Organizations within the aeronautics and astronautics sector, whose ownership is distributed through shares available for purchase on public exchanges, represent a significant segment of the global economy. These entities are involved in diverse activities ranging from the design and manufacture of aircraft and spacecraft to the provision of related services, such as maintenance, repair, and overhaul. A prime example is a corporation that designs and manufactures commercial airplanes, and whose stock is listed on the New York Stock Exchange.

The vitality of these organizations influences technological advancement, job creation, and national security. Historically, they have been instrumental in pioneering air travel, space exploration, and defense technologies. Their open access to capital markets allows them to fund research and development, expand operations, and pursue mergers and acquisitions, all of which contribute to innovation and growth within the industry. The financial performance of these entities also serves as a barometer for broader economic trends and investor confidence.

The subsequent sections will delve into the key characteristics, financial structures, market dynamics, and regulatory landscape impacting these organizations. Analysis will also focus on the investment considerations and challenges facing these enterprises in an increasingly complex and competitive global environment.

This section provides essential considerations for stakeholders involved in, or contemplating involvement with, organizations in the aeronautics and astronautics field that offer publicly traded securities. Sound investment decisions necessitate a thorough understanding of both the inherent opportunities and the potential risks.

Tip 1: Evaluate Research and Development Investment: Examine the level of capital commitment dedicated to innovation. Organizations with substantial R&D budgets often demonstrate a commitment to long-term growth and maintaining a competitive edge. For example, a company heavily investing in sustainable aviation technologies signals foresight and potential for future market leadership.

Tip 2: Analyze Government Contracts and Dependencies: Ascertain the extent to which revenue is derived from governmental agreements. While these contracts can provide stability, they are also subject to political and budgetary fluctuations. Scrutinize the terms, duration, and potential renewal clauses of key government agreements.

Tip 3: Assess Supply Chain Resilience: Evaluate the organizations supply chain infrastructure and its vulnerability to disruptions. Diversification of suppliers and strategic stockpiling of critical components are indicators of robust risk management. Geopolitical instability and trade restrictions can significantly impact material procurement.

Tip 4: Monitor Regulatory Compliance: Ensure adherence to stringent industry regulations governing safety, environmental impact, and export controls. Non-compliance can lead to substantial penalties and reputational damage. Review audit reports and governance structures to assess the effectiveness of compliance programs.

Tip 5: Understand Market Diversification: Investigate the breadth of products and services offered across commercial, defense, and space exploration sectors. A diversified portfolio mitigates risk associated with downturns in specific market segments. Companies solely reliant on defense contracts are more susceptible to geopolitical shifts.

Tip 6: Scrutinize Financial Health Metrics: Conduct a thorough review of key financial indicators, including debt-to-equity ratio, cash flow, and profit margins. Healthy financials provide a buffer against economic uncertainty and support sustained investment in future growth. Compare these metrics against industry benchmarks.

Tip 7: Examine Geopolitical Exposure: Assess the company’s exposure to geopolitical risks, including international trade relations, sanctions, and political instability in key markets. Companies with significant operations in volatile regions face higher operational and financial risks.

These considerations are paramount for informed decision-making and risk mitigation. Thorough due diligence, coupled with a comprehensive understanding of the sector’s dynamics, is crucial for achieving successful investment outcomes.

The concluding section will summarize the key drivers and challenges within the specific industrial domain, providing a cohesive overview of the investment landscape.

1. Stock Performance

Stock performance serves as a critical indicator of investor confidence and the perceived financial health of publicly traded aerospace companies. It reflects market sentiment regarding the organization’s ability to generate profits, innovate, and compete effectively within the global aerospace industry. Understanding the factors driving stock performance is paramount for stakeholders seeking to assess the long-term investment potential of these entities.

- Earnings Reports and Analyst Ratings

Quarterly and annual earnings reports significantly influence stock valuation. Exceeding earnings expectations typically results in positive market reactions, while disappointing results can trigger sell-offs. Analyst ratings, derived from in-depth financial analysis and industry forecasts, provide guidance to investors, further impacting stock prices. For example, an upgrade from a major investment bank, citing strong projected growth in commercial aircraft sales, can lead to a surge in a company’s stock value.

