The value of shares in a specific investment vehicle focusing on companies within the defense and aerospace sectors constitutes a key indicator for investors. This value, expressed in a monetary unit, reflects the collective market sentiment and financial performance of the underlying holdings of the fund. For instance, a price of $50 per share indicates the cost to acquire one unit of ownership in the fund at a specific point in time.

This market value serves as a crucial benchmark for evaluating investment returns, assessing portfolio performance, and making informed decisions regarding buying, selling, or holding shares. Its historical trend provides insights into the fund’s overall growth trajectory, its sensitivity to market fluctuations, and the general health of the defense and aerospace industries. Changes in this value are influenced by factors such as geopolitical events, government spending on defense, technological advancements, and overall economic conditions.

Analyzing the factors that drive these fluctuations and understanding the fund’s positioning within the broader market landscape are critical for investors seeking to leverage opportunities within this specialized sector.

Insights for Investors

The following points offer guidance for those monitoring the market value of investments concentrated in the defense and aerospace industries. Understanding these factors can contribute to more informed decision-making.

Tip 1: Monitor Geopolitical Events. Global instability and evolving international relations often correlate with increased defense spending, potentially impacting the profitability and, subsequently, the fund’s value.

Tip 2: Track Government Defense Budgets. Changes in governmental spending on defense programs directly influence the revenue streams of many companies held within the fund. Reviewing budget allocations can provide early signals of future performance.

Tip 3: Analyze Technological Advancements. Innovations in aerospace and defense technologies, such as unmanned systems, advanced materials, or cybersecurity solutions, can create growth opportunities for companies within the fund.

Tip 4: Assess Economic Indicators. Broader economic conditions, including interest rates and inflation, can affect the financial performance of companies within the fund and overall investor sentiment.

Tip 5: Compare Performance Against Benchmarks. Evaluate the fund’s performance relative to relevant industry benchmarks and peer funds to gauge its competitive positioning and identify potential areas of strength or weakness.

Tip 6: Review Fund Holdings. Understand the specific companies and their weighting within the fund’s portfolio. Significant changes in holdings can signal shifts in investment strategy or risk tolerance.

Tip 7: Consider Management Expertise. Examine the experience and track record of the fund’s management team, including their investment philosophy and approach to risk management.

Careful attention to these insights offers a foundation for assessing the opportunities and risks associated with targeted investments.

These considerations are essential for navigating the complexities of this specialized market.

1. Daily Market Valuation

Daily market valuation serves as the cornerstone in determining the “fidelity defense and aerospace fund price.” It is the process by which the aggregate value of all holdings within the fund is calculated at the close of each trading day, directly influencing the price investors observe. This calculation is not arbitrary; it is rooted in the real-time assessment of the underlying assets.

- Net Asset Value (NAV) Calculation

The Net Asset Value (NAV) is the primary driver of daily market valuation. It is computed by summing the total market value of the fund’s assets, subtracting liabilities, and then dividing by the number of outstanding shares. For example, if the fund holds $1 billion in assets, has $10 million in liabilities, and 10 million shares outstanding, the NAV would be $99 per share. This NAV directly dictates the “fidelity defense and aerospace fund price” at which shares are bought and sold.

- Influence of Individual Stock Performance

The performance of individual companies within the fund’s portfolio significantly affects the daily valuation. If a key holding, such as a major defense contractor, experiences a surge in stock price due to a large contract win, this will positively impact the fund’s overall asset value and consequently, increase the daily valuation. Conversely, negative news about a significant holding can depress the fund’s price.

- Impact of Market Sentiment and Trading Activity

Beyond the intrinsic value of holdings, market sentiment and trading activity play a crucial role. Increased demand for shares of the “fidelity defense and aerospace fund” can drive the price above its calculated NAV due to market forces. Conversely, significant selling pressure can push the price below the NAV. This dynamic interplay between investor behavior and fundamental valuation is central to understanding daily price movements.

- Transparency and Regulatory Oversight

The process of daily market valuation is subject to stringent regulatory oversight to ensure transparency and prevent manipulation. Funds are required to adhere to specific accounting standards and valuation methodologies. This oversight aims to protect investors by providing a reliable and accurate representation of the fund’s value each day. Any discrepancies or irregularities are subject to scrutiny by regulatory bodies.

In summary, the daily market valuation is not merely a number, but a multifaceted calculation reflecting the intrinsic value of assets, investor sentiment, and regulatory constraints. It is the foundational element that directly determines the “fidelity defense and aerospace fund price” that investors rely on for informed decision-making.

2. Supply-Demand Dynamics

The relationship between supply and demand significantly influences the “fidelity defense and aerospace fund price.” Increased demand for shares, often driven by positive industry news, geopolitical events suggesting increased defense spending, or favorable analyst ratings, can elevate the fund’s price. This occurs as buyers compete for a limited number of shares available at the prevailing price. Conversely, an increase in the supply of shares, perhaps due to widespread investor selling prompted by concerns about defense budget cuts or negative industry outlooks, exerts downward pressure on the price. The equilibrium point, where supply meets demand, determines the market value at any given time.

