The interconnected network responsible for the creation and distribution of products within the aircraft and spacecraft manufacturing sector involves a multifaceted system. This incorporates sourcing raw materials, component manufacturing, assembly, testing, delivery, and after-sales support. The system’s complexity is driven by stringent quality control requirements, long lead times, and the involvement of numerous global suppliers.

A robust and efficient system in this high-technology sector is critical for on-time project completion, cost control, and maintaining a competitive edge. Historically, inefficiencies within these systems have led to significant delays, budget overruns, and compromised product quality. Effective strategies focused on risk mitigation, supplier relationship management, and technology adoption are therefore paramount.

The following sections will examine key aspects of ensuring operational effectiveness, including strategies for navigating industry challenges, optimizing procurement processes, implementing advanced technologies, and fostering collaborative partnerships. Each of these elements plays a vital role in creating a streamlined and resilient framework.

Key Strategies for Optimizing Operations

Effective execution within the interconnected network requires a strategic approach to manage complexity and ensure resilience. The following guidelines provide a foundation for achieving operational excellence.

Tip 1: Prioritize Risk Mitigation: Identify potential disruptions within the network, such as geopolitical instability, supplier financial distress, or natural disasters. Develop contingency plans to address these risks and minimize potential impact on production schedules.

Tip 2: Enhance Supplier Relationship Management: Foster collaborative partnerships with key suppliers. Establish clear communication channels, performance metrics, and shared goals. Conduct regular audits and assessments to ensure compliance with quality standards and ethical business practices.

Tip 3: Implement Advanced Technologies: Leverage digital tools such as predictive analytics, artificial intelligence, and blockchain technology to improve visibility, optimize inventory levels, and streamline logistics processes. These technologies can enable real-time decision-making and enhance overall efficiency.

Tip 4: Embrace Lean Principles: Apply lean manufacturing principles to eliminate waste, reduce lead times, and improve overall productivity. Identify and address bottlenecks in the production process through value stream mapping and continuous improvement initiatives.

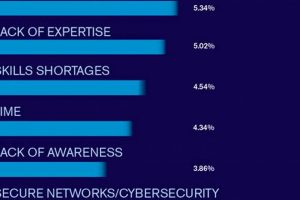

Tip 5: Strengthen Cybersecurity Measures: Implement robust cybersecurity protocols to protect sensitive data and prevent disruptions to critical systems. Conduct regular security audits and employee training to mitigate the risk of cyberattacks.

Tip 6: Invest in Talent Development: Provide ongoing training and development opportunities for employees to enhance their skills and knowledge. This will ensure that the workforce is equipped to manage the complexities of the evolving sector and implement new technologies effectively.

Adopting these strategies will contribute to increased efficiency, reduced costs, and improved overall performance. Proactive management of this network is crucial for maintaining a competitive advantage in a dynamic global environment.

The next section will offer concluding thoughts on ensuring long-term success in this intricate and demanding sector.

1. Supplier Qualification

Supplier qualification forms a cornerstone within aerospace sector execution. The selection and validation of suppliers is not merely procedural; it is a critical element that directly impacts product integrity, safety, and overall operational efficiency. A robust supplier qualification process minimizes risks associated with substandard components, delays, and regulatory non-compliance.

- Technical Capability Assessment

This assessment rigorously evaluates a supplier’s technical expertise, manufacturing processes, and quality control systems. It involves scrutinizing the supplier’s ability to meet stringent aerospace standards such as AS9100. For instance, a supplier of aircraft engine components must demonstrate proficiency in precision machining, materials testing, and adherence to tight tolerances. Failure to meet these requirements can result in engine failures, compromising flight safety and leading to significant financial repercussions.

- Financial Stability Verification

Assessing a supplier’s financial health is crucial to ensure their long-term viability and ability to fulfill contractual obligations. A financially unstable supplier may face difficulties in procuring raw materials, investing in necessary equipment, or maintaining consistent production levels. This can lead to delays, quality issues, or even supplier bankruptcy, disrupting the entire chain. Thorough financial due diligence, including reviewing financial statements and credit ratings, is therefore essential.

- Compliance and Certification Audits

Aerospace suppliers must adhere to a complex web of regulations and industry standards. Compliance audits verify that suppliers are meeting these requirements, including those related to environmental impact, ethical labor practices, and data security. Certification audits, such as those conducted by NADCAP (National Aerospace and Defense Contractors Accreditation Program), provide independent validation of a supplier’s adherence to specific process standards. Non-compliance can result in fines, legal action, and reputational damage for both the supplier and the aircraft manufacturer.

