexities underscore the importance of consulting with tax professionals who specialize in Oklahoma tax law and the aerospace industry.

3. Credit Calculation

Credit calculation forms the quantitative core of the Oklahoma tax credit for aerospace engineers. It directly dictates the financial benefit received, serving as the tangible incentive for qualified professionals. The calculation method, as defined by state statute, determines the magnitude of the tax reduction, influencing its effectiveness in attracting and retaining talent. A poorly designed calculation may render the incentive insufficient to overcome competing offers from other states or private sector employers. Conversely, an overly generous calculation could lead to unsustainable fiscal burdens on the state. A well-calibrated formula is therefore essential to achieve the intended economic objectives.

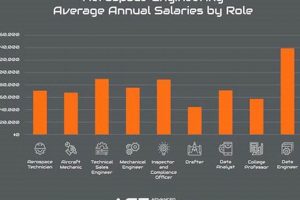

The specific parameters used in the credit calculation can vary, often incorporating factors such as the engineer’s salary, years of experience, educational attainment, or the employer’s investment in research and development. For example, the calculation might be based on a percentage of the engineer’s gross income, capped at a certain dollar amount annually. Alternatively, it may be structured as a tiered system, offering larger credits to engineers with advanced degrees or specialized expertise. The design of the calculation method reflects the state’s priorities in attracting specific types of aerospace professionals. Furthermore, the calculation is often subject to periodic review and adjustment to ensure its continued relevance and effectiveness in a dynamic economic environment.

In conclusion, the method for credit calculation serves as a crucial mechanism for translating the policy objective of attracting aerospace engineers into a concrete financial incentive. Its design and parameters directly affect the attractiveness of the credit, its cost to the state, and its overall impact on the aerospace industry. Challenges exist in balancing the desire to provide a meaningful incentive with the need for fiscal responsibility and administrative simplicity. The ongoing assessment and refinement of the credit calculation formula are essential to maximizing its long-term benefits for both the aerospace sector and the Oklahoma economy.

4. Application Procedures

Application procedures represent the structured sequence of actions and documentation required to formally claim the Oklahoma tax credit for aerospace engineers. Adherence to these procedures is mandatory for individuals and businesses seeking to benefit from the state’s incentive program. Failure to comply fully with the prescribed steps can result in delays in processing, denial of the credit, or potential legal ramifications.

- Form Submission and Documentation

The initial step generally involves completing and submitting the designated application form, typically available on the Oklahoma Tax Commission’s website. This form requires detailed information about the aerospace engineer, their employer, and their qualifications. Substantiating documentation, such as employment contracts, pay stubs, educational transcripts, and professional certifications, must accompany the application. The completeness and accuracy of these materials are critical for a successful application. For instance, an application lacking proof of relevant educational credentials is likely to be rejected.

- Verification of Eligibility

Upon submission, the Oklahoma Tax Commission undertakes a verification process to confirm the applicant’s eligibility for the tax credit. This may involve cross-referencing information provided on the application with state databases, contacting the employer to verify employment details, and independently confirming the engineer’s qualifications. In cases of doubt or discrepancy, the Tax Commission may request additional documentation or clarification from the applicant. Successful verification is a prerequisite for advancing to the next stage of the application process.

- Credit Calculation and Claim

Once eligibility is confirmed, the next step involves calculating the amount of the tax credit that can be claimed. This calculation is based on formulas prescribed in Oklahoma law, typically linked to the engineer’s salary or a percentage thereof. The calculated credit is then claimed on the engineer’s state income tax return or, in some cases, on the employer’s tax return. Accurate record-keeping and adherence to the prescribed calculation method are essential for claiming the correct credit amount. Mistakes in the calculation can lead to audits or penalties.

- Audits and Compliance

The Oklahoma Tax Commission retains the right to audit applications for the aerospace engineer tax credit, even after the credit has been claimed. These audits serve to ensure ongoing compliance with the program’s requirements. During an audit, the applicant may be required to provide additional documentation to substantiate their eligibility and the accuracy of the credit calculation. Failure to cooperate with an audit or the discovery of non-compliance can result in the recapture of previously claimed credits and the imposition of penalties. Therefore, maintaining thorough records and adhering to all applicable rules is paramount.

Successful navigation of the application procedures associated with the Oklahoma tax credit for aerospace engineers requires diligent attention to detail, meticulous record-keeping, and a thorough understanding of applicable laws and regulations. Consultation with a qualified tax professional is recommended to ensure compliance and maximize the potential benefits of the incentive program. The stringent processes are designed to ensure accountability and prevent fraudulent claims, safeguarding the integrity of the incentive program and its intended benefits for the state’s aerospace sector.

5. Economic Impact

The economic impact of the Oklahoma tax credit for aerospace engineers represents a multifaceted interplay of financial incentives, workforce development, and industry growth. The provision’s intended effect is to stimulate the aerospace sector within the state, generating a ripple effect of economic benefits. A direct consequence of the tax credit is the reduction in the after-tax cost of employing aerospace engineers. This, in turn, is designed to encourage both qualified professionals to relocate to or remain in Oklahoma and aerospace companies to establish or expand operations there. The importance of economic impact as a component of the tax credit lies in its function as a gauge of the program’s success. A positive economic impact, measured through increased job creation, higher wages, and greater investment in research and development, validates the rationale for the tax credit’s existence. Conversely, a negligible or negative economic impact would indicate a need for re-evaluation or modification of the program. For example, if several aerospace companies relocate to Oklahoma or significantly expand their operations following the implementation of the tax credit, and simultaneously there is a documented increase in the number of aerospace engineers employed in the state, this would be a tangible indication of a positive economic impact. The practical significance of understanding this connection lies in the ability to assess the effectiveness of the policy and make informed decisions regarding its future.

