The alphanumeric code representing shares of Vertical Aerospace traded on a public exchange provides investors with a concise identifier. This ticker allows individuals and institutions to easily track the company’s performance, place buy and sell orders, and access real-time market data related to their investment in the advanced air mobility sector.

Utilizing this symbol offers numerous benefits, including efficient communication across financial platforms, standardized market reporting, and streamlined portfolio management. Its existence reflects Vertical Aerospace’s position as a publicly traded entity and facilitates its participation in the global financial ecosystem, enhancing transparency and access to capital markets. Understanding the history of a company’s entry into the public market, including its initial public offering (IPO), can provide valuable context for interpreting its stock’s performance.

The following sections will delve into the companys performance in financial market, analysis of the associated risks and opportunities in industry and the factors influencing the valuation of its equity.

Tips Regarding Vertical Aerospace Stock Symbol

The following guidelines provide clarity and direction for effectively managing investments associated with the Vertical Aerospace stock symbol. Prudent decision-making relies on a thorough understanding of market dynamics and company-specific factors.

Tip 1: Monitor Real-Time Market Data. Tracking the stock symbols performance throughout the trading day provides essential insights into price fluctuations and market sentiment.

Tip 2: Analyze Financial Reports Regularly. Reviewing quarterly and annual reports issued by Vertical Aerospace is crucial for understanding the company’s financial health and future prospects.

Tip 3: Stay Informed About Industry Developments. The advanced air mobility sector is rapidly evolving; therefore, staying abreast of industry news, technological advancements, and regulatory changes is paramount.

Tip 4: Consider Diversification. Avoid concentrating investments solely on the Vertical Aerospace stock symbol. Diversifying a portfolio across different sectors can mitigate risk.

Tip 5: Consult with a Financial Advisor. Seeking professional advice from a qualified financial advisor can provide personalized guidance tailored to individual investment goals and risk tolerance.

Tip 6: Understand Market Volatility. Recognize that the market value associated with the stock symbol can experience periods of significant volatility. Maintain a long-term investment perspective to navigate short-term fluctuations.

Tip 7: Be Aware of Macroeconomic Factors. Consider the impact of broader economic trends, such as interest rate changes, inflation, and geopolitical events, on the overall market and the stock symbols performance.

Adhering to these recommendations can contribute to a more informed and strategic approach to investment decisions. Effective risk management and continuous learning are essential for navigating the complexities of the stock market.

The concluding section will provide a summary of the key findings and offer a final perspective on the investment potential associated with this particular security.

1. Ticker Identification

Ticker identification is fundamental to navigating stock market information. In the context of Vertical Aerospace, the specific symbol assigned serves as the primary identifier for investors to locate and track the company’s equity within financial systems.

- Uniqueness and Standardization

Each publicly traded company is assigned a unique ticker symbol. This symbol is standardized across exchanges and financial data providers. For Vertical Aerospace, its designated symbol ensures that all market participants are referencing the same entity when placing trades or analyzing data. Without this standardization, confusion and trading errors could occur.

- Data Retrieval and Analysis

The ticker symbol is the key input for retrieving real-time stock quotes, historical data, financial news, and analyst reports. Financial platforms and brokerage accounts use this symbol to present relevant information about Vertical Aerospace. Investors rely on this data to assess the company’s performance, make informed investment decisions, and manage their portfolios.

- Order Placement and Execution

When placing buy or sell orders for Vertical Aerospace shares, investors must use the correct ticker symbol. This ensures that the order is directed to the appropriate security and that the trade is executed accurately. Using an incorrect or outdated symbol could result in purchasing shares of a different company or failing to execute the desired trade.

- Branding and Recognition

While primarily functional, the ticker symbol also serves as a form of brand recognition for Vertical Aerospace within the financial community. Regular exposure to the symbol in financial news and market updates reinforces the company’s presence and identity among investors and analysts. This contributes to overall market awareness and can influence investor perception.

In summary, ticker identification is not merely a label but a critical mechanism for ensuring accuracy, efficiency, and clarity in the trading and analysis of Vertical Aerospace’s stock. It underpins all aspects of market participation, from data retrieval to order execution, and contributes to the company’s broader recognition within the financial landscape.