- Contract Wins and Backlog

The acquisition of significant government or commercial contracts directly affects investor perceptions of future revenue streams. A substantial backlog of orders provides stability and predictability, reassuring shareholders. A publicly traded aerospace company securing a multi-billion dollar defense contract often experiences a corresponding increase in its stock price, reflecting confidence in its long-term prospects.

- Technological Innovation and Market Leadership

Companies that consistently demonstrate technological innovation and maintain market leadership positions tend to command higher valuations. Investors are willing to pay a premium for firms that are at the forefront of developing new technologies, such as advanced materials, autonomous systems, or sustainable propulsion. An aerospace company pioneering the development of fuel-efficient aircraft engines, for instance, is likely to attract significant investor interest and achieve favorable stock performance.

- Macroeconomic Factors and Geopolitical Events

Broader economic trends, such as global GDP growth, interest rates, and inflation, exert considerable influence on stock performance across all sectors, including aerospace. Geopolitical events, such as trade wars, political instability, and armed conflicts, can also create volatility and impact investor sentiment. Heightened global tensions may increase demand for defense-related products, benefiting some companies, while negatively affecting others dependent on international trade.

In summary, the stock performance of publicly traded aerospace companies is a multifaceted reflection of financial results, market position, technological capabilities, and external factors. A comprehensive understanding of these interconnected elements is essential for informed investment decisions and accurate assessment of the sector’s overall health and long-term potential.

2. Market Capitalization

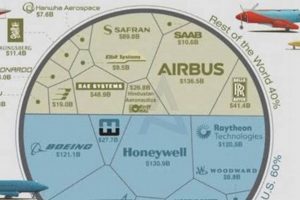

Market capitalization serves as a fundamental metric for evaluating the size and overall value of publicly traded aerospace companies. It represents the aggregate market value of a company’s outstanding shares and is calculated by multiplying the current share price by the total number of shares outstanding. This valuation metric is a key indicator of a company’s position and influence within the broader aerospace industry.

- Indicator of Company Size and Scale

Market capitalization directly reflects the scale and magnitude of an aerospace company’s operations. Larger market capitalizations typically indicate established organizations with significant assets, substantial revenue streams, and extensive market reach. For instance, a corporation with a market capitalization exceeding $100 billion suggests a global presence with diversified operations across commercial, defense, and space sectors. Conversely, smaller market capitalizations often characterize emerging companies or specialized firms with niche market focus.

- Influencer of Investor Sentiment and Liquidity

Market capitalization shapes investor perceptions and influences the liquidity of a company’s stock. Larger market capitalization companies tend to attract institutional investors, such as pension funds and mutual funds, due to their stability and liquidity. This increased investor interest can drive higher trading volumes and potentially enhance stock valuation. Conversely, smaller companies may experience lower trading volumes and greater price volatility, making them less attractive to risk-averse investors.

- Driver of Mergers and Acquisitions (M&A) Activity

Market capitalization plays a crucial role in mergers and acquisitions within the aerospace industry. Larger companies with substantial market capitalizations may seek to acquire smaller firms to expand their product portfolios, gain access to new technologies, or increase market share. Conversely, smaller companies may become attractive acquisition targets for larger entities seeking to consolidate their position in a particular market segment. A company with a low market capitalization but valuable intellectual property may be acquired by a bigger company.

- Reflection of Growth Potential and Future Prospects

Market capitalization implicitly reflects market expectations regarding an aerospace company’s future growth potential. Companies with strong growth prospects, driven by technological innovation, expanding market opportunities, or successful execution of strategic initiatives, often command higher market capitalizations. Investors are willing to pay a premium for companies that are positioned to capitalize on emerging trends, such as sustainable aviation, space exploration, or unmanned aerial systems. Market capitalization serves as a forward-looking indicator of anticipated performance.

In conclusion, market capitalization is a pivotal metric for assessing publicly traded aerospace companies, encapsulating their size, investor perception, potential for mergers and acquisitions, and anticipated growth prospects. It offers a comprehensive overview of a company’s significance within the industry and its attractiveness to investors.