- Performance Monitoring and Evaluation

Supplier performance must be continuously monitored and evaluated to ensure ongoing adherence to quality standards and contractual obligations. Key performance indicators (KPIs) such as on-time delivery, defect rates, and responsiveness to corrective actions provide valuable insights into supplier performance. Regular performance reviews and audits help identify areas for improvement and ensure that suppliers are consistently meeting expectations. Failing to proactively monitor and address performance issues can lead to recurring problems and disruptions in the chain.

These facets are interconnected, creating a comprehensive approach to supplier management. Effective supplier qualification minimizes risks, ensures product quality, and supports the overall stability and competitiveness of the sector. By implementing rigorous qualification processes, companies can build strong, reliable, and sustainable supplier relationships, which are essential for navigating the complexities of the sector.

2. Risk Mitigation

Within the aerospace sector, a robust system is susceptible to numerous potential disruptions, rendering proactive risk mitigation indispensable. These risks span geopolitical instability, natural disasters, supplier financial distress, and cybersecurity threats, all capable of severely impacting production schedules and financial stability. The highly intricate and global nature of aerospace supply networks amplifies the potential for cascading failures. For instance, the 2011 Tohoku earthquake in Japan disrupted the supply of specialized electronic components, causing significant delays in aircraft manufacturing across the globe. This illustrates the far-reaching consequences of single-source dependencies and the critical need for diversified sourcing strategies.

Effective risk mitigation involves several key steps: risk identification, assessment, and response. Identification entails systematically identifying potential threats to the network, considering both internal and external factors. Assessment requires evaluating the likelihood and impact of each identified risk. Response involves developing and implementing strategies to mitigate, transfer, or avoid these risks. This might include establishing buffer inventories, securing alternative suppliers, or investing in cybersecurity infrastructure. Furthermore, proactive risk management requires continuous monitoring and adaptation, as the threat landscape is constantly evolving. Regular stress tests and simulations can help identify vulnerabilities and validate the effectiveness of mitigation strategies.

In conclusion, risk mitigation is not merely a reactive measure but a proactive and integral component within aerospace systems. A failure to adequately address potential disruptions can result in significant financial losses, reputational damage, and even safety compromises. By prioritizing risk management and implementing robust mitigation strategies, organizations can enhance the resilience of their networks, ensuring business continuity and maintaining a competitive advantage. The investment in proactive risk management represents a strategic imperative for long-term success in this dynamic and demanding environment.

3. Demand Forecasting

Accurate demand forecasting forms a cornerstone of effective systems within the aerospace sector. It provides the foundational data upon which production planning, inventory management, and resource allocation decisions are based. Inaccurate forecasts can lead to significant inefficiencies, including excess inventory, stockouts, production delays, and increased costs. The long lead times and high costs associated with aerospace components amplify the consequences of forecasting errors.

- Historical Data Analysis

This technique involves analyzing past sales data, order patterns, and market trends to identify recurring patterns and predict future demand. Historical data can reveal seasonal fluctuations, cyclical trends, and the impact of promotional activities. For example, analyzing past demand for aircraft replacement parts can help forecast future demand based on the age and usage of the existing aircraft fleet. The accuracy of historical data analysis depends on the availability of reliable and comprehensive data sets. Inaccurate or incomplete data can lead to biased forecasts and suboptimal decision-making.

- Statistical Modeling

Statistical models, such as time series analysis and regression analysis, use mathematical algorithms to predict future demand based on historical data and other relevant variables. Time series analysis identifies patterns in historical data, such as trends, seasonality, and cyclical variations, and uses these patterns to extrapolate future demand. Regression analysis examines the relationship between demand and other variables, such as economic indicators, market share, and pricing. For instance, a statistical model might predict demand for new aircraft based on projected growth in air passenger traffic and airline profitability. The effectiveness of statistical modeling depends on the appropriateness of the chosen model and the quality of the input data.

- Qualitative Forecasting

Qualitative forecasting relies on expert opinion, market research, and customer surveys to predict future demand. This technique is particularly useful when historical data is limited or unreliable, such as when introducing a new product or entering a new market. For example, a survey of airline executives might provide insights into their future aircraft purchasing plans. The accuracy of qualitative forecasting depends on the expertise and impartiality of the individuals involved and the rigor of the data collection and analysis methods.

- Collaborative Forecasting

Collaborative forecasting involves sharing demand information and forecasts with suppliers and customers to improve forecast accuracy and reduce variability. This approach enables all participants in the chain to make more informed decisions and better align their operations. For example, an aircraft manufacturer might share its production schedule with its component suppliers, allowing them to plan their production accordingly. Collaborative forecasting requires trust, communication, and a willingness to share sensitive information among participants.