2. Market Performance

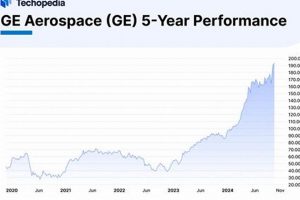

Market performance, when examined in relation to the Vertical Aerospace stock symbol, encapsulates a range of indicators reflecting investor confidence and the perceived value of the company within the financial markets. This performance is a critical factor for both current shareholders and prospective investors.

- Price Volatility

Price volatility, measured by the degree of price fluctuations over a specific period, directly impacts the perceived risk associated with the Vertical Aerospace stock symbol. High volatility may deter risk-averse investors, while attracting those seeking short-term gains. The stock’s beta, a measure of its volatility relative to the market, provides insights into its sensitivity to broader market movements. For example, significant news, such as a successful flight test or a regulatory hurdle, can trigger substantial price swings.

- Trading Volume

Trading volume represents the number of shares of Vertical Aerospace exchanged during a given period. Higher trading volume often suggests increased liquidity and heightened interest in the stock, while lower volume can indicate uncertainty or disinterest. A sudden surge in trading volume might signal a significant event, such as institutional investors entering or exiting positions. Consistent monitoring of trading volume provides valuable clues about market sentiment.

- Relative Performance to Peers

Evaluating the Vertical Aerospace stock symbol’s performance relative to its industry peersother companies involved in electric vertical takeoff and landing (eVTOL) aircraft or related technologiesoffers a comparative benchmark. Outperformance may indicate a competitive advantage or superior technology, while underperformance could suggest operational challenges or market headwinds. Comparing key financial metrics, such as revenue growth and profitability, against competitors provides a more comprehensive understanding of the company’s standing.

- Long-Term Trend Analysis

Analyzing the long-term price trend of the Vertical Aerospace stock symbol reveals patterns and insights into its overall market trajectory. Identifying trends, such as upward or downward slopes, as well as support and resistance levels, can inform investment strategies. This analysis often involves technical indicators like moving averages and trendlines, which help to smooth out short-term fluctuations and highlight underlying direction. A consistent upward trend may indicate growing investor confidence, while a sustained decline could raise concerns about the company’s future prospects.

These facets of market performance, when collectively analyzed, offer a nuanced understanding of the Vertical Aerospace stock symbol’s position within the broader financial landscape. Investors utilize these indicators to assess risk, evaluate potential returns, and make informed decisions about whether to buy, sell, or hold shares.

3. Trading Volume

Trading volume, when directly linked to the Vertical Aerospace stock symbol, provides a quantifiable measure of investor interest and market liquidity. It represents the number of shares exchanged during a specific period, serving as an indicator of the level of participation in the company’s equity. Increased trading volume often correlates with significant events, such as earnings announcements, regulatory approvals, or major contracts, reflecting market reaction to new information. Conversely, decreased trading volume may suggest investor uncertainty or a lack of immediate catalysts affecting the stock’s valuation. A high trading volume may indicate a strong consensus about the stocks value, while low volume could reflect divergent views or a wait-and-see approach. For example, if Vertical Aerospace announces a partnership with a major airline, the subsequent trading volume could surge as investors react to the perceived positive implications.

Monitoring the trading volume associated with the Vertical Aerospace stock symbol is crucial for assessing the ease with which shares can be bought or sold without significantly impacting the market price. Higher trading volume generally implies greater liquidity, allowing investors to enter or exit positions more readily. Low-volume trading, however, can lead to wider bid-ask spreads and potential price slippage, increasing transaction costs and posing challenges for large institutional investors. Real-time data on trading volume, available through financial platforms, enables investors to gauge the level of market engagement and adjust their trading strategies accordingly. The fluctuations in trading volume, therefore, is not random, but a reflection of how market assesses news, risks and potentials.

In summary, the trading volume surrounding the Vertical Aerospace stock symbol is not merely a numerical value but a critical gauge of market dynamics and investor sentiment. Understanding its fluctuations, particularly in relation to specific company events or broader market trends, is essential for informed decision-making. While high volume can signify strong conviction, and low volume may suggest caution, both extremes present unique challenges that require careful consideration within a comprehensive investment strategy. Continuous observation of this parameter is indispensable for investors aiming to navigate the complexities of the stock market and to correctly value the Vertical Aerospace equity.