Real-world examples illustrate this dynamic. Following the announcement of a major arms deal or a significant increase in a country’s defense budget, investor interest in defense-related funds typically surges, driving up demand and subsequently the price. Conversely, periods of international peace negotiations or governmental efforts to reduce military spending can lead to a decline in investor confidence, resulting in increased selling and a drop in the fund’s price. News regarding technological advancements in the aerospace sector, successful product launches by companies within the fund’s portfolio, or positive earnings reports can also spur demand and affect pricing.

Understanding supply-demand dynamics is crucial for investors seeking to predict or react to movements in the “fidelity defense and aerospace fund price.” While these forces are complex and influenced by numerous factors, awareness of their fundamental relationship can inform more strategic investment decisions. Analyzing market trends, tracking news related to the defense and aerospace industries, and monitoring investor sentiment are key components of assessing these dynamics and their potential impact on the fund’s value.

3. Benchmark Comparisons

Benchmark comparisons are integral to evaluating the performance of the “fidelity defense and aerospace fund price.” These comparisons involve assessing the fund’s price fluctuations and overall returns against relevant industry benchmarks, such as the S&P Aerospace & Defense Select Industry Index or similar indices. This analysis provides context for understanding whether the fund is outperforming, underperforming, or performing in line with the broader sector. For example, if the fund’s price increases by 10% in a year while the S&P Aerospace & Defense Select Industry Index rises by 15%, the benchmark comparison reveals relative underperformance. The selection of an appropriate benchmark is critical, as it should accurately reflect the investment focus and risk profile of the fund.

The practical significance of these comparisons lies in their ability to inform investment decisions. Investors use benchmark comparisons to assess the fund’s management effectiveness, identify potential risks, and determine whether the fund is meeting its stated objectives. If a fund consistently underperforms its benchmark, it may indicate that the fund’s investment strategy is not well-suited to the current market environment or that the management team is not effectively executing its strategy. Furthermore, benchmark comparisons can help investors evaluate the fund’s risk-adjusted returns, providing a more comprehensive picture of its performance. These comparisons also serve as a tool for evaluating the fund’s expense ratio relative to its performance, helping investors determine whether they are receiving adequate value for the fees charged.

In conclusion, benchmark comparisons offer a vital framework for evaluating the “fidelity defense and aerospace fund price.” By analyzing the fund’s performance relative to appropriate benchmarks, investors gain valuable insights into its strengths and weaknesses, informing more strategic investment choices. While these comparisons are not the sole determinant of investment success, they are an essential component of a thorough due diligence process, contributing to a more informed understanding of the fund’s overall value proposition.

4. Performance History

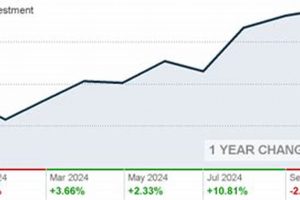

Performance history is intrinsically linked to the “fidelity defense and aerospace fund price,” serving as a tangible record of past value fluctuations and overall growth trends. This historical data acts as a key indicator for prospective and current investors, providing insights into the fund’s sensitivity to market events, industry-specific catalysts, and overall economic conditions. For example, a consistent history of positive returns during periods of geopolitical instability may suggest the fund is well-positioned to benefit from increased defense spending. Conversely, periods of underperformance during industry downturns would highlight potential vulnerabilities. The “fidelity defense and aerospace fund price” at any given time is, in part, a reflection of how the market perceives its past performance and future potential based on this historical record.

Analyzing this historical data requires a nuanced approach, considering both short-term and long-term trends. Short-term price fluctuations may be influenced by speculative trading or temporary market corrections, while long-term trends provide a more reliable indication of the fund’s sustainable growth potential. Evaluating performance during various market cyclesbull markets, bear markets, and periods of economic recessionoffers a comprehensive understanding of the fund’s resilience and risk profile. Furthermore, comparing the fund’s performance history against relevant benchmarks provides crucial context for assessing its relative performance within the defense and aerospace sector.

In conclusion, the “fidelity defense and aerospace fund price” cannot be fully understood without considering its performance history. This historical record provides valuable insights into the fund’s risk profile, growth potential, and sensitivity to market conditions. While past performance is not necessarily indicative of future results, it remains a crucial tool for investors seeking to make informed decisions about investing in the Fidelity Defense and Aerospace Fund.

5. Investor Sentiment

Investor sentiment, reflecting the overall attitude or feeling of investors towards a specific investment, plays a significant role in determining the “fidelity defense and aerospace fund price”. This collective mood, driven by a variety of factors, can lead to fluctuations in demand and supply, consequently affecting the fund’s market valuation.

- News and Geopolitical Events

Positive news regarding defense contracts, technological advancements in aerospace, or heightened geopolitical tensions often fosters optimistic investor sentiment. This optimism can lead to increased buying pressure, driving the “fidelity defense and aerospace fund price” upward. Conversely, negative news, such as defense budget cuts or easing of international conflicts, can trigger bearish sentiment, leading to increased selling and a price decrease.