Effective demand forecasting is not a one-time event but an ongoing process that requires continuous monitoring, evaluation, and refinement. The choice of forecasting technique depends on the specific context, the availability of data, and the desired level of accuracy. Organizations that invest in robust forecasting processes are better positioned to manage their networks effectively, reduce costs, and improve customer service. The integration of advanced analytics and machine learning techniques offers further opportunities to enhance forecasting accuracy and improve decision-making across the aerospace enterprise.

4. Inventory Optimization

Inventory optimization within aerospace systems is a critical undertaking directly impacting operational efficiency and profitability. Given the unique characteristics of the aerospace sector, including long lead times, high component costs, and stringent quality requirements, efficient inventory management is paramount. Inefficiencies in inventory control can lead to substantial financial losses, production delays, and compromised customer service. For instance, holding excess inventory ties up significant capital, while stockouts can halt production lines, resulting in missed deadlines and contractual penalties. Consider the case of a major aircraft manufacturer that experienced significant delays in delivering new aircraft due to shortages of specific fasteners. This incident underscores the importance of maintaining optimal inventory levels to avoid disruptions in production.

Effective inventory optimization involves a multifaceted approach that balances the costs of holding inventory with the risks of stockouts. This includes implementing sophisticated forecasting techniques, optimizing safety stock levels, and streamlining procurement processes. Furthermore, advanced technologies such as predictive analytics and machine learning can be leveraged to improve demand forecasting and optimize inventory levels in real time. For example, some aerospace companies are using machine learning algorithms to analyze historical data, market trends, and supplier performance to predict future demand and adjust inventory levels accordingly. Such proactive measures minimize the risk of stockouts while reducing holding costs.

In conclusion, inventory optimization is an indispensable component of aerospace systems. It requires a strategic approach that integrates advanced technologies, robust forecasting methods, and streamlined procurement processes. Successfully optimizing inventory levels allows aerospace companies to minimize costs, improve operational efficiency, and enhance customer satisfaction. The ongoing pursuit of optimized inventory management represents a critical pathway to maintaining competitiveness and achieving long-term success in this highly demanding sector.

5. Technology Integration

The implementation of advanced technologies is transforming operational frameworks within the aerospace sector. These integrations enhance visibility, efficiency, and responsiveness, ultimately improving decision-making across the entire value stream.

- Predictive Analytics

Predictive analytics utilizes statistical algorithms and machine learning techniques to forecast future demand, identify potential disruptions, and optimize inventory levels. For example, airlines use predictive analytics to anticipate maintenance needs based on aircraft usage data, enabling proactive scheduling and minimizing downtime. This integration enables preemptive identification of potential delays or material shortages, allowing for early intervention and reduced disruption.

- Blockchain Technology

Blockchain technology enhances traceability and transparency by providing a secure and immutable record of transactions and product provenance. This is particularly valuable in the aerospace sector, where counterfeit parts and materials pose a significant risk. By tracking the movement of components from origin to final assembly, blockchain can ensure authenticity and compliance with regulatory requirements. This can significantly enhance safety and reduce the risk of using substandard parts.

- Internet of Things (IoT)

IoT devices, such as sensors and RFID tags, provide real-time visibility into the location, condition, and performance of assets. This data enables better inventory management, optimized logistics, and improved maintenance scheduling. For instance, sensors embedded in aircraft components can monitor temperature, pressure, and vibration levels, providing valuable data for predictive maintenance programs. These technologies allow for proactive issue resolution and minimize unplanned downtime.

- Cloud Computing

Cloud computing provides scalable and cost-effective access to computing resources, enabling organizations to store, process, and analyze large volumes of data. This is essential for managing the complex data generated within the aerospace sector. By leveraging cloud-based platforms, companies can improve collaboration, streamline processes, and gain access to advanced analytics tools. This can facilitate improved data-driven decision-making and improve overall operational efficiency.

The strategic integration of these technologies can transform the effectiveness of execution within the sector. These advancements enhance the ability to manage risk, optimize resource allocation, and improve customer satisfaction. By embracing technology, organizations can position themselves for success in an increasingly competitive and rapidly evolving global market.

6. Regulatory Compliance

Adherence to a stringent regulatory framework is paramount for every element within the aerospace sector. This framework, enforced by agencies such as the FAA, EASA, and others, governs all stages of component sourcing, manufacturing, testing, and distribution. Non-compliance can result in significant financial penalties, production delays, and, most critically, compromised safety.

- FAA Regulations (Part 21, Part 145)

These regulations dictate the requirements for manufacturing processes, quality control systems, and maintenance procedures. For example, FAA Part 21 outlines the requirements for obtaining a Production Certificate, which allows a manufacturer to produce aircraft parts. Failure to comply with these requirements can result in the revocation of the certificate, halting production. Compliance necessitates rigorous documentation, traceability, and adherence to specified quality standards.