4. Investor Sentiment

Investor sentiment, a prevailing attitude or feeling towards the market or a specific security, significantly influences the trading dynamics associated with the Vertical Aerospace stock symbol. It reflects the collective expectations and emotional biases of market participants, impacting buying and selling pressure. Positive sentiment, driven by factors such as favorable news, technological advancements, or positive analyst ratings, can lead to increased demand for the stock, pushing its price upward. Conversely, negative sentiment, fueled by concerns about regulatory hurdles, competition, or financial performance, may result in selling pressure, causing the stock price to decline. For instance, a successful demonstration of its eVTOL aircraft could generate optimistic sentiment, attracting new investors and bolstering the share price. Therefore, is crucial to understand the dynamics between sentiment and market behavior.

The relationship between investor sentiment and the Vertical Aerospace stock symbol is complex and multifaceted. Sentiment is not solely based on rational analysis of financial data; it often incorporates subjective factors, such as media coverage, social media trends, and herd behavior. The advanced air mobility sector, in which Vertical Aerospace operates, is particularly susceptible to sentiment-driven fluctuations due to its innovative nature and reliance on future projections. A prominent short seller expressing doubts about the company’s technology, or a well-known investor endorsing the stock, can drastically alter the stock’s trajectory. Understanding this influence allows analysts and investors to interpret price movements and trading patterns more effectively, separating genuine value from transient market noise.

In conclusion, investor sentiment serves as a critical component shaping the market behavior of the Vertical Aerospace stock symbol. It’s dynamic and often unpredictable, yet its impact is undeniable. Successfully navigating the complexities of this relationship requires a balanced approach combining fundamental analysis with an awareness of prevailing sentiment trends. Understanding that investor feelings about the company will invariably have an effect on prices, traders must be vigilant in their work on interpreting sentiment for better decisions. Failing to do so may create a situation where traders are unable to act accordingly within the market.

5. Company Valuation

Company valuation serves as a critical assessment of a firm’s intrinsic worth, directly influencing the market price and investor perception of its stock symbol. In the context of Vertical Aerospace, accurately determining its valuation is essential for both current shareholders and prospective investors seeking to gauge the investment’s potential and associated risks.

- Discounted Cash Flow (DCF) Analysis

DCF analysis projects a company’s future free cash flows and discounts them back to their present value, considering the time value of money and the risk associated with those cash flows. For Vertical Aerospace, DCF analysis requires careful estimation of revenue growth, operating margins, and capital expenditures, particularly given the nascent nature of the advanced air mobility market. A higher DCF valuation suggests that the stock symbol is undervalued, while a lower valuation may indicate overvaluation. The discount rate used reflects the perceived riskiness of Vertical Aerospaces future cash flows, encompassing factors such as regulatory uncertainties and technological hurdles.

- Comparable Company Analysis (Comps)

Comps involves comparing Vertical Aerospace to publicly traded companies in similar industries or with comparable business models. Key financial metrics, such as price-to-earnings (P/E) ratio, price-to-sales (P/S) ratio, and enterprise value-to-EBITDA (EV/EBITDA), are used to derive valuation multiples. Applying these multiples to Vertical Aerospaces financial metrics yields an implied valuation. Selecting appropriate comparable companies is crucial; for example, comparing Vertical Aerospace to established aerospace manufacturers or other eVTOL companies provides context for its relative valuation. Significant differences in valuation multiples compared to peers may indicate market inefficiencies or unique factors affecting Vertical Aerospace’s stock symbol.

- Asset-Based Valuation

Asset-based valuation focuses on the net asset value (NAV) of a company, subtracting total liabilities from total assets. While less relevant for high-growth technology companies like Vertical Aerospace, it provides a baseline valuation based on tangible assets. However, the value of intellectual property, patents, and future technological advancements, which are significant for Vertical Aerospace, are often not fully reflected in asset-based valuations. This method can be used as a lower-bound estimate, offering insights into the intrinsic value floor.