Further analysis of the economic impact involves examining indirect effects, such as the stimulation of supporting industries and services. A thriving aerospace sector requires a robust ecosystem of suppliers, vendors, and educational institutions. The presence of a significant aerospace engineering workforce can attract these supporting businesses, creating additional jobs and investment. The growth of the aerospace industry can also lead to increased demand for housing, transportation, and other consumer goods and services, benefiting local communities. However, it is important to consider potential downsides, such as increased strain on public infrastructure or competition for resources. Therefore, a comprehensive economic impact assessment should consider both the positive and negative consequences of the tax credit. For example, if an aerospace company establishes a new facility in a rural area, it may require significant investment in infrastructure upgrades, such as roads and utilities. These costs need to be factored into the overall economic impact analysis.

In conclusion, the Oklahoma tax credit for aerospace engineers is fundamentally linked to economic impact, with the intention of stimulating growth and innovation within the state’s aerospace sector. Assessing this impact requires a multi-faceted approach, considering both direct and indirect effects, as well as potential drawbacks. While the tax credit can be a powerful tool for economic development, its success hinges on careful design, implementation, and ongoing evaluation. Challenges exist in accurately measuring the economic impact, particularly in attributing specific outcomes solely to the tax credit. Nevertheless, a thorough understanding of the connection between the tax credit and economic impact is essential for policymakers, aerospace companies, and the engineering workforce alike. The long-term success of the program relies on a clear understanding of whether it is effectively achieving its intended economic objectives.

Frequently Asked Questions

This section addresses common inquiries concerning the financial incentive designed to attract and retain aerospace engineering talent in Oklahoma. The information provided is intended for informational purposes only and should not be considered legal or financial advice.

Question 1: What constitutes a “qualified aerospace engineer” for purposes of this tax credit?

A qualified aerospace engineer generally holds a bachelor’s degree or higher in aerospace engineering or a closely related field. The individual must be actively engaged in engineering tasks directly related to the design, development, testing, or manufacturing of aircraft, spacecraft, or related systems. Specific requirements may be outlined in Oklahoma state statutes and regulations.

Question 2: Which employers are considered “qualified aerospace companies” eligible for the incentive?

A qualified aerospace company is typically defined as a business entity that derives a significant portion of its revenue from aerospace-related activities within Oklahoma. The exact criteria may involve specific industry classification codes or revenue thresholds, as determined by the Oklahoma Tax Commission and the Oklahoma Department of Commerce.

Question 3: How is the amount of the Oklahoma tax credit for aerospace engineers calculated?

The calculation method is determined by Oklahoma state law and may involve a percentage of the engineer’s salary, capped at a specific dollar amount annually. Other factors, such as years of experience or educational attainment, may also be considered. Consult official state resources for the precise formula.

Question 4: What documentation is required when applying for this tax credit?

Applicants typically must provide documentation such as employment contracts, pay stubs, educational transcripts, and professional certifications. These documents serve to verify eligibility and the accuracy of the credit calculation. Specific requirements are outlined on the application forms provided by the Oklahoma Tax Commission.

Question 5: Is the Oklahoma tax credit for aerospace engineers available to both residents and non-residents?

Eligibility is primarily determined by employment within Oklahoma, not necessarily by residency status. Non-residents employed by qualified aerospace companies in Oklahoma and meeting all other eligibility criteria may be able to claim the credit.

Question 6: How frequently is the Oklahoma tax credit for aerospace engineers reviewed and updated?

Oklahoma state tax laws are subject to periodic review and potential amendment by the Oklahoma Legislature. Changes to the credit’s eligibility requirements, calculation method, or application procedures may occur. Monitoring legislative updates and consulting with tax professionals is essential for staying informed.

This information offers a basic overview of the Oklahoma tax credit for aerospace engineers. It is crucial to consult the official Oklahoma Tax Commission website and qualified tax professionals for detailed guidance and the most up-to-date information.

Further research is advised to gain a thorough understanding of the legislative history and potential future changes to this incentive program.

Oklahoma Tax Credit for Aerospace Engineers

The preceding analysis has explored the multifaceted dimensions of the Oklahoma tax credit for aerospace engineers. It has dissected the eligibility requirements, clarified the definition of qualifying employment, examined the mechanics of credit calculation, and outlined the application procedures. Furthermore, it has assessed the intended and potential economic impacts of the incentive program, emphasizing its role in attracting and retaining skilled professionals within a crucial sector of Oklahoma’s economy. Understanding these facets is paramount for stakeholders seeking to benefit from or evaluate the effectiveness of this financial instrument.

As Oklahoma continues to develop its aerospace industry, the continued relevance and efficacy of the Oklahoma tax credit for aerospace engineers require ongoing scrutiny. Policymakers, businesses, and engineers must remain vigilant in monitoring legislative updates and adapting to potential changes in program parameters. A proactive approach to understanding and utilizing this incentive is essential to maximizing its intended benefits and contributing to the sustained growth of Oklahoma’s aerospace sector. The ultimate success of this policy hinges on informed participation and continuous evaluation of its impact on the state’s economic landscape.