- REACH and RoHS Compliance

REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) and RoHS (Restriction of Hazardous Substances) regulations restrict the use of certain hazardous materials in products. Compliance requires manufacturers to identify and eliminate prohibited substances from their processes. For instance, cadmium plating, commonly used for corrosion protection, is restricted under RoHS. Non-compliance can lead to product recalls, export restrictions, and legal penalties.

- ITAR and EAR Regulations

The International Traffic in Arms Regulations (ITAR) and Export Administration Regulations (EAR) control the export of defense-related articles and technologies. Compliance requires obtaining licenses for the export of certain aerospace components, software, and technical data. For instance, exporting flight control systems or related software to certain countries requires an ITAR license. Failure to comply can result in significant fines, imprisonment, and export restrictions.

- AS9100 Standard

AS9100 is a widely adopted quality management standard specific to the aerospace industry. Certification to AS9100 demonstrates a commitment to quality, safety, and continuous improvement. Compliance requires establishing and maintaining a quality management system that meets the requirements of the standard. For example, AS9100 requires documented procedures for managing non-conforming products and implementing corrective actions. Certification enhances credibility and provides a competitive advantage when dealing with aerospace customers.

These regulatory touchpoints significantly impact every facet of the network, from supplier selection and qualification to product testing and delivery. Adherence to these mandates is not merely a matter of legal obligation but also a fundamental requirement for ensuring product safety, maintaining operational integrity, and preserving the reputation of all involved parties. The proactive management of compliance risk is therefore essential for all organizations operating within the aerospace ecosystem.

Frequently Asked Questions

This section addresses common inquiries regarding the orchestration of resources and activities within the aerospace manufacturing and distribution sector. The following questions and answers provide insights into critical aspects of ensuring efficient and resilient operations.

Question 1: What are the primary challenges facing operational frameworks within the aerospace industry?

Challenges include long lead times for specialized components, stringent regulatory requirements, global disruptions affecting material sourcing, and the need for enhanced cybersecurity protocols to protect sensitive data. These elements necessitate robust risk mitigation strategies and proactive planning.

Question 2: How does demand forecasting contribute to operational effectiveness in this sector?

Accurate demand forecasting minimizes excess inventory and production delays. By analyzing historical data, employing statistical models, and incorporating qualitative assessments, organizations can better anticipate future demand and optimize resource allocation, thereby enhancing efficiency and reducing costs.

Question 3: What role does supplier relationship management play in mitigating risks?

Strong relationships with key suppliers provide stability and reliability. Collaborative partnerships, clear communication channels, and shared performance metrics enable proactive identification and resolution of potential disruptions, ensuring a consistent flow of materials and components.

Question 4: How can technology integration enhance resilience and visibility?

Technologies such as predictive analytics, blockchain, and the Internet of Things (IoT) provide real-time visibility into the location, condition, and performance of assets. These tools enable proactive maintenance, optimized logistics, and improved decision-making, enhancing overall resilience and responsiveness.

Question 5: What are the key elements of a robust risk mitigation strategy?

A comprehensive risk mitigation strategy includes identifying potential threats, assessing their likelihood and impact, and developing response plans to minimize disruptions. Diversifying the supplier base, securing alternative sourcing options, and establishing buffer inventories are essential components of such a strategy.

Question 6: How does regulatory compliance impact operational decision-making?

Compliance with regulations such as FAA Part 21 and REACH mandates rigorous documentation, traceability, and adherence to specific quality standards. These regulations impact all stages of the network, influencing supplier selection, manufacturing processes, and product testing, ensuring safety and adherence to industry best practices.

Effective operations require a holistic approach encompassing accurate forecasting, strong supplier relationships, technology integration, robust risk mitigation, and unwavering regulatory compliance. These elements are interconnected and contribute to a resilient and competitive environment.

The next section will delve into future trends impacting the sector, exploring emerging technologies and evolving operational models.

Conclusion

This discussion has explored the intricate facets of orchestrating the flow of goods and services within the aircraft and spacecraft manufacturing sector. Emphasis has been placed on supplier qualification, risk mitigation, demand forecasting, inventory optimization, technology integration, and adherence to regulatory mandates. These interconnected elements underscore the complexity and critical nature of managing the creation and distribution of products in this domain.

Effective strategies and vigilant oversight are essential for ensuring operational stability, mitigating potential disruptions, and maintaining a competitive advantage. Continued investment in technological advancements, proactive risk management, and collaborative partnerships will be paramount for navigating the evolving landscape of the industry and securing long-term success.

![Israel Aerospace Industries North America: [Insights] Innovating the Future of Flight with Reliable Aviation Solutions Israel Aerospace Industries North America: [Insights] | Innovating the Future of Flight with Reliable Aviation Solutions](https://mixaerospace.com/wp-content/uploads/2026/01/th-592-300x200.jpg)