- Precedent Transactions Analysis

Precedent transactions analysis involves examining past mergers, acquisitions, and private equity investments in similar companies to derive valuation benchmarks. The transaction multiples, such as transaction value-to-revenue, are applied to Vertical Aerospace to estimate its potential valuation in a hypothetical transaction scenario. This method is particularly relevant when assessing the attractiveness of Vertical Aerospace as a potential acquisition target. The terms and conditions of precedent transactions, including premiums paid and deal structures, provide valuable context for evaluating the companys worth.

The application of these valuation methodologies provides a multifaceted view of Vertical Aerospace’s intrinsic value. These metrics, together, help establish realistic expectations of what the share may be worth. The investor can use all these factors for their own analysis to determine whether the current price accurately reflects its long-term potential. Ultimately, the alignment or divergence between the company’s valuation and its stock symbol’s market price informs investment decisions and shapes market sentiment toward the firm’s future.

Frequently Asked Questions About the Vertical Aerospace Stock Symbol

This section addresses common inquiries regarding the financial instrument representing Vertical Aerospace shares, providing concise and informative answers.

Question 1: What does the Vertical Aerospace stock symbol represent?

The stock symbol serves as a unique identifier for shares of Vertical Aerospace traded on a public exchange. It allows investors to track the company’s performance, access market data, and place buy or sell orders.

Question 2: Where is the Vertical Aerospace stock symbol traded?

The specific exchange on which the shares are traded depends on the company’s initial public offering (IPO) and subsequent listings. Refer to official company announcements or financial news sources for the most accurate information.

Question 3: How can the Vertical Aerospace stock symbol be used to monitor performance?

Real-time price quotes, historical data, and financial charts associated with the stock symbol enable investors to assess the company’s performance over various timeframes. Monitoring price fluctuations, trading volume, and key financial ratios provides insights into market sentiment and the company’s overall health.

Question 4: What factors influence the price of the Vertical Aerospace stock symbol?

Numerous factors can impact the stock’s price, including company-specific news (e.g., earnings reports, product announcements), industry trends, macroeconomic conditions (e.g., interest rates, inflation), and investor sentiment. The interplay of these factors determines market demand and supply for the shares.

Question 5: How can the risk associated with investing in the Vertical Aerospace stock symbol be mitigated?

Diversification, thorough research, and a long-term investment horizon can help mitigate risk. Consulting with a qualified financial advisor and staying informed about industry developments are also crucial steps.

Question 6: What are the potential benefits of investing in the Vertical Aerospace stock symbol?

Potential benefits include capital appreciation (i.e., an increase in the stock price), dividend income (if the company pays dividends), and participation in the growth of the advanced air mobility sector. However, these benefits are not guaranteed and are subject to market conditions and company performance.

Understanding the stock symbol is key to evaluating a companys performance and potential for investments. Also, understanding all the implications can provide a better insight on the market.

Next, let’s investigate what implications can be found about future market projections.

Vertical Aerospace Stock Symbol Conclusion

This examination has detailed various facets of the ticker representing Vertical Aerospace, emphasizing its role in market tracking, valuation assessment, and investment decision-making. The symbol functions as a gateway to understanding the company’s market performance, investor sentiment, and financial health. Analysis of trading volume, price volatility, and comparative metrics offers a comprehensive perspective on its equity.

The data associated with the Vertical Aerospace stock symbol warrants ongoing scrutiny and informed interpretation. Continued diligence in monitoring market developments, understanding company financials, and recognizing industry trends remains crucial for investors seeking to navigate the complexities of this emerging sector and make prudent decisions. The advanced air mobility sector is rapidly changing and the associated equity should reflect these changes.

![GE Aerospace Stock Down Today: Reasons & Outlook [2024] Innovating the Future of Flight with Reliable Aviation Solutions GE Aerospace Stock Down Today: Reasons & Outlook [2024] | Innovating the Future of Flight with Reliable Aviation Solutions](https://mixaerospace.com/wp-content/uploads/2026/01/th-780-300x200.jpg)

![Astro Aerospace Stock: What Happened? [Analysis & Trends] Innovating the Future of Flight with Reliable Aviation Solutions Astro Aerospace Stock: What Happened? [Analysis & Trends] | Innovating the Future of Flight with Reliable Aviation Solutions](https://mixaerospace.com/wp-content/uploads/2026/01/th-715-300x200.jpg)