3. Dividend Yields

Dividend yields, expressed as a percentage, represent the annual dividend payment relative to a company’s stock price. For publicly traded aerospace companies, these yields can indicate financial stability and profitability, serving as an attractive element for income-seeking investors. A consistently high dividend yield may suggest a mature company with stable earnings, while a low or non-existent yield might indicate a focus on reinvesting profits for growth or reflect financial challenges. For instance, a well-established aerospace manufacturer with a history of consistent profitability might offer a dividend yield in the range of 2-3%, while a smaller, rapidly expanding company might prioritize reinvesting earnings into research and development, thus offering a lower or no dividend yield.

The stability and predictability of cash flows within the aerospace sector, particularly among companies holding long-term government contracts or possessing significant aftermarket service revenues, often support consistent dividend payouts. However, dividend yields are also subject to fluctuations based on economic conditions, contract performance, and strategic investment decisions. Economic downturns or unexpected program delays can negatively impact earnings, potentially leading to dividend reductions or suspensions. In practice, an aerospace company facing reduced government spending may choose to decrease its dividend payout to preserve cash for restructuring or to fund new initiatives.

Analyzing dividend yields in conjunction with other financial metrics provides a comprehensive understanding of the financial health and investment potential of publicly traded aerospace companies. Although high dividend yields can be appealing, investors should carefully assess the sustainability of these payouts by evaluating factors such as free cash flow, earnings growth, and debt levels. Reduced earnings forecasts or increased debt burdens may jeopardize future dividend payments, highlighting the need for thorough due diligence.

4. Debt Obligations

Debt obligations represent a critical component of the financial structure of publicly traded aerospace companies. These obligations, encompassing various forms such as bonds, loans, and other credit instruments, are employed to finance capital-intensive projects, research and development initiatives, and operational expansions. The scale of debt obligations can significantly influence an aerospace company’s financial flexibility and long-term strategic positioning. For instance, a company undertaking the development of a new aircraft model may incur substantial debt to fund the engineering, testing, and manufacturing processes, directly impacting its balance sheet. The management of debt levels becomes paramount, as excessive debt can constrain a company’s ability to invest in innovation or respond effectively to market fluctuations. Boeing’s experience with the 787 Dreamliner development, which involved significant debt accumulation, illustrates the challenges associated with managing large-scale projects and their impact on financial leverage.

The impact of debt extends to shareholder value, impacting potential dividend payouts and stock valuation. Interest payments on debt reduce net income, which is a key determinant of shareholder returns. Furthermore, a high debt-to-equity ratio can increase the perceived risk associated with the company, potentially leading to a lower stock valuation. Credit rating agencies closely monitor the debt levels of aerospace companies, and downgrades in credit ratings can increase borrowing costs and further restrict access to capital. An instance where a company’s credit rating declines due to increased debt could negatively affect its ability to secure favorable terms on future financing. Therefore, publicly traded aerospace companies meticulously balance the need for debt financing with the imperative of maintaining a healthy financial profile.

In summary, debt obligations are an inherent aspect of publicly traded aerospace companies, supporting capital-intensive operations and strategic growth initiatives. Effective management of debt levels is crucial for sustaining financial stability, preserving shareholder value, and ensuring long-term competitiveness. Navigating the complexities of debt requires aerospace companies to strike a balance between leveraging financial resources and mitigating the associated risks, ultimately influencing their ability to thrive in a dynamic global marketplace.

5. Government Contracts

Government contracts represent a cornerstone of revenue and operational stability for many publicly traded aerospace companies. These agreements, typically awarded by national defense agencies or space exploration organizations, provide a predictable income stream and enable long-term planning and investment. The reliance on government agreements, however, introduces specific considerations and dependencies for these publicly held entities.

- Revenue Stability and Predictability

Government contracts often span multiple years, providing a predictable revenue base for aerospace companies. This stability is particularly valuable in an industry characterized by long development cycles and high capital expenditures. A contract to supply military aircraft, for example, can ensure revenue for a decade or more, allowing companies to confidently invest in infrastructure and personnel. This stability also translates to increased investor confidence and a more predictable stock valuation.

- Stringent Regulatory Oversight

Agreements with governmental bodies are subject to rigorous regulatory oversight and compliance requirements. Aerospace companies must adhere to stringent quality control standards, ethical guidelines, and security protocols. Failure to comply with these regulations can result in significant penalties, reputational damage, and contract termination. Companies undergoing security breaches risk contract loss, impacting revenue.