- Economic Conditions

Broader economic conditions significantly influence investor sentiment towards the fund. A strong economy generally fosters confidence in the market, leading to increased investment in various sectors, including defense and aerospace. Conversely, economic downturns can breed uncertainty and risk aversion, prompting investors to reduce exposure to potentially volatile sectors, impacting the “fidelity defense and aerospace fund price”.

- Market Trends and Momentum

Prevailing market trends and momentum play a crucial role in shaping investor sentiment. A sustained upward trend in the “fidelity defense and aerospace fund price” can attract momentum-driven investors, further fueling demand and driving the price higher. Conversely, a persistent downward trend can trigger fear and panic selling, accelerating the price decline.

- Analyst Ratings and Recommendations

Analyst ratings and recommendations from financial institutions significantly influence investor sentiment. Positive ratings and buy recommendations can generate increased interest in the fund, leading to higher demand and a subsequent rise in the “fidelity defense and aerospace fund price”. Conversely, negative ratings and sell recommendations can trigger a wave of selling, putting downward pressure on the price.

These factors collectively demonstrate how investor sentiment, often irrational and driven by emotion, can significantly impact the “fidelity defense and aerospace fund price.” Understanding these dynamics is crucial for investors seeking to navigate the complexities of this sector and make informed investment decisions.

Frequently Asked Questions

The following questions address common inquiries regarding the factors influencing the market value of the Fidelity Defense and Aerospace Fund. These answers aim to provide clarity and context for investors navigating this specific sector.

Question 1: What primary factors determine the daily fluctuations observed in the Fidelity Defense and Aerospace Fund price?

The daily value variations are predominantly driven by market supply and demand, influenced by the performance of underlying holdings, geopolitical events, and macroeconomic indicators. Positive news concerning a major defense contractor within the fund, for example, could lead to an increase in demand and a subsequent rise in the price. Conversely, negative economic data or international de-escalation could decrease the price.

Question 2: How does government spending on defense and aerospace impact the fund’s price?

Government defense budgets and specific contract awards directly affect the revenue streams of companies held within the fund. Increases in military spending or significant contract wins typically translate to higher profits for these companies, which in turn can drive up the fund’s price. Conversely, budget cuts or contract losses can negatively impact the fund’s value.

Question 3: What role does technological innovation play in influencing the Fidelity Defense and Aerospace Fund price?

Technological advancements and disruptive innovations in the defense and aerospace industries can create growth opportunities for companies developing and implementing these technologies. Funds holding these innovative companies often experience increased investor interest and potential price appreciation. This effect is particularly pronounced when new technologies secure government contracts or gain widespread adoption within the industry.

Question 4: How does investor sentiment impact the fund’s price, and what drives this sentiment?

Investor sentiment, whether positive or negative, significantly influences the fund’s trading volume and price. This sentiment is shaped by factors such as news headlines, economic forecasts, analyst ratings, and overall market conditions. Optimistic sentiment often leads to increased buying pressure, while pessimistic sentiment can trigger selling, impacting the fund’s value.

Question 5: How does comparing the fund to relevant benchmarks assist in understanding its price performance?

Benchmarking against relevant indices, such as the S&P Aerospace & Defense Select Industry Index, provides context for evaluating the fund’s relative performance. If the fund consistently outperforms its benchmark, it indicates strong management and strategic investment decisions. Conversely, underperformance may suggest a need to re-evaluate the fund’s investment approach.

Question 6: Is past price performance a reliable indicator of future returns for the Fidelity Defense and Aerospace Fund?

While past performance can offer insights into the fund’s historical trends and risk profile, it is not necessarily indicative of future results. Market conditions, economic factors, and industry dynamics can change significantly over time, impacting the fund’s performance. Therefore, investment decisions should be based on a comprehensive analysis of current market conditions and future outlook, not solely on past price performance.

These answers provide a foundational understanding of the factors that influence the value. Further research and consultation with a financial advisor are recommended before making any investment decisions.

This understanding of the influences on fund price sets the stage for a deeper exploration of investment strategies within the defense and aerospace sectors.

Conclusion

This exploration has illuminated the multifaceted factors influencing the “fidelity defense and aerospace fund price.” From daily market valuations driven by net asset value and individual stock performance to the significant role of supply-demand dynamics, geopolitical events, and investor sentiment, a comprehensive understanding of these elements is crucial for informed investment decisions. Benchmarking against relevant indices and analyzing historical performance offer valuable context for evaluating the fund’s relative strengths and weaknesses.

Ultimately, the “fidelity defense and aerospace fund price” represents a complex interplay of market forces and industry-specific dynamics. Continuous monitoring, diligent research, and a strategic approach are essential for navigating the opportunities and risks associated with this specialized sector. Informed investment decisions should be guided by thorough analysis, professional advice, and a clear understanding of individual risk tolerance.

![Fidelity Defense & Aerospace: Invest Wisely | [Fund Name] Safem Fabrication - Precision Engineering & Custom Manufacturing Solutions Fidelity Defense & Aerospace: Invest Wisely | [Fund Name] | Safem Fabrication - Precision Engineering & Custom Manufacturing Solutions](https://mixaerospace.com/wp-content/uploads/2025/06/th-4954-300x200.jpg)