- Political and Budgetary Influence

Government contracts are inherently subject to political and budgetary fluctuations. Changes in government administrations, shifts in defense priorities, or budget cuts can lead to contract cancellations, reductions, or delays. The dependence on a single government customer can create a concentration risk, making aerospace companies vulnerable to policy changes. Diversification across multiple governmental clients mitigates concentration risk from one government.

- Technological Advancement and Innovation

These agreements frequently drive technological advancement and innovation within the aerospace industry. Governments often seek cutting-edge technologies for defense and space exploration, incentivizing companies to invest in research and development. The development of advanced radar systems or hypersonic propulsion technologies are examples of innovations spurred by government funding. These advancements not only benefit the government but also create opportunities for commercial applications.

The dependence on government contracts, therefore, creates a unique dynamic for publicly traded aerospace companies. While offering revenue stability and driving technological advancements, these agreements also introduce regulatory burdens and political uncertainties. Effective management of these factors is crucial for maintaining financial stability and delivering shareholder value in this sector. Careful balancing of the factors is crucial for the sector’s success.

Frequently Asked Questions

This section addresses common inquiries pertaining to publicly traded organizations operating within the aeronautics and astronautics domains. The information provided aims to enhance understanding of these entities and their role in the global economy.

Question 1: What distinguishes entities traded on public exchanges in the aeronautics sector from privately held organizations?

Publicly traded organizations offer ownership shares to the general public, providing access to capital markets for funding operations and expansion. Privately held organizations, conversely, restrict ownership to a limited number of individuals or entities.

Question 2: How are the stock prices of organizations in the aeronautics and astronautics sectors influenced?

Stock prices are affected by a confluence of factors, including financial performance, contract awards, technological advancements, macroeconomic conditions, and geopolitical events. Investor sentiment and broader market trends also exert influence.

Question 3: What key financial metrics should be examined when evaluating these organizations?

Essential financial metrics include revenue growth, profit margins, debt-to-equity ratio, cash flow, and order backlog. Examination of these metrics provides insights into financial health and operational efficiency.

Question 4: What risks are inherent in investing in the stock of aerospace companies?

Risks encompass cyclical demand, regulatory changes, dependence on government contracts, technological obsolescence, supply chain disruptions, and geopolitical instability. Due diligence is essential for mitigating these risks.

Question 5: How do government agreements impact the financial performance of these publicly held enterprises?

Government contracts can provide revenue stability but also introduce regulatory and political dependencies. Changes in government priorities or budgetary constraints can significantly affect financial performance.

Question 6: What are the primary drivers of innovation within these publicly traded companies?

Innovation is driven by the pursuit of technological superiority, the need to meet evolving customer demands, and the desire to gain a competitive advantage. Investment in research and development is crucial for fostering innovation.

The information provided is intended for informational purposes only and should not be construed as investment advice. Consultation with a qualified financial advisor is recommended prior to making investment decisions.

The concluding section summarizes the key considerations discussed and offers a consolidated perspective on publicly traded companies within the sector.

Conclusion

This exploration of publicly traded aerospace companies underscores their critical role in global technology, security, and economic systems. The analysis reveals intricate relationships between financial performance, government contracts, technological innovation, and market dynamics. Effective navigation of these complexities requires a deep understanding of financial metrics, regulatory landscapes, and geopolitical influences.

Continued scrutiny of these entities is vital for informed decision-making and strategic positioning within the aerospace sector. The ongoing evolution of this domain necessitates adaptability, diligent risk assessment, and a commitment to long-term value creation. The future trajectory of publicly traded aerospace companies remains contingent upon their ability to innovate, compete, and respond effectively to the evolving demands of a globalized marketplace.

![LA Aerospace Companies: Guide & Top Firms [2024] Innovating the Future of Flight with Reliable Aviation Solutions LA Aerospace Companies: Guide & Top Firms [2024] | Innovating the Future of Flight with Reliable Aviation Solutions](https://mixaerospace.com/wp-content/uploads/2026/02/th-342-300x200.